you position:Home > us stock market today live cha > us stock market today live cha

Broker Borrowing Your Stock: What You Need to Know

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the fast-paced world of stock trading, brokers often engage in practices that can impact your investments. One such practice is broker borrowing your stock. This article delves into what this means, why it happens, and how it can affect you.

Understanding Broker Borrowing

Broker borrowing refers to the practice where a brokerage firm borrows stocks from you to lend to other clients or to cover short positions. This is a common practice in the financial industry, and it can occur for various reasons.

Why Does Broker Borrowing Happen?

Covering Short Positions: If a client has sold a stock short (betting that the price will fall), the brokerage firm may need to borrow the stock to deliver to the buyer. In this case, they might borrow the stock from you.

Lending to Other Clients: Brokers may also borrow stocks from you to lend to other clients who are looking to buy stocks on margin. This allows clients to purchase more stocks than they can afford with cash.

Market Manipulation: In some cases, brokers may borrow stocks to manipulate the market. This is considered unethical and illegal.

How Does Broker Borrowing Affect You?

Potential Loss of Dividends: If you own stocks that are borrowed by the broker, you may miss out on receiving dividends.

Increased Risk: If the stock price falls, you may be responsible for covering the loss, even though you did not sell the stock.

Lack of Control: You lose control over the stocks that are borrowed, as the broker can use them as they see fit.

Cases to Consider

Case 1: A client had stocks borrowed by the broker to cover a short position. The stock price fell, and the client was required to cover the loss, resulting in a significant financial loss.

Case 2: A client's stocks were borrowed by the broker to lend to another client. The borrowed stocks were involved in market manipulation, and the client was unaware of this.

What Can You Do?

Review Your Brokerage Agreement: Ensure that you understand the terms and conditions of your brokerage agreement regarding broker borrowing.

Ask Questions: Don't hesitate to ask your broker about any concerns you have regarding broker borrowing.

Monitor Your Investments: Regularly review your portfolio to ensure that your stocks are not being borrowed without your knowledge.

In conclusion, broker borrowing is a common practice in the stock market, but it can have significant implications for your investments. Understanding how it works and how it can affect you is crucial in making informed decisions about your portfolio.

so cool! ()

last:Understanding the US International Stock Index: A Comprehensive Guide

next:nothing

like

- Understanding the US International Stock Index: A Comprehensive Guide

- US Steel Price Stock: What You Need to Know

- 2025 US Stock Market Outlook: Navigating Risks and Opportunities

- Small US Stock Exchange: Opportunities and Insights

- Htht Us Stock Split: What You Need to Know

- US Delta Air Lines Stock: A Comprehensive Analysis"

- US FAANG Stocks: The Powerhouse of Tech Investing

- Unlocking the Potential of MDT: A Deep Dive into Its Stock Performance

- How Can I Trade in the US Stock Market from India?

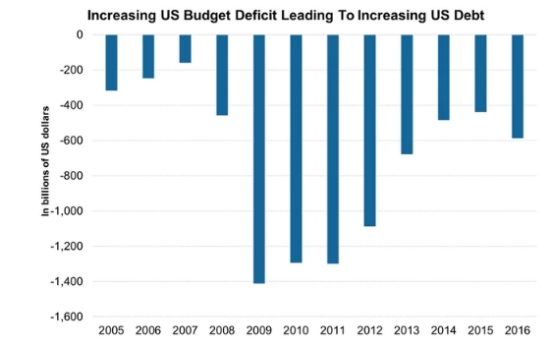

- US Debt Impact on Stock Market: Understanding the Critical Link

- Maximizing Your Investment Potential with Citibank HK US Stock Trading

- Exploring the US Foods Stock Yards in Greensburg, PA: A Hub of Agribusiness Innov

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Broker Borrowing Your Stock: What You Need to

Broker Borrowing Your Stock: What You Need to

Superior Resources Ltd: US Stock Symbol and In

Cheap US Infrastructure Stocks: A Smart Invest

How to Buy Shiba Inu Stock in the US: A Compre

Manulife Stock Price US: Key Insights and Futu

"How Many Stocks Are on the US Stock

Impact of US Election on Stock Market Dynamics

The Surging Number of Companies Listed on US S

Baidu Stock US: The Ultimate Guide to Baidu�

How to Buy Bitcoin Stock in the US: A Step-by-

Top US Stocks to Watch in 2024: A Comprehensiv

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Can You Buy Canadian Back Stocks in the US? A "

- Best Cannabis Stocks in the US: Your Ultimate "

- Understanding UBS US Stock: A Comprehensive Gu"

- Investing in GlaxoSmithKline Stock: A Comprehe"

- Best US Industrial Stocks to Watch in 2023"

- US Stock Less Than $1: A Hidden Investment Opp"

- Stock Index World: A Global Perspective Exclud"

- Best Dividend US Stock: Unveiling the Ultimate"

- How US Job Data Impacts the Stock Market"

- The Best Way to Buy Stocks in the US: A Compre"