you position:Home > us stock market today > us stock market today

Unlocking the Potential of US Stock Futures Markets

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the dynamic world of finance, the US stock futures markets have emerged as a crucial component for investors seeking to capitalize on market movements. This article delves into the intricacies of these markets, offering insights into how they operate and the benefits they provide to both seasoned traders and newcomers alike.

Understanding US Stock Futures Markets

US stock futures markets allow investors to speculate on the future price of stocks without owning the actual shares. These markets are based on contracts that obligate the buyer to purchase and the seller to sell an underlying asset at a predetermined price and date in the future. This mechanism provides a flexible and efficient way to gain exposure to the stock market without the need for immediate ownership.

Key Features of US Stock Futures Markets

Leverage: One of the most significant advantages of trading in stock futures is the ability to leverage your investment. This means you can control a larger position with a smaller amount of capital, potentially amplifying your returns. However, it's crucial to understand that leverage also increases risk.

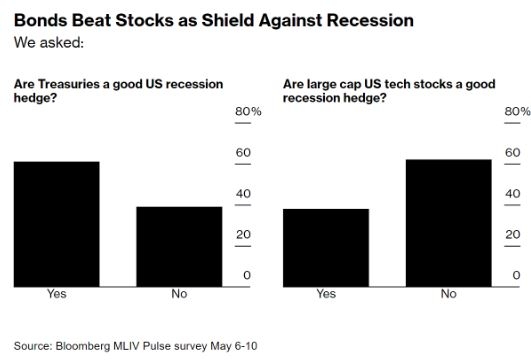

Hedging: Investors can use stock futures to hedge their portfolio against potential market downturns. By taking opposite positions in the futures market, they can offset potential losses in their stock holdings.

Market Access: The US stock futures markets provide access to a wide range of stocks, including those that are not available for direct trading. This allows investors to diversify their portfolios and gain exposure to various sectors and regions.

24/7 Trading: Unlike traditional stock exchanges, which operate during specific hours, US stock futures markets are open 24 hours a day, five days a week. This allows investors to trade at their convenience, regardless of their time zone.

How to Trade US Stock Futures

Trading in US stock futures requires a clear understanding of the market and the associated risks. Here are some key steps to get started:

Choose a Broker: Select a reputable broker that offers access to US stock futures markets. Ensure that the broker provides the necessary tools and resources to support your trading activities.

Open an Account: Once you've chosen a broker, open a trading account. This process typically involves providing personal and financial information, as well as agreeing to the broker's terms and conditions.

Understand the Trading Platform: Familiarize yourself with the trading platform provided by your broker. Ensure that you understand how to place orders, monitor market movements, and manage your positions.

Develop a Trading Strategy: Create a well-defined trading strategy that aligns with your investment goals and risk tolerance. This may involve technical analysis, fundamental analysis, or a combination of both.

Stay Informed: Keep yourself updated with the latest market news and developments. This will help you make informed trading decisions and stay ahead of market trends.

Case Study: Apple Inc.

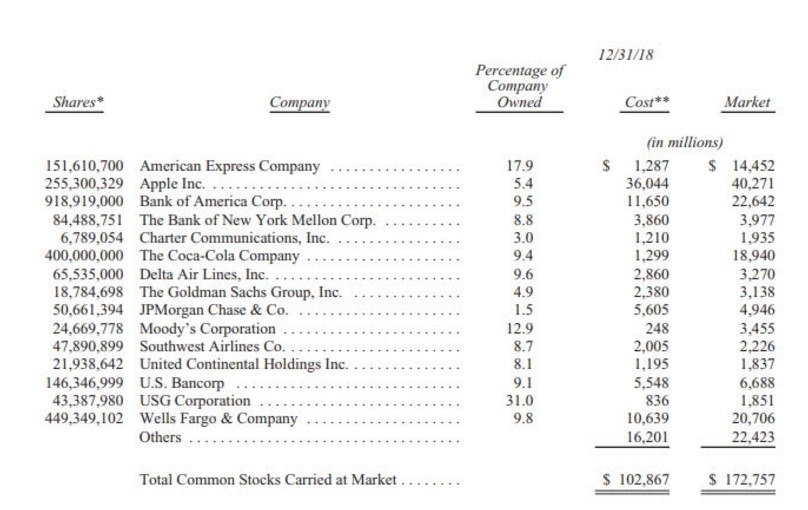

Consider the case of Apple Inc. (AAPL). An investor who expects the stock to rise in the near future might purchase Apple stock futures contracts. If the stock price does indeed increase, the investor can sell the contracts at a profit. Conversely, if the stock price falls, the investor can sell the contracts at a loss, potentially mitigating the impact of the decline in the actual stock price.

Conclusion

US stock futures markets offer a unique and powerful tool for investors seeking to capitalize on market movements. By understanding the intricacies of these markets and developing a well-defined trading strategy, investors can potentially enhance their investment returns and manage risk effectively.

so cool! ()

like

- US Foods Stock Yards Chesterfield: A Glimpse into the Heart of Meat Processing

- US Steel CNN Stocks: The Ultimate Guide to Investing in the Metal Giant

- Exploring Chinese Company Stocks in the US Market

- Outlook for the US Stock Market in 2023: What to Expect and How to Prepare

- Taiwan Semiconductor US Stock: A Comprehensive Guide to Investing in TSMC

- Us Stock Airline: Exploring the Best Opportunities in the Sky"

- Chinese Economic Espionage and Its Impact on the US Stock Market

- Among Us Game Stock Name: Unveiling the Hidden Gems"

- Title: Comprehensive Analysis of Sial Corporation (SIAL.O) Stock Performance

- Unlocking Global Opportunities: The Ultimate Guide to US Expat Stock Trader Accou

- US Government Shutdown Impact on Stock Market: A Comprehensive Analysis

- US Biggest Stock Losers Today: A Deep Dive into Market Declines

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Unlocking the Potential of US Stock Futures Ma

Unlocking the Potential of US Stock Futures Ma

Understanding the 1929 Stock Market Crash: A D

CBD Stocks US: The Future of Wellness Investin

Among Us Stocking Stuffer Ideas: Unforgettable

US Steel Stock Buyback: Boosting Shareholder V

Understanding US Oil Stock Futures: A Comprehe

"Uncover the Hidden Gems: Top US Chea

US Stock Downgrade: Understanding the Implicat

Unusual Options Sweeps Today: A Deep Dive into

Unlock the Potential of NYT Stocks: A Comprehe

Shopify Stock Price: What You Need to Know

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- How to Buy FaceDrive Stock in the US: A Step-b"

- Interactive Brokers Commission Fees for US Sto"

- Understanding the US Stock Market: A Comprehen"

- Technical Analysis of US Stocks in July 2025: "

- Understanding the US Stock Exchange Index: A C"

- Samsung Stock US ADR: A Comprehensive Guide to"

- Understanding the Johnson & Johnson US"

- Is the US Stock Market Going to Crash? A Compr"

- "Analyst Recommendations: Top US Stoc"

- Stock Us History: The Evolution of the U.S. St"