you position:Home > us stock market today > us stock market today

Owning Us Stocks in Canada: A Strategic Investment Move

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's globalized world, investing in stocks across borders has become increasingly popular. For American investors, owning stocks in Canada presents a unique opportunity. This article delves into the benefits and considerations of investing in Canadian stocks, offering insights for those looking to diversify their portfolios.

Why Invest in Canadian Stocks?

1. Strong Economic Foundation

Canada boasts a stable and robust economy, making it an attractive destination for investors. The country has a diverse range of industries, including energy, technology, and natural resources, providing a wide array of investment options.

2. High-Quality Companies

Canada is home to numerous high-quality companies that are listed on major stock exchanges. These companies often have strong financial performance, solid management teams, and a commitment to innovation.

3. Favorable Tax Environment

Canada offers a favorable tax environment for investors. The country has a lower corporate tax rate compared to the United States, making it more attractive for companies to operate and investors to invest.

4. Diversification Benefits

Investing in Canadian stocks allows American investors to diversify their portfolios and reduce exposure to risks associated with the U.S. market. This diversification can provide stability and potentially enhance returns over the long term.

How to Invest in Canadian Stocks

1. Research and Due Diligence

Before investing in Canadian stocks, it's crucial to conduct thorough research and due diligence. This includes analyzing financial statements, understanding the company's business model, and assessing its competitive position in the market.

2. Use a Brokerage Account

To invest in Canadian stocks, you'll need a brokerage account that supports international trading. Many U.S.-based brokers offer access to Canadian markets, making it easier for investors to diversify their portfolios.

3. Consider Currency Fluctuations

When investing in Canadian stocks, it's important to consider currency fluctuations. The Canadian dollar can move independently of the U.S. dollar, which can impact the value of your investment.

4. Monitor Your Investments

Once you've invested in Canadian stocks, it's crucial to monitor your investments regularly. This includes staying informed about market trends, company news, and economic indicators that could impact your investments.

Case Study: Investment in Canadian Tech Stocks

One area where Canadian stocks have performed well is in the technology sector. Companies like Shopify and Microsoft have seen significant growth, offering attractive investment opportunities for American investors.

Conclusion

Investing in Canadian stocks can be a strategic move for American investors looking to diversify their portfolios and capitalize on the strengths of the Canadian economy. By conducting thorough research, using a reputable brokerage, and staying informed, investors can take advantage of the benefits that owning Canadian stocks can offer.

so cool! ()

last:Best US Stock Today: Top Picks for Investors"

next:nothing

like

- Best US Stock Today: Top Picks for Investors"

- Understanding the Dow Jones Total Market Index: A Comprehensive Guide

- Top Momentum Stocks: US Market Cap Over $2 Billion

- Index Funds: A Key Player in the US Stock Market

- Recent US Stock Market Decline: Reasons and Implications for 2025

- US Airlines Stock Buybacks: A Boost to Investors' Portfolios?"

- Dow Jones Current Quote: Your Ultimate Guide to Real-Time Stock Market Informatio

- Us Share Futures: Exploring the World of Stock Market Investing

- Maximizing Returns with BTQ US Stock: A Comprehensive Guide

- Stock Market Outlook for October 2024: What Investors Need to Know"

- US Crude Stock Expectations: A Comprehensive Outlook

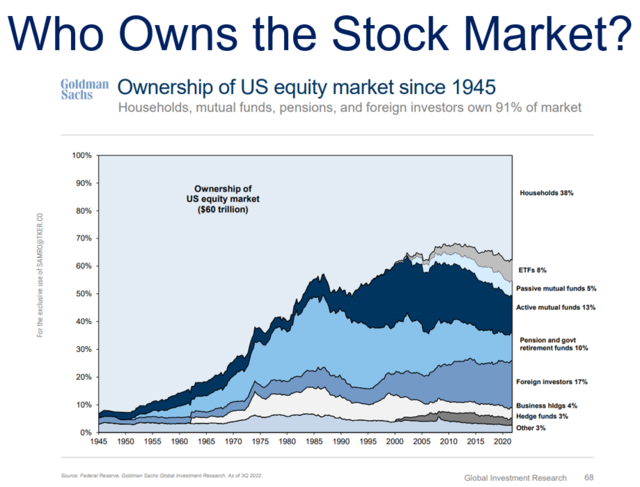

- Does the U.S. Government Own Stocks? Unveiling the Truth

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Owning Us Stocks in Canada: A Strategic Invest

Owning Us Stocks in Canada: A Strategic Invest

Top US Stocks Momentum 2025: A Strategic Inves

"Decoding the US Stock Market: A Deca

US Steel Stock Buyback: Boosting Shareholder V

Current State of the US Stock Market in March

"MSN Money Homepage: Your Ultimate Gu

"Chinese Stocks Impact on U.S. Market

ADR Stocks in the US: Your Gateway to Global I

Does the U.S. Stock Exchange Use Windows? Unve

Black Friday US Stock Market: A Comprehensive

US Biggest Stock Losers Today: A Deep Dive int

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Best Stock Investments to Watch in 2025: A Str"

- Is the US Government Buying Stocks? A Comprehe"

- Unlocking Global Opportunities: A Comprehensiv"

- US Fund Managers Trim Bank Stocks Amid Market "

- Current Trends in US Real Estate Stocks: A Com"

- Unlocking Profits with US Dollar Stock Index F"

- Understanding the US Stock Market: Key Insight"

- Countries Where You Can Trade All US Stocks: Y"

- The 2008 US Stock Market Crash: Causes, Conseq"

- US Senator Sold Stock Holdings: The Truth Behi"