you position:Home > us stock market today > us stock market today

Does the U.S. Government Own Stocks? Unveiling the Truth

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving financial landscape, one question that often sparks curiosity is whether the U.S. government owns stocks. This article delves into this intriguing topic, shedding light on the reality behind the question.

Understanding the Federal Reserve's Role

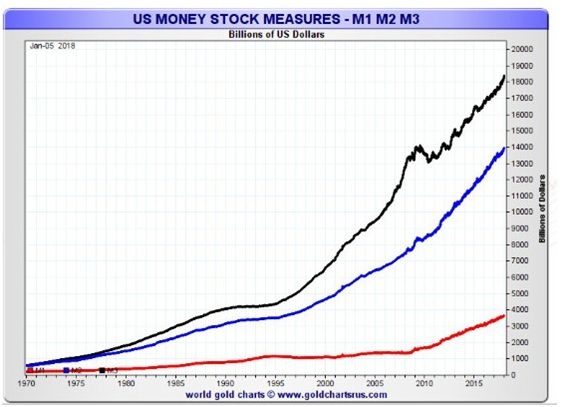

The Federal Reserve, often referred to as the Fed, plays a pivotal role in the U.S. economy. As the central banking system of the United States, the Fed has the authority to influence the nation's monetary policy, including the buying and selling of stocks.

The Federal Reserve's Stock Holdings

Contrary to popular belief, the Federal Reserve does not directly own stocks. Instead, the Fed's investments are primarily focused on government securities, including U.S. Treasury bills, notes, and bonds. These securities are considered low-risk assets and serve as a crucial tool for the Fed to conduct monetary policy.

The Federal Reserve's Investment Strategy

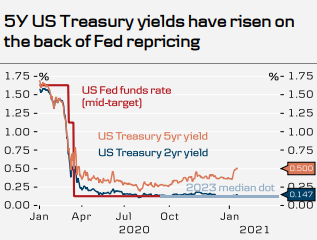

The Fed's investment strategy is designed to maximize the return on its assets while maintaining stability and security. While the Fed does not directly invest in stocks, it indirectly influences the stock market through its control over interest rates and other monetary policy tools.

How the Federal Reserve Impacts the Stock Market

The Federal Reserve's actions can have a significant impact on the stock market. For instance, when the Fed raises interest rates, it can lead to higher borrowing costs for companies, potentially affecting their profitability and stock prices. Conversely, when the Fed lowers interest rates, it can stimulate economic growth and boost stock prices.

Case Study: The 2008 Financial Crisis

One notable example of the Federal Reserve's impact on the stock market is the 2008 financial crisis. In response to the crisis, the Fed implemented various emergency lending programs and purchased large quantities of government securities. These actions helped stabilize the financial system and prevent a deeper recession, ultimately benefiting the stock market.

The Role of the U.S. Treasury

While the Federal Reserve does not own stocks, the U.S. Treasury does. The Treasury manages the government's finances, including the sale of stocks to finance government spending. These stocks are often referred to as "Treasury stock" and are held by investors, including domestic and foreign entities.

Conclusion

In conclusion, while the U.S. government, through the Federal Reserve and the Treasury, does not directly own stocks, it plays a crucial role in shaping the financial landscape and indirectly influencing the stock market. Understanding the complexities of these relationships is essential for anyone interested in the U.S. economy and the stock market.

so cool! ()

last:Quotes on Stock Market Crash: Insights and Lessons Learned

next:nothing

like

- Quotes on Stock Market Crash: Insights and Lessons Learned

- Today Market Close: Key Insights and Analysis

- May 2025 US Stock Market Summary: Key Developments and Insights

- Google Results Today: The Ultimate Guide to Mastering Search Engine Optimization

- Live Stock Charts: Your Ultimate Guide to Real-Time Market Insights

- US Equity Market Today: A Comprehensive Overview

- Stock Finance: Sina.cn US Quotes – Your Ultimate Guide

- Retailers in the US Stocking Indian Ingredients: A Culinary Revolution

- Indian Companies on the US Stock Exchange: A Growing Presence

- Unveiling the Power of Good US Small Cap Stock Mutual Funds

- Invest in US Stocks: A Comprehensive Guide to Maximizing Your Returns

- Understanding the US Market Value: Key Insights and Strategies

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Does the U.S. Government Own Stocks? Unveiling

Does the U.S. Government Own Stocks? Unveiling

"Elliott Wave Theory and Its Implicat

Best Stock Investments to Watch in 2025: A Str

British Pound to US Dollar Stock Chart: A Comp

Promising Us Stocks 2025 Outlook: Top 5 Stocks

US Job Data: How It Impacts the Stock Market&a

Understanding the Value of Boeing Stock in US

Reuters US Stocks Article: Unveiling the Lates

Schlumberger US Stocks: A Comprehensive Guide

Exploring Chinese Company Stocks in the US Mar

"Dbs Buy Us Stocks: A Guide to Invest

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Data Centre Stocks: The US Market's Hidde"

- US Fund Managers Trim Bank Stocks Amid Market "

- Us Stock Airline: Exploring the Best Opportuni"

- Top Companies Selling Medical Marijuana on the"

- Best US Stocks to Buy Now for Long-Term Invest"

- How Much Has S Corporation Saved Your Business"

- Countries Where You Can Trade All US Stocks: Y"

- Understanding the Daily Dollar Value of Traded"

- Maximizing Efficiency: Understanding US Foods "

- Latest US Stock Market News: September 2025 Ro"