you position:Home > us stock market today live cha > us stock market today live cha

Understanding the US International Stock Index: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In today's interconnected global economy, the US International Stock Index has become a vital tool for investors seeking to diversify their portfolios. This index tracks the performance of U.S. companies that have significant operations or market exposure outside the United States. By understanding this index, investors can gain valuable insights into the global market trends and potential investment opportunities. In this article, we will delve into the details of the US International Stock Index, its components, and its significance in the global investment landscape.

What is the US International Stock Index?

The US International Stock Index is a benchmark that measures the performance of U.S.-listed stocks of companies with substantial international operations. It provides a snapshot of how these companies are faring in the global market, allowing investors to gauge the potential risks and rewards associated with investing in these stocks.

Components of the US International Stock Index

The US International Stock Index is typically composed of companies from various sectors, including technology, healthcare, consumer goods, and finance. These companies have a significant presence in markets outside the United States, which makes them susceptible to global economic and political events.

Key Characteristics of the US International Stock Index

- Diversification: The US International Stock Index offers investors a way to diversify their portfolios by investing in companies with operations across different regions and industries.

- Global Exposure: Investors gain exposure to the global market, which can lead to higher returns when the global economy is performing well.

- Risk Management: Investing in the US International Stock Index can help mitigate the risks associated with investing in a single country or region.

Significance of the US International Stock Index

The US International Stock Index is a valuable tool for investors for several reasons:

- Global Economic Trends: By tracking the performance of U.S. companies with international operations, the index provides insights into global economic trends and market dynamics.

- Investment Opportunities: The index can help investors identify potential investment opportunities in emerging markets and developed economies.

- Risk Assessment: The index allows investors to assess the risks associated with investing in companies with significant international exposure.

Case Study: Apple Inc.

One of the most prominent companies in the US International Stock Index is Apple Inc. Apple's significant presence in Asia, particularly in China, has allowed the company to capitalize on the growing demand for technology products in the region. By investing in Apple, investors gain exposure to the rapidly growing Asian market and the potential for higher returns.

Conclusion

The US International Stock Index is a crucial tool for investors looking to diversify their portfolios and gain exposure to the global market. By understanding the components and characteristics of this index, investors can make informed decisions and capitalize on potential investment opportunities. Whether you are a seasoned investor or just starting out, the US International Stock Index is a valuable resource for navigating the complexities of the global investment landscape.

so cool! ()

last:US Steel Price Stock: What You Need to Know

next:nothing

like

- US Steel Price Stock: What You Need to Know

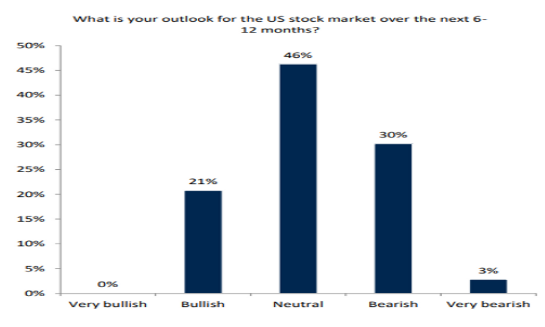

- 2025 US Stock Market Outlook: Navigating Risks and Opportunities

- Small US Stock Exchange: Opportunities and Insights

- Htht Us Stock Split: What You Need to Know

- US Delta Air Lines Stock: A Comprehensive Analysis"

- US FAANG Stocks: The Powerhouse of Tech Investing

- Unlocking the Potential of MDT: A Deep Dive into Its Stock Performance

- How Can I Trade in the US Stock Market from India?

- US Debt Impact on Stock Market: Understanding the Critical Link

- Maximizing Your Investment Potential with Citibank HK US Stock Trading

- Exploring the US Foods Stock Yards in Greensburg, PA: A Hub of Agribusiness Innov

- Undervalued US Stocks in 2018: Opportunities for Investors"

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

Understanding the US International Stock Index

Understanding the US International Stock Index

US Steel Price Stock: What You Need to Know

Is LG Chem on the US Stock Market? A Comprehen

"Unlocking the Potential: The Thrivin

Top 5 US Marijuana Stocks to Buy in 2023

Retailers Often Use Stock Management Systems t

Tea Cafe Contact Us: Discover Our Exclusive St

Best Stock Advisor US: Unveiling the Top Finan

Manulife Stock Price US: Key Insights and Futu

Best Dividend US Stock: Unveiling the Ultimate

"Greninja Amiibo Toys R Us Stock: A C

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US 1 List of Stocks to Buy: Top Picks for 2023"

- Htht Us Stock Split: What You Need to Know"

- US Stem Cells Stock: The Future of Biotechnolo"

- Toys "R" Us Stock: A Journey"

- Juneteenth and Its Impact on the US Stock Mark"

- "Unveiling the Latest US Stock Exchan"

- High Power Blue Laser eBay US Stock: Your Ulti"

- Best US Stock Market Index Fund: Your Ultimate"

- Blue Chip Stocks in the US: Top Investments fo"

- Stocks CHK-US: Unveiling the Potential of U.S."