you position:Home > us stock market today > us stock market today

Understanding the Dow Jones Total Market Index: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the vast world of financial markets, the Dow Jones Total Market Index stands as a vital tool for investors seeking to gauge the overall health and performance of the U.S. stock market. This index, which tracks the performance of over 3,000 companies, provides a comprehensive view of the market's dynamics. In this article, we delve into the details of the Dow Jones Total Market Index, its significance, and how it can be utilized for investment purposes.

What is the Dow Jones Total Market Index?

The Dow Jones Total Market Index is a market capitalization-weighted index that aims to represent the entire U.S. stock market. It includes stocks from all sectors and market capitalizations, offering a broad perspective on market trends and movements. Unlike other indices that focus on a specific segment of the market, the Dow Jones Total Market Index provides a holistic view of the entire U.S. equity landscape.

How is the Dow Jones Total Market Index Calculated?

The Dow Jones Total Market Index is calculated by taking the market capitalization of each company in the index and weighting it accordingly. The market capitalization is the total value of a company's outstanding shares of stock. By weighting the index in this manner, the Dow Jones Total Market Index reflects the relative importance of each company within the overall market.

Significance of the Dow Jones Total Market Index

The Dow Jones Total Market Index holds significant importance for several reasons:

- Comprehensive Representation: As mentioned earlier, the index includes stocks from all sectors and market capitalizations, providing a comprehensive view of the U.S. stock market.

- Market Trend Analysis: By tracking the performance of over 3,000 companies, the Dow Jones Total Market Index allows investors to analyze market trends and identify potential opportunities.

- Investment Strategy: The index serves as a valuable tool for investors looking to diversify their portfolios and gain exposure to a wide range of companies across various sectors.

How to Use the Dow Jones Total Market Index for Investment

Investors can utilize the Dow Jones Total Market Index in several ways:

- Portfolio Diversification: By investing in a fund or exchange-traded fund (ETF) that tracks the Dow Jones Total Market Index, investors can gain exposure to a broad range of companies without having to individually select stocks.

- Market Trend Analysis: Investors can monitor the performance of the Dow Jones Total Market Index to gain insights into market trends and make informed investment decisions.

- Benchmarking: The index can be used as a benchmark to compare the performance of individual stocks or investment portfolios against the broader market.

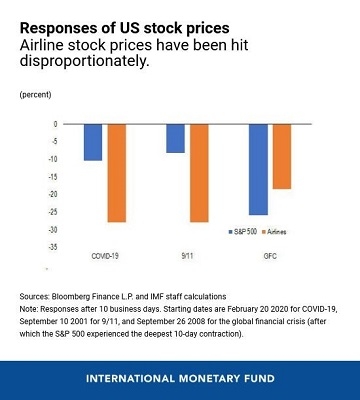

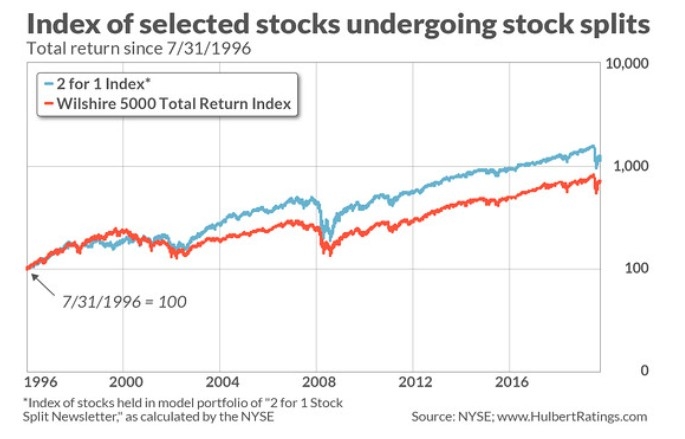

Case Study: The Impact of the Dow Jones Total Market Index on the Financial Crisis of 2008

One notable example of the Dow Jones Total Market Index's impact on the financial markets is its performance during the 2008 financial crisis. As the crisis unfolded, the index experienced significant volatility, reflecting the turmoil in the broader market. This period demonstrated the importance of the Dow Jones Total Market Index as a barometer of market conditions and a tool for investors to assess the overall health of the U.S. stock market.

In conclusion, the Dow Jones Total Market Index is a crucial tool for investors seeking to understand and navigate the U.S. stock market. By providing a comprehensive view of the market's performance and trends, the index allows investors to make informed decisions and diversify their portfolios effectively.

so cool! ()

last:Top Momentum Stocks: US Market Cap Over $2 Billion

next:nothing

like

- Top Momentum Stocks: US Market Cap Over $2 Billion

- Index Funds: A Key Player in the US Stock Market

- Recent US Stock Market Decline: Reasons and Implications for 2025

- US Airlines Stock Buybacks: A Boost to Investors' Portfolios?"

- Dow Jones Current Quote: Your Ultimate Guide to Real-Time Stock Market Informatio

- Us Share Futures: Exploring the World of Stock Market Investing

- Maximizing Returns with BTQ US Stock: A Comprehensive Guide

- Stock Market Outlook for October 2024: What Investors Need to Know"

- US Crude Stock Expectations: A Comprehensive Outlook

- Does the U.S. Government Own Stocks? Unveiling the Truth

- Quotes on Stock Market Crash: Insights and Lessons Learned

- Today Market Close: Key Insights and Analysis

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Understanding the Dow Jones Total Market Index

Understanding the Dow Jones Total Market Index

Novo Nordisk US Stock: A Comprehensive Analysi

Best US Stock to Invest Today: Unveiling the T

RIL Stock in US: A Comprehensive Guide to Inve

New York Markets Today: A Comprehensive Look a

The Lost Decade for US Stocks: An In-Depth Ana

Unlocking the Potential of Trading US Stocks f

"Trump's Tariff Threats Cause Wi

Diamondback Energy US Stocks: A Lucrative Inve

Does the U.S. Stock Exchange Use Windows? Unve

Comparative Analysis of Canadian and US Stock

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Live Stock Charts: Your Ultimate Guide to Real"

- Novo Nordisk US Stock: A Comprehensive Analysi"

- "Top Cannabis Stocks to Invest In as "

- "Understanding the Tax Implications o"

- Top Performing US Stocks in 2022: Unveiling th"

- "News Affecting Us Stock Market: Infl"

- How Much Is an Amazon Stock Worth Today?"

- May 2025 US Stock Market Summary: Key Developm"

- Stock Market Outlook: October 2025 - US Market"

- US Alternative Energy Stocks: A Smart Investme"