you position:Home > us stock market today > us stock market today

Understanding the US Stock Market: Key Insights and Trends

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The US stock market stands as a cornerstone of global financial markets, offering investors a diverse range of opportunities and challenges. With its vast array of stocks, indices, and investment vehicles, navigating the US stock market requires a solid understanding of key concepts and trends. In this article, we delve into the essential aspects of the US stock market, providing insights that can help investors make informed decisions.

The Basics of the US Stock Market

The US stock market is primarily composed of two major exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list thousands of companies, ranging from large multinational corporations to emerging startups. Investors can buy and sell shares of these companies, aiming to profit from price fluctuations or dividends.

Key Indices

Understanding the major stock market indices is crucial for gaining insight into the overall health of the market. The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are among the most widely followed indices. Each represents a basket of stocks and provides a snapshot of the market's performance.

- S&P 500: This index tracks the performance of 500 large companies listed on US exchanges. It's often considered a bellwether for the US economy.

- Dow Jones Industrial Average: Comprising 30 large, publicly-owned companies, this index is known for its historical significance and is often used as a gauge of the US stock market's overall performance.

- NASDAQ Composite: This index includes all domestic and international common stocks listed on the NASDAQ Stock Market, making it a broad representation of the technology sector.

Investment Strategies

Investors can adopt various investment strategies when engaging with the US stock market. Here are some common approaches:

- Active Trading: This strategy involves buying and selling stocks frequently, often within short time frames, to capitalize on price movements.

- Long-Term Investing: This approach focuses on holding stocks for an extended period, typically years or even decades, with the goal of benefiting from long-term growth.

- Dividend Investing: Investors pursuing this strategy seek companies that consistently pay dividends, often using the dividends as a source of income.

Risk Management

Managing risk is a crucial aspect of investing in the US stock market. Diversification, setting stop-loss orders, and staying informed about market trends are all essential risk management techniques.

Case Studies

Let's consider a couple of case studies to illustrate how the US stock market can impact investors:

- Apple Inc.: Over the past decade, Apple has become one of the most valuable companies in the world, with its stock price soaring. Investors who bought Apple stock in 2010 and held it until 2020 would have seen a significant return on their investment.

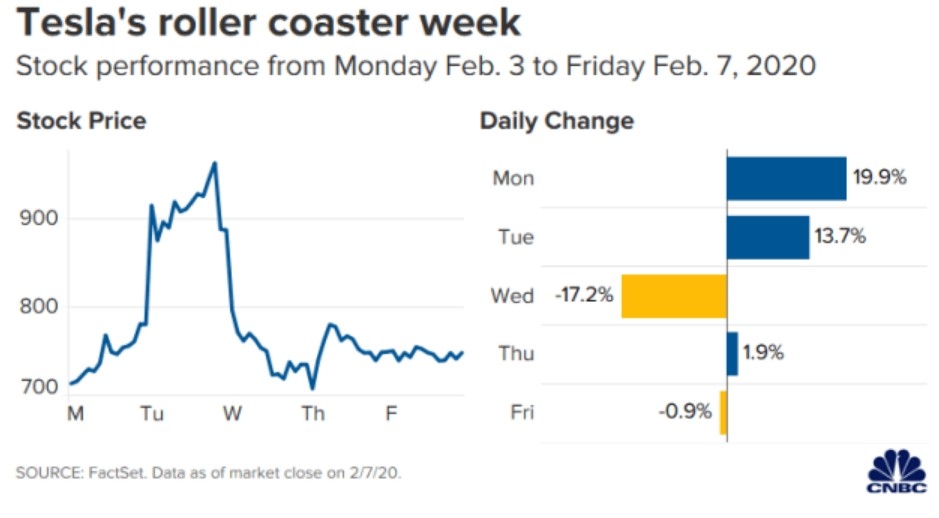

- Tesla, Inc.: Tesla's stock has experienced massive volatility, with periods of rapid growth followed by sharp declines. Investors who bought Tesla stock in 2010 and held it until 2020 would have seen a mix of gains and losses, highlighting the risks associated with investing in high-risk, high-reward companies.

Conclusion

The US stock market offers a wealth of opportunities for investors, but it also comes with its share of challenges. By understanding the basics, adopting sound investment strategies, and managing risk effectively, investors can navigate the market and potentially achieve their financial goals.

so cool! ()

last:Stock Market Quotes Live: Real-Time Insights for Investors

next:nothing

like

- Stock Market Quotes Live: Real-Time Insights for Investors

- Understanding the Dynamics of Stock Market Prices

- Canopy Growth Corp US Stock: A Deep Dive into the Leading Cannabis Company

- Stock Market Change Since Trump Took Office: A Comprehensive Analysis

- Top 50 US Stocks: The Ultimate Investment Guide

- US Alternative Energy Stocks: A Smart Investment for the Future

- US Government Buying Stocks: A Strategic Move for Economic Stability"

- Understanding the NYSE Total Market Capitalization: A Comprehensive Guide

- Unlocking the Potential of HLF Stocks: A Comprehensive Analysis

- HSBC US Stock T 3: A Comprehensive Analysis

- Stock Market Overview: Fluctuations Over the Past Week"

- Dow Jones Stock Market Graph: A Comprehensive Guide to Understanding Market Trend

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Understanding the US Stock Market: Key Insight

Understanding the US Stock Market: Key Insight

Best Performing Stocks in the US: Top Picks fo

Toys R Us in Stock: The Ultimate Rubik's

Maximizing Us Real Capital Stock: Strategies f

"Chinese Stocks Impact on U.S. Market

US Biggest Stock Losers Today: A Deep Dive int

Foxconn Stock Price in US Dollars: Latest Tren

Unlocking Global Opportunities: A Comprehensiv

ADR Stocks in the US: Your Gateway to Global I

In-Depth Analysis of GBLX.PK: A Comprehensive

Outlook for the US Stock Market in 2023: What

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Buy Us Stock from Australia: A Smart Investmen"

- How to Buy China Stock in the US: A Comprehens"

- Anheuser Busch Stock US: A Deep Dive into the "

- October 2025 US Stock Market Outlook: What to "

- "Us Highland Inc Stock: A Comprehensi"

- Unlock the Potential of US Stock KDHAX: A Comp"

- Can I Buy US Stocks in Australia? A Comprehens"

- Is the Stock Market Closed Today in the US?"

- Toys R Us in Stock: The Ultimate Rubik's "

- Maximizing Returns: A Deep Dive into the US St"