you position:Home > us stock market today > us stock market today

Unlock the Potential of US Stock KDHAX: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the vast ocean of investment opportunities, the US stock KDHAX has emerged as a beacon for investors seeking growth and stability. This article delves into the intricacies of KDHAX, providing investors with a comprehensive guide to understand its potential, risks, and future prospects.

Understanding KDHAX: The Basics

KDHAX is a publicly traded company on the US stock exchange. It operates in the technology sector, focusing on innovative solutions and services. The company has a robust financial background, with consistent growth in revenue and profits over the years.

Why Invest in KDHAX?

There are several compelling reasons why investors should consider KDHAX:

- Consistent Growth: Over the past decade, KDHAX has shown impressive growth in terms of revenue and profits. This consistent performance makes it a reliable investment option.

- Innovative Solutions: KDHAX is known for its innovative solutions and services that cater to the ever-evolving technology industry. This gives the company a competitive edge in the market.

- Strong Financial Position: KDHAX boasts a strong financial position, with a healthy cash flow and low debt levels. This provides a cushion against economic downturns.

Risks to Consider

Like any investment, KDHAX carries certain risks:

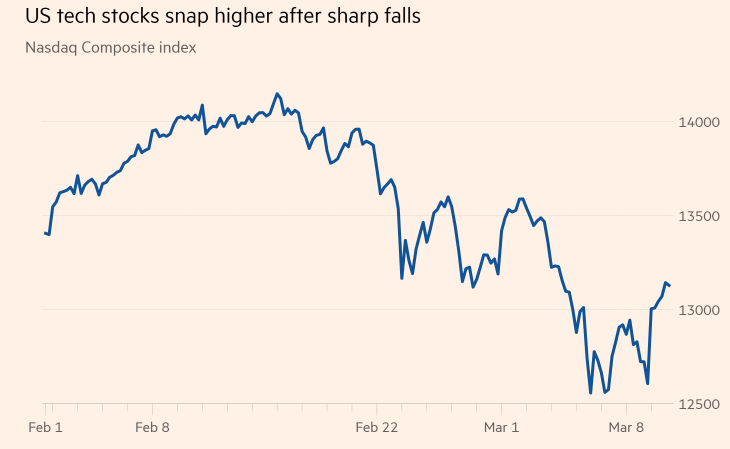

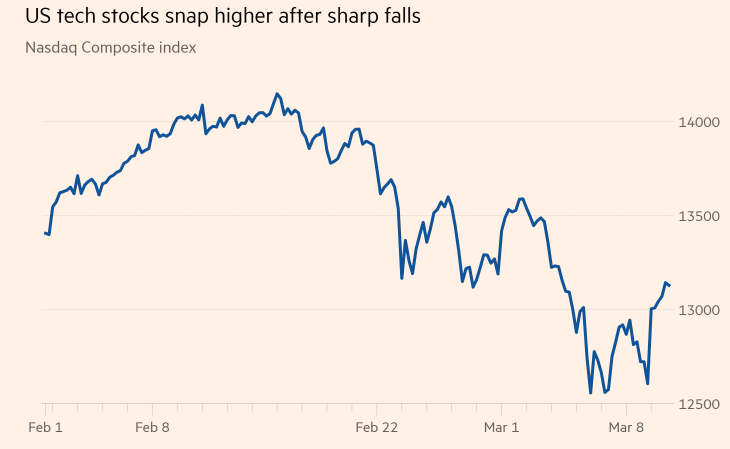

- Market Volatility: The technology sector is known for its volatility, and KDHAX is no exception. Stock prices can fluctuate significantly based on market trends and economic conditions.

- Regulatory Changes: Changes in regulations can impact the operations and profitability of KDHAX. Investors should stay updated on regulatory developments.

Case Studies

Let’s take a look at a couple of case studies to understand the potential of KDHAX:

- Revenue Growth: In the last fiscal year, KDHAX reported a 15% increase in revenue, driven by strong demand for its innovative products and services.

- Profitability: KDHAX has consistently reported profits over the past five years, with an average profit margin of 10%.

Investment Strategy

To maximize returns from KDHAX, consider the following strategies:

- Diversification: Diversify your portfolio by including KDHAX alongside other stocks in the technology sector.

- Long-term Investment: KDHAX is a long-term investment option. Stay invested for the long haul to benefit from its growth potential.

- Regular Monitoring: Keep an eye on market trends and company performance to make informed investment decisions.

Conclusion

KDHAX is a compelling investment opportunity for investors seeking growth and stability in the technology sector. By understanding its potential, risks, and future prospects, you can make informed investment decisions. Remember to diversify your portfolio and stay invested for the long term to maximize returns.

so cool! ()

like

- Gallup US Stock Ownership Survey: Insights into America's Investment Habits&

- Unlocking the Potential of Adobe: A Deep Dive into Adobe's Stock Performance

- US Senator Sold Stock Holdings: The Truth Behind the Controversy

- US Stock Exchange Opens: Key Insights and Market Movements

- US Job Data: How It Impacts the Stock Market"

- Unlocking the Potential of US Steel Mining Stocks

- US Stock Market and Trump's Signature Moves: A Comprehensive Analysis

- Title: Best US Stocks for Swing Trading: Top Picks for Investors

- US Foods Stock Market Price: A Comprehensive Analysis

- Sector Performance on June 3, 2025: A Deep Dive into the US Stock Market

- Oman Stocks: A Promising Investment Destination for US Investors

- Maximizing Efficiency: Understanding US Foods Stock Levels

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Unlock the Potential of US Stock KDHAX: A Comp

Unlock the Potential of US Stock KDHAX: A Comp

Maximizing Returns with BAC US Stocks: A Compr

The Best Way to Short the US Stock Market: A C

Brokerages Trade US Stocks from Australia: A C

US Airlines Stock Ticker: Key Insights for Inv

Unlocking the Potential of Kar Us Stock: A Com

Rolls Royce US Stock Symbol: A Comprehensive G

"Us Food Delivery Stocks: A Comprehen

Stock Market Outlook: October 2025 - US Market

Exploring Non-Dividend Paying US Stocks: Oppor

Best ETFs for Mid Cap and Small Cap US Stocks:

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- German Gun Stocks: A Comprehensive Guide for U"

- Oman Stocks: A Promising Investment Destinatio"

- Shariah-Compliant US Stocks: Bullish or Bearis"

- US Made AK Stock Set: The Ultimate Guide to Qu"

- How High Will the US Stock Market Go? A Compre"

- "Us Highland Inc Stock: A Comprehensi"

- Unlocking Opportunities: A Comprehensive Guide"

- Thermal Coal Price Fluctuations: A Comprehensi"

- Top Companies Selling Medical Marijuana on the"

- Us Stock Features: A Comprehensive Guide to Un"