you position:Home > us stock market today live cha > us stock market today live cha

US Debt Impact on Stock Market: Understanding the Critical Link

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The relationship between the US debt and the stock market is a complex one, with implications that can affect investors and the broader economy. In this article, we delve into how the nation's debt levels can impact stock market performance, and what this means for investors looking to navigate the volatile landscape.

The Rising Tide of Debt

The United States has been on a steady path of accumulating debt over the years. As of the latest data, the national debt stands at over $31 trillion. This figure includes both public and intragovernmental debt, and it has been growing at an alarming rate. The question on many investors' minds is: what does this mean for the stock market?

Understanding the Impact

When the US government accumulates debt, it typically does so by issuing bonds. These bonds are purchased by investors, including both domestic and foreign entities. The interest payments on these bonds are a significant portion of the government's budget, and they can have a ripple effect on the stock market.

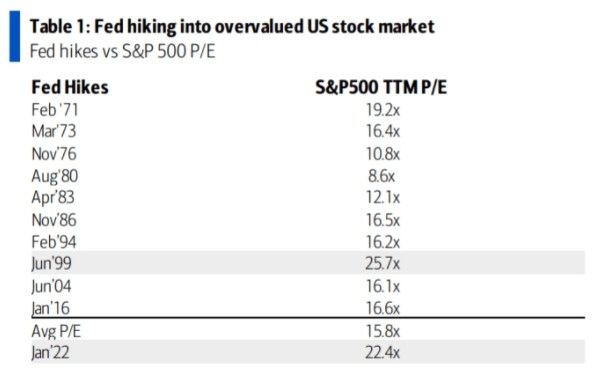

Interest Rates and Stock Market Performance

One of the primary ways in which US debt impacts the stock market is through interest rates. When the government needs to borrow more money, it often has to offer higher interest rates to attract investors. This can lead to an increase in the cost of borrowing for companies, which can, in turn, reduce their profitability and impact stock prices.

Interest rates are a critical factor in determining the attractiveness of stocks. When rates are low, companies can borrow money more cheaply, which can lead to increased investment in expansion and hiring. This can boost stock prices. Conversely, when interest rates rise, borrowing costs increase, potentially leading to lower profits and lower stock prices.

Market Sentiment and Confidence

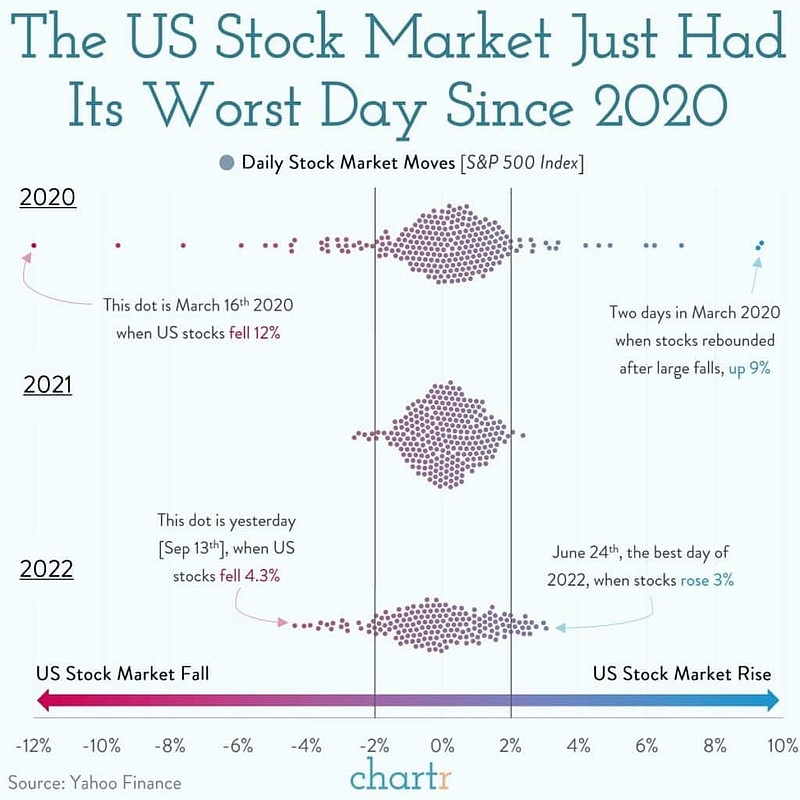

The level of debt held by the government can also influence market sentiment. High levels of debt can lead to concerns about the government's ability to manage its finances, which can cause investors to become more cautious. This can lead to a decrease in stock prices as investors seek safer investments.

Market sentiment plays a crucial role in the stock market. When investors are optimistic, they are more likely to invest in stocks, driving prices up. Conversely, when sentiment turns negative, investors may sell off their stocks, leading to a decline in prices.

Case Studies

One notable example of how US debt impacted the stock market is the financial crisis of 2008. At that time, the government's debt levels were significantly lower than they are today. However, the crisis was triggered by a number of factors, including the government's response to the crisis, which involved significant borrowing to stimulate the economy.

The stimulus measures helped to stabilize the stock market in the short term, but the long-term impact of the increased debt was a source of concern for many investors. This example illustrates how the level of debt can have a lasting impact on the stock market.

Conclusion

The relationship between US debt and the stock market is a complex one, with implications that can affect investors and the broader economy. Understanding this relationship is crucial for anyone looking to invest in the stock market. As the national debt continues to rise, it's important to monitor its impact on the stock market and adjust investment strategies accordingly.

so cool! ()

last:Maximizing Your Investment Potential with Citibank HK US Stock Trading

next:nothing

like

- Maximizing Your Investment Potential with Citibank HK US Stock Trading

- Exploring the US Foods Stock Yards in Greensburg, PA: A Hub of Agribusiness Innov

- Undervalued US Stocks in 2018: Opportunities for Investors"

- Understanding BYD US Stock Ticker: A Comprehensive Guide

- DFW.State.Or.US Fish Stocking: The Ultimate Guide to Oregon's Angling Advent

- Top US Stocks to Watch in 2024: A Comprehensive Guide

- Unveiling the Secrets of US Stock Crash Prediction: Future-Proof Your Investments

- US Marijuana-Based Stocks: A Lucrative Investment Opportunity

- iShares US Infrastructure ETF Stock: A Comprehensive Guide to Investing in Americ

- 2025 5 19 US Stock Market Summary: Key Highlights and Analysis

- Can We Trade in US Stocks from India?

- Impact of US Election on Stock Market Dynamics: Key Insights and Analysis&quo

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

US Debt Impact on Stock Market: Understanding

US Debt Impact on Stock Market: Understanding

Understanding the Chinese Company Stock Market

US Stock Investor: Mastering the Market for Bi

In-Depth Analysis of CLF: An Insight into the

Unlocking Trading Success: Exploring US Broker

Earnings Calendar: October 6, 2025 – Top US

"PDD US Stock Price: Key Insights and

US Stem Cells Stock: The Future of Biotechnolo

Fidelity US Small and Mid Cap Stock Fund: A Co

"Unveiling the US Stock Index Returns

Superior Resources Ltd: US Stock Symbol and In

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Good Dividend Stocks: Top US Investments for I"

- Average Return in US Stock Market: Insights an"

- Rolls-Royce US Stock: A Comprehensive Guide to"

- "Ishares Core S&P Total US St"

- "List of Mid-Cap Stocks in the US: To"

- US Person Ownership in Foreign Corporation Own"

- "Unveiling the Average Rate of Return"

- US Marijuana ETF Stocks: A Comprehensive Guide"

- Tea Cafe Contact Us: Discover Our Exclusive St"

- How to Invest in the US Stock Market from the "