you position:Home > us stock market today > us stock market today

Understanding the Dynamics of Stock Market Prices

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the fast-paced world of finance, the stock market price is a critical indicator that reflects the value of a company. It's a number that can make or break investors' portfolios. But what exactly influences stock market prices? In this article, we'll delve into the factors that drive stock prices and how investors can navigate this complex landscape.

Market Sentiment and Stock Prices

One of the most significant factors affecting stock market prices is market sentiment. This refers to the overall attitude of investors towards the market. When investors are optimistic, they tend to buy more stocks, driving up prices. Conversely, when investors are pessimistic, they sell off their stocks, leading to a decline in prices.

Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and inflation, play a crucial role in determining stock market prices. For instance, a strong GDP growth rate often indicates a healthy economy, which can boost stock prices. However, if inflation is high, it can erode purchasing power and lead to a decline in stock prices.

Company Performance

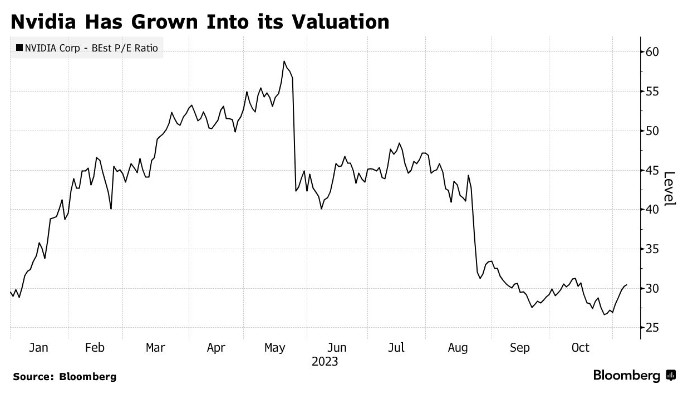

The financial performance of a company is another key factor that influences its stock price. Investors closely monitor metrics like revenue, earnings per share (EPS), and profit margins. A company that consistently beats its earnings estimates is likely to see its stock price rise.

Dividends and Yield

Dividends and yield are also important factors to consider. Dividends are payments made by a company to its shareholders, and a high dividend yield can make a stock more attractive to investors. However, it's essential to analyze the sustainability of dividends and the company's ability to continue paying them.

Market Trends and Technical Analysis

Market trends and technical analysis are techniques used by investors to predict future stock prices. Technical analysis involves studying historical price and volume data to identify patterns and trends. While this approach can be useful, it's important to remember that past performance is not always indicative of future results.

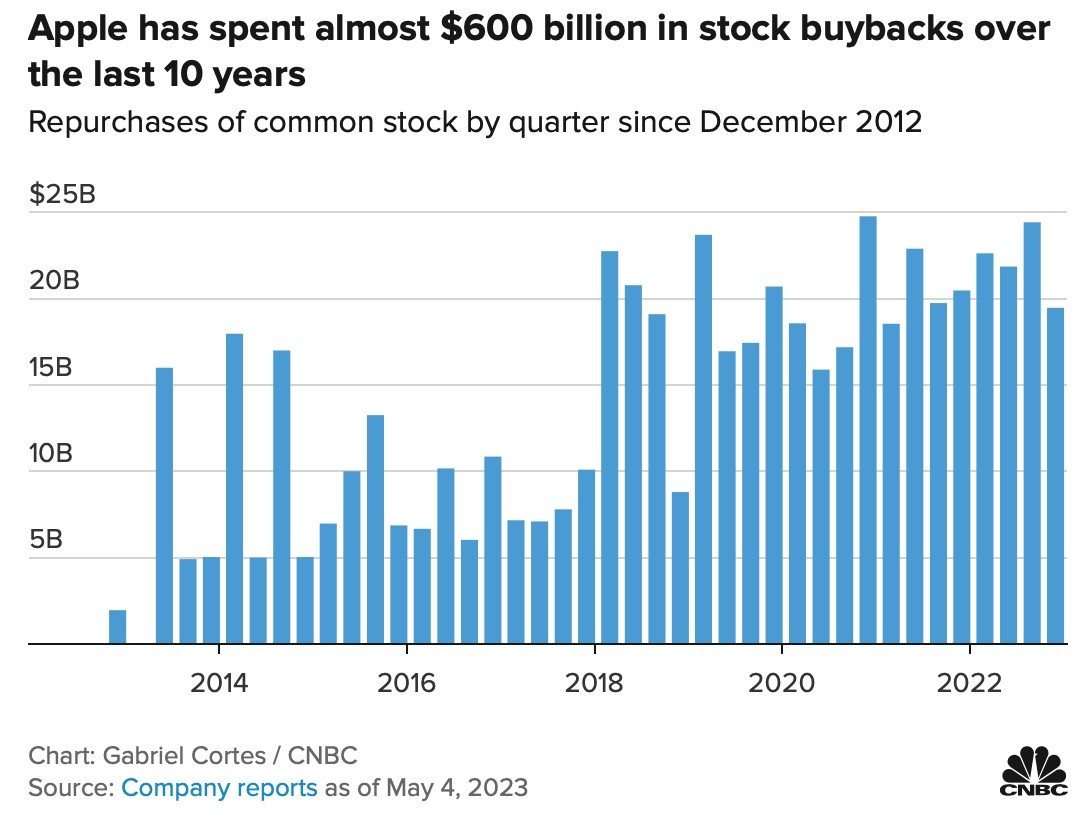

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. (AAPL) is one of the most valuable companies in the world. Its stock price has been influenced by various factors over the years. For instance, during the tech boom of the late 1990s, Apple's stock price soared. However, after the dot-com bubble burst, the stock price plummeted. Since then, Apple has consistently delivered strong financial results, leading to a steady increase in its stock price.

Conclusion

Understanding the dynamics of stock market prices is crucial for investors looking to make informed decisions. By considering factors like market sentiment, economic indicators, company performance, dividends, and market trends, investors can better navigate the complex world of the stock market. Remember, investing in the stock market involves risks, and it's essential to do thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

like

- Canopy Growth Corp US Stock: A Deep Dive into the Leading Cannabis Company

- Stock Market Change Since Trump Took Office: A Comprehensive Analysis

- Top 50 US Stocks: The Ultimate Investment Guide

- US Alternative Energy Stocks: A Smart Investment for the Future

- US Government Buying Stocks: A Strategic Move for Economic Stability"

- Understanding the NYSE Total Market Capitalization: A Comprehensive Guide

- Unlocking the Potential of HLF Stocks: A Comprehensive Analysis

- HSBC US Stock T 3: A Comprehensive Analysis

- Stock Market Overview: Fluctuations Over the Past Week"

- Dow Jones Stock Market Graph: A Comprehensive Guide to Understanding Market Trend

- Invest Stocks US: Your Ultimate Guide to Successful Stock Investment in America

- Unlocking the Power of the S&P 500: A Deep Dive into Yahoo's Financi

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Understanding the Dynamics of Stock Market Pri

Understanding the Dynamics of Stock Market Pri

How Much Is an Amazon Stock Worth Today?

US Pre-Market Stock: A Comprehensive Guide to

International US Stocks: The Long-Term Strateg

Data Centre Stocks: The US Market's Hidde

Canopy Growth Corp US Stock: A Deep Dive into

Is the US Stock Market Up or Down?

Hot US Stocks Today: Top Picks for Investors

US Alternative Energy Stocks: A Smart Investme

Buying US Stocks as a Foreigner: A Comprehensi

Us Cellular Stock Price Today: A Comprehensive

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "Us Food Delivery Stocks: A Comprehen"

- Maximizing Returns with BAC US Stocks: A Compr"

- Stock Market Change Since Trump Took Office: A"

- Chart Us Stocks vs US Real Estate Market: A Co"

- Understanding the Johnson & Johnson US"

- Can I Buy US Stocks in Europe?"

- Major Stock Markets in the US: A Comprehensive"

- Is the US Stock Market Open on Boxing Day?"

- "Analyst Recommendations: Top US Stoc"

- In-Depth Analysis of Vigilant's Stock Per"