you position:Home > us stock market today live cha > us stock market today live cha

Small US Stock Exchange: Opportunities and Insights

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The small US stock exchange has long been a hidden gem for investors seeking opportunities beyond the big-name companies. In this article, we'll explore the advantages, potential risks, and key insights into investing in small US stock exchanges.

Understanding Small US Stock Exchanges

Small US stock exchanges, also known as over-the-counter (OTC) markets, are platforms where companies with lower market capitalization trade. These exchanges include the NASDAQ OTCQB, OTCQX, and the Pink Sheets. While these exchanges may not attract the same level of attention as the New York Stock Exchange (NYSE) or NASDAQ, they offer a wealth of opportunities for savvy investors.

Advantages of Investing in Small US Stock Exchanges

Access to High-Growth Companies: Small US stock exchanges are home to many emerging and high-growth companies. These companies often have the potential for significant growth but may not be as widely recognized or followed by larger investors.

Higher Returns: Historically, small-cap stocks have offered higher returns than their large-cap counterparts. This is due to the higher volatility and potential for growth in smaller companies.

Lower Trading Costs: Trading on small US stock exchanges is often more cost-effective compared to the major exchanges. This can result in significant savings, especially for active traders.

Potential Risks of Investing in Small US Stock Exchanges

Liquidity Risks: Small-cap stocks can be less liquid than large-cap stocks, making it challenging to buy and sell shares at desired prices. This can be particularly problematic during times of market volatility.

Higher Volatility: Small-cap stocks are generally more volatile than their larger counterparts, leading to higher potential for both gains and losses.

Limited Research and Information: Smaller companies may not have the same level of research coverage and information available as larger companies, making it more challenging for investors to make informed decisions.

Key Insights for Investing in Small US Stock Exchanges

Do Your Homework: Thorough research is crucial when investing in small US stock exchanges. Analyze financial statements, management teams, and industry trends to identify potential winners.

Diversify Your Portfolio: Investing in a diverse mix of small-cap stocks can help mitigate risks associated with high volatility and liquidity issues.

Stay Informed: Keep up with market news and industry developments to stay ahead of potential opportunities and risks.

Case Studies

Case Study 1: Tesla (NASDAQ: TSLA) began trading on the NASDAQ OTCBB in 2004 before making its big move to the NASDAQ. Investing in Tesla at its early stages would have been a significant opportunity for investors on the OTC markets.

Case Study 2: BioNTech SE (NASDAQ: BNTX) was listed on the NASDAQ OTCQB before going public. Investing in BioNTech during its OTC days could have resulted in substantial returns for early investors.

Conclusion

Small US stock exchanges offer unique opportunities for investors looking to diversify their portfolios and invest in high-growth companies. While these exchanges come with potential risks, thorough research and informed decisions can lead to significant rewards. Keep in mind the advantages and disadvantages of investing in small US stock exchanges and stay informed to make the most of these opportunities.

so cool! ()

last:Htht Us Stock Split: What You Need to Know

next:nothing

like

- Htht Us Stock Split: What You Need to Know

- US Delta Air Lines Stock: A Comprehensive Analysis"

- US FAANG Stocks: The Powerhouse of Tech Investing

- Unlocking the Potential of MDT: A Deep Dive into Its Stock Performance

- How Can I Trade in the US Stock Market from India?

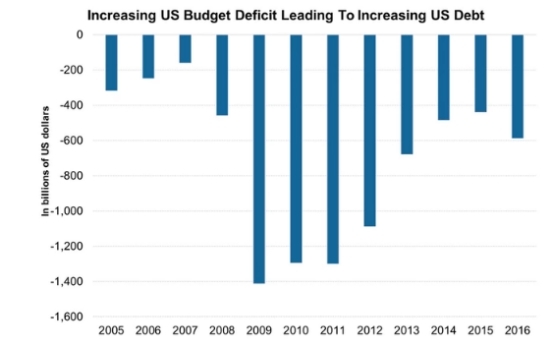

- US Debt Impact on Stock Market: Understanding the Critical Link

- Maximizing Your Investment Potential with Citibank HK US Stock Trading

- Exploring the US Foods Stock Yards in Greensburg, PA: A Hub of Agribusiness Innov

- Undervalued US Stocks in 2018: Opportunities for Investors"

- Understanding BYD US Stock Ticker: A Comprehensive Guide

- DFW.State.Or.US Fish Stocking: The Ultimate Guide to Oregon's Angling Advent

- Top US Stocks to Watch in 2024: A Comprehensive Guide

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Small US Stock Exchange: Opportunities and Ins

Small US Stock Exchange: Opportunities and Ins

"Gree Us Stock: Your Ultimate Guide t

Current Stock Market Numbers: A Comprehensive

http stocks.us.reuters.com stocks fulldescript

Brokers That Trade Canadian Stocks in the US:

Unlocking the Secrets of US Prison Stocks: A C

Us Banks Stock Symbols: A Comprehensive Guide

"In-Depth Analysis of the VOO Stock:

Can Indian Citizens Trade in the US Stock Mark

Understanding the China Stocks in the US Marke

Stock Associate Salary at Toys "R&

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- http stocks.us.reuters.com stocks fulldescript"

- Unlock the Potential of US Glass Company Stock"

- US Ending Stocks of Ethane and Ethylene: A Com"

- SK Hynix Stock in US: A Comprehensive Guide to"

- Scotia iTrade Buying US Stocks: A Comprehensiv"

- Dollarama Stock US: A Comprehensive Analysis a"

- How to Buy SoftBank Stock in the US: A Step-by"

- Largest US Banks: A Deep Dive into Their Stock"

- Pentax Repair: Japanese Stock in the US - A Co"

- Amazon B Stock US: Unveiling the Hidden Gems o"