you position:Home > us stock market today > us stock market today

China Manipulating US Stock Market: The Truth Behind the Hype

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In recent years, there has been a growing concern among investors and policymakers about the potential influence of China on the US stock market. The allegations of China manipulating the US stock market have been a hot topic in the financial world. This article aims to delve into the truth behind these claims, examining the evidence and the implications for investors.

Understanding the Accusations

The accusations of China manipulating the US stock market primarily revolve around the idea that Chinese investors are using various tactics to gain an unfair advantage. These tactics include:

- Insider Trading: Allegations suggest that Chinese investors have access to insider information about US companies, allowing them to make profitable trades before the information becomes public.

- Market Manipulation: Some argue that Chinese investors are engaging in pump-and-dump schemes, where they buy up shares of a company and then sell them at a higher price, causing the stock to plummet.

- Hedge Fund Activities: There are concerns that Chinese hedge funds are manipulating the market by taking large positions in certain stocks, driving up prices and then selling off their holdings.

The Evidence

While there is no concrete evidence to prove that China is systematically manipulating the US stock market, there are some instances that raise eyebrows. For example:

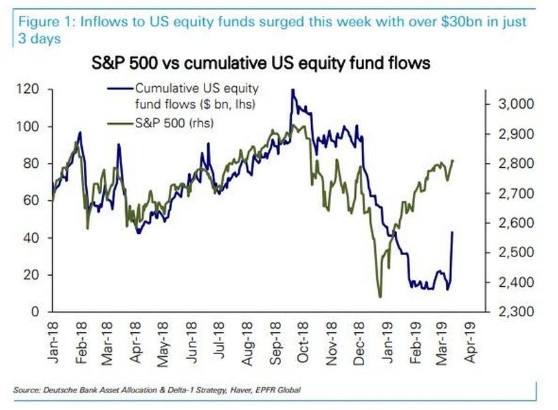

- The 2018 Tech Stock Crash: In 2018, there was a significant drop in the value of US tech stocks, which some analysts attributed to Chinese investors selling off their holdings.

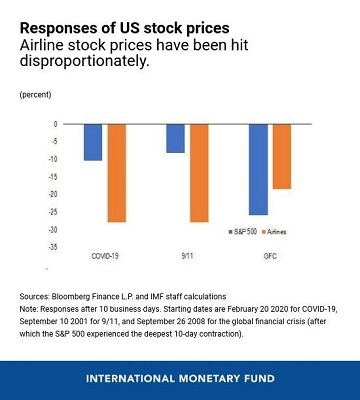

- The 2020 Market Volatility: During the COVID-19 pandemic, the US stock market experienced unprecedented volatility, with some analysts suggesting that Chinese investors were responsible for the rapid sell-offs.

The Implications

The potential manipulation of the US stock market by China has several implications:

- Investor Confidence: The allegations could erode investor confidence in the US stock market, leading to a decrease in investment and economic growth.

- Regulatory Reforms: There may be calls for stricter regulations to prevent market manipulation and protect investors.

- International Relations: The issue could strain relations between the US and China, leading to trade disputes and other geopolitical tensions.

Case Studies

One notable case study is the 2018 collapse of the Chinese tech giant, Luckin Coffee. The company was accused of fabricating sales data, which led to a significant drop in its stock price. While this case does not directly involve the US stock market, it highlights the potential risks associated with Chinese companies operating in the global market.

Conclusion

While the allegations of China manipulating the US stock market are concerning, there is no concrete evidence to support these claims. It is essential for investors and policymakers to remain vigilant and take appropriate measures to protect the integrity of the market. As the global economy becomes increasingly interconnected, it is crucial to address these concerns and work towards a more transparent and fair financial system.

so cool! ()

last:Citibank Buys US Stocks: A Strategic Move for Financial Growth

next:nothing

like

- Citibank Buys US Stocks: A Strategic Move for Financial Growth

- Top US Stocks Momentum 2025: A Strategic Investment Guide

- Largest Stock Broker in the US: Discover the Leading Financial Powerhouse

- Hot Momentum Stocks: Top Picks for the US Market

- US Midterm Election: What Does It Mean for the Stock Market?

- US Large Cap Stocks Highest Returns Last 5 Trading Days: A Closer Look

- Analyst Upgrades US Stocks: News Today

- Title: Top 5 Best Chinese Stocks in the US to Watch in 2023

- Unlocking the Potential of US Stock Futures Markets

- US Foods Stock Yards Chesterfield: A Glimpse into the Heart of Meat Processing

- US Steel CNN Stocks: The Ultimate Guide to Investing in the Metal Giant

- Exploring Chinese Company Stocks in the US Market

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

China Manipulating US Stock Market: The Truth

China Manipulating US Stock Market: The Truth

"Total Value of US Stock Market Capit

How Many Bonds Are Listed on the US Stock Mark

Buying US Stocks as a Foreigner: A Comprehensi

Shariah-Compliant US Stocks: Bullish or Bearis

Can I Buy VW Stock in the US? Your Ultimate Gu

Best US Stocks to Buy in 2020: Top Picks for I

Buy Us Stock from Australia: A Smart Investmen

Should You Invest in Only US Stocks?

Best Free Stock Trading App in the US: Your Ul

Low Volume US Stocks: Opportunities and Risks

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding the Daily Dollar Value of Traded"

- Nice.O: A Deep Dive into the Potential of This"

- CSCO US Stock Price: A Comprehensive Analysis"

- US Stock Futures Edge Lower: What It Means for"

- Is the US Stock Market in a Bubble? An In-Dept"

- Title: Exploring the Mexican Stock Market'"

- Best US Stock to Buy Today: Top Picks for 2023"

- 2018 US Stock Market Loses: A Comprehensive An"

- PFBC State PA US WebGIS Trout Stocking Details"

- Southern Company US Utilities Stocks: A Compre"