you position:Home > us stock market today > us stock market today

HSBC US Stock T 3: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving world of finance, staying informed about the stock market is crucial. One such stock that has garnered significant attention is HSBC's US Stock T 3. This article delves into a comprehensive analysis of HSBC's US Stock T 3, exploring its performance, potential, and future prospects.

Understanding HSBC's US Stock T 3

HSBC Holdings plc, also known as the Hongkong and Shanghai Banking Corporation, is a leading global banking and financial services organization. Its US Stock T 3, represented by the ticker symbol HSBC, is a publicly traded stock on the New York Stock Exchange (NYSE).

Performance Analysis

In recent years, HSBC's US Stock T 3 has demonstrated a strong performance. The stock has seen significant growth, driven by the company's robust financial performance and expansion into new markets. Key factors contributing to this growth include:

- Strong Revenue Growth: HSBC has consistently reported strong revenue growth, reflecting its successful expansion strategy.

- Improved Profitability: The company has managed to improve its profitability, with a focus on cost optimization and revenue diversification.

- Global Presence: HSBC's extensive global network has provided it with a competitive edge, allowing it to tap into various markets and customer segments.

Market Trends and Future Prospects

The financial services industry is subject to constant change, and understanding market trends is crucial for investors. Here are some key trends that could impact HSBC's US Stock T 3:

- Digital Transformation: The rise of digital banking and fintech companies is reshaping the financial services industry. HSBC has been actively investing in digital transformation, which could drive future growth.

- Regulatory Environment: Changes in the regulatory environment can have a significant impact on the financial services industry. HSBC has been proactive in managing regulatory risks, which could contribute to its long-term stability.

- Economic Conditions: Global economic conditions, such as inflation and interest rates, can influence the performance of financial stocks. HSBC's ability to navigate these conditions will be crucial for its future success.

Case Studies

To illustrate the potential of HSBC's US Stock T 3, let's look at a few case studies:

- HSBC's Expansion into Asia: In 2019, HSBC announced its expansion into Asia, targeting growth in key markets such as China and India. This move has been well-received by investors, contributing to the stock's growth.

- HSBC's Digital Transformation: HSBC has been investing heavily in digital transformation, launching innovative products and services such as mobile banking and digital payments. This focus on digital has helped the company stay competitive and has been a key driver of growth.

Conclusion

HSBC's US Stock T 3 is a compelling investment opportunity for investors looking to gain exposure to the global financial services industry. With a strong performance, a focus on growth, and a proactive approach to market trends, HSBC's US Stock T 3 could be a valuable addition to any portfolio.

so cool! ()

last:Stock Market Overview: Fluctuations Over the Past Week"

next:nothing

like

- Stock Market Overview: Fluctuations Over the Past Week"

- Dow Jones Stock Market Graph: A Comprehensive Guide to Understanding Market Trend

- Invest Stocks US: Your Ultimate Guide to Successful Stock Investment in America

- Unlocking the Power of the S&P 500: A Deep Dive into Yahoo's Financi

- How to Buy Hong Kong Stock in the US: A Comprehensive Guide

- Top Casino Stocks in the US: A Guide to Investment Opportunities

- Moto E US Cellular Stock ROM: The Ultimate Guide

- Is the Stock Market Closed Today in the US?

- Only Us Corporations Can List Their Stocks on the NYSE: Understanding the Exclusi

- Unlocking Global Opportunities: A Comprehensive Guide to TRP US Global Stock Fund

- Is US Bank a Dividend Stock?

- Toys R Us in Stock: The Ultimate Rubik's Cube Guide"

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

HSBC US Stock T 3: A Comprehensive Analysis

HSBC US Stock T 3: A Comprehensive Analysis

Today's US Stock Market Live: Key Insight

How High Will the US Stock Market Go? A Compre

US Cobalt Stock Price: Trends, Influences, and

Dow Jones Stock Market Graph: A Comprehensive

Meip-US Stock Price: A Comprehensive Analysis

Nov 7 US Stock Market: Ford Motor's Perfo

Buying US Stocks as a Foreigner: A Comprehensi

Low Volume US Stocks: Opportunities and Risks

Current State of the US Stock Market in March

Top US Stocks Market Cap: Unveiling the Giants

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Citibank Buys US Stocks: A Strategic Move for "

- Stock Us History: The Evolution of the U.S. St"

- Maximizing Returns: A Deep Dive into the US St"

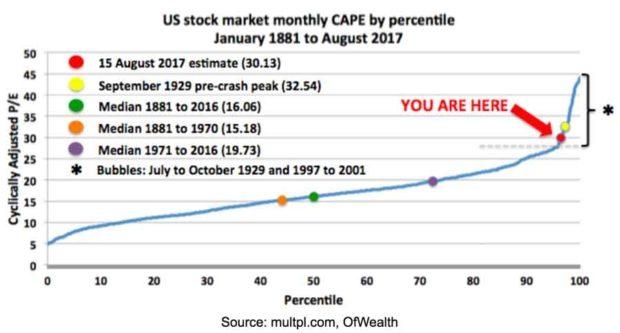

- "Current Shiller CAPE Ratio: US Stock"

- Mesoblast US Stock Price: A Comprehensive Anal"

- In-Depth Analysis of Vigilant's Stock Per"

- US Stock Exchange Opens: Key Insights and Mark"

- Unlocking the Potential of Citibank US Stock: "

- Us Stock Airline: Exploring the Best Opportuni"

- How to Buy UK Stocks in the US: A Comprehensiv"