you position:Home > us stock market today > us stock market today

Understanding the NYSE Total Market Capitalization: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The New York Stock Exchange (NYSE) stands as a cornerstone of global financial markets, and its total market capitalization is a critical indicator of its significance. This article delves into what the NYSE total market capitalization represents, its significance, and how it impacts investors and the broader market.

What is NYSE Total Market Capitalization?

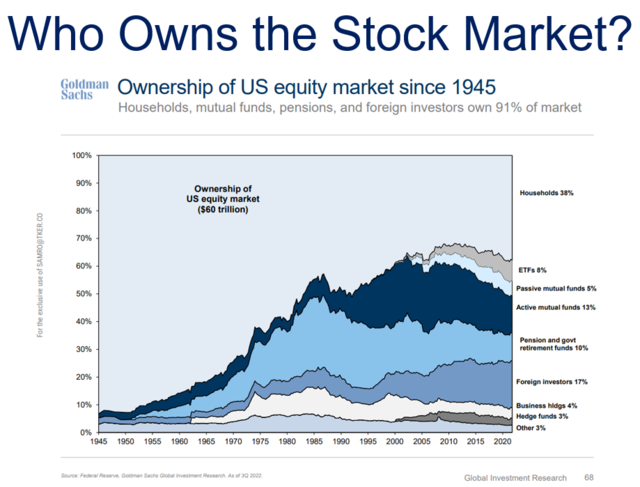

The NYSE total market capitalization is the aggregate value of all the stocks listed on the New York Stock Exchange. It provides a snapshot of the overall size and value of the exchange, reflecting the combined worth of all its listed companies. This figure is calculated by multiplying the total number of outstanding shares of each company by its current market price.

Significance of NYSE Total Market Capitalization

Economic Indicator: The NYSE total market capitalization serves as a vital economic indicator. It reflects the overall health and performance of the U.S. economy and the stock market. An increasing total market capitalization often suggests a growing economy and investor confidence.

Investor Confidence: The NYSE total market capitalization is a key metric for investors. It helps them gauge the potential risks and returns associated with investing in the stock market. A higher total market capitalization can indicate a more stable and profitable market.

Market Trends: The NYSE total market capitalization provides insights into market trends. For instance, a surge in the total market capitalization may indicate a strong bull market, while a decline may signal a bear market.

How NYSE Total Market Capitalization Impacts Investors

Investment Opportunities: A higher NYSE total market capitalization opens up more investment opportunities. Investors can explore a wide range of companies across various industries, sectors, and market capitalizations.

Risk Management: The NYSE total market capitalization helps investors assess the risk associated with their investments. A higher total market capitalization may indicate lower risk, as these companies are often more established and stable.

Market Performance Analysis: Investors can analyze the performance of the market by tracking the NYSE total market capitalization. This allows them to make informed decisions based on market trends and economic indicators.

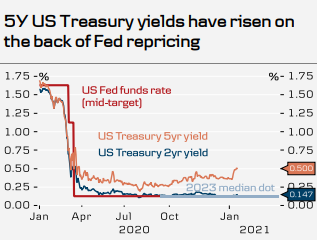

Case Study: The Impact of COVID-19 on NYSE Total Market Capitalization

The COVID-19 pandemic had a significant impact on the NYSE total market capitalization. In early 2020, as the pandemic spread globally, the total market capitalization experienced a sharp decline. However, as the market adapted to the new normal, the total market capitalization recovered and even reached new highs.

This case study highlights the resilience of the stock market and the importance of monitoring the NYSE total market capitalization for investors.

Conclusion

The NYSE total market capitalization is a crucial metric for understanding the size, health, and potential of the stock market. By tracking this figure, investors can make informed decisions and stay ahead of market trends.

so cool! ()

last:Unlocking the Potential of HLF Stocks: A Comprehensive Analysis

next:nothing

like

- Unlocking the Potential of HLF Stocks: A Comprehensive Analysis

- HSBC US Stock T 3: A Comprehensive Analysis

- Stock Market Overview: Fluctuations Over the Past Week"

- Dow Jones Stock Market Graph: A Comprehensive Guide to Understanding Market Trend

- Invest Stocks US: Your Ultimate Guide to Successful Stock Investment in America

- Unlocking the Power of the S&P 500: A Deep Dive into Yahoo's Financi

- How to Buy Hong Kong Stock in the US: A Comprehensive Guide

- Top Casino Stocks in the US: A Guide to Investment Opportunities

- Moto E US Cellular Stock ROM: The Ultimate Guide

- Is the Stock Market Closed Today in the US?

- Only Us Corporations Can List Their Stocks on the NYSE: Understanding the Exclusi

- Unlocking Global Opportunities: A Comprehensive Guide to TRP US Global Stock Fund

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Understanding the NYSE Total Market Capitaliza

Understanding the NYSE Total Market Capitaliza

The Evolution of the US Stock Market: A Journe

Top Casino Stocks in the US: A Guide to Invest

US Steel Stock Buyback: Boosting Shareholder V

Chinese Economic Espionage and Its Impact on t

Buy Us Stock from Australia: A Smart Investmen

Title: The Broadest Based Index of US Stock: U

Platform to Buy US Stocks: Your Ultimate Guide

Investing in the USA: Top Mutual Funds for US

Moto E US Cellular Stock ROM: The Ultimate Gui

How the U.S. Stock Market Reacts to Trade Wars

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- 2018 US Stock Market Loses: A Comprehensive An"

- How Seed Stock Bulls Are Raised in the US"

- Taiwan Semiconductor US Stock: A Comprehensive"

- 60 Percent Stock Allocation: A Strategic Insig"

- Understanding the NYSE Total Market Capitaliza"

- Can I Buy US Stocks in Australia? A Comprehens"

- Top Performing US Stocks in 2022: Unveiling th"

- Best ETFs for Mid Cap and Small Cap US Stocks:"

- Equinix US Real Estate Stocks: A Lucrative Inv"

- China Manipulating US Stock Market: The Truth "