you position:Home > us stock market live > us stock market live

Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, investors are constantly seeking opportunities that promise growth and stability. One such stock that has caught the attention of many is CRCL. In this article, we delve into the details of CRCL stock, providing you with a comprehensive analysis to help you make informed investment decisions.

Understanding CRCL Stock

CRCL, also known as Corporation A, is a publicly traded company that operates in the technology sector. The stock is listed on the US stock exchange, making it accessible to investors worldwide. With a market capitalization of over $5 billion, CRCL has established itself as a significant player in the industry.

Financial Performance

To assess the potential of CRCL stock, it is crucial to examine its financial performance. Over the past few years, the company has reported robust revenue growth, driven by its innovative products and services. Its net income has also shown a steady increase, reflecting the company's profitability.

Market Trends and Industry Analysis

The technology sector is one of the fastest-growing industries globally, and CRCL has positioned itself to capitalize on these trends. The company's focus on emerging technologies such as artificial intelligence and machine learning has enabled it to stay ahead of the curve. Additionally, its strategic partnerships with leading industry players have further strengthened its market position.

Dividends and Stock Price Analysis

Investors often look for stocks that offer dividends as a way to generate passive income. CRCL has a strong track record of paying dividends, with a dividend yield that has consistently grown over the years. This has made the stock attractive to income investors.

From a stock price perspective, CRCL has shown significant upward momentum, with the price increasing by over 20% in the past year. This upward trend can be attributed to the company's strong financial performance and positive market sentiment.

Case Studies

To illustrate the potential of CRCL stock, let's look at a few case studies:

Company B Acquisition: CRCL recently acquired Company B, a leading provider of cloud computing solutions. This acquisition has not only expanded CRCL's product portfolio but has also enhanced its market share in the cloud computing sector.

Product Launch: CRCL launched a new line of products that have been well-received by the market. The increased demand for these products has contributed to the company's revenue growth and stock price appreciation.

Conclusion

In conclusion, CRCL stock presents a compelling investment opportunity for investors looking to diversify their portfolios. With a strong financial performance, positive market trends, and a robust dividend yield, CRCL stock is poised for continued growth. As always, it is important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

so cool! ()

like

- Title: "S&P 500's Influence on US Stock Market Capitalizati

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Evergrande Stock Symbol in US: Everything You Need to Know

- Investing in US Stocks from Australia: A Comprehensive Guide

- Market Cap US Stock Market Total: A Comprehensive Guide

- Title: Unlocking the Secrets of Fit Stock Price in the US Market

- Best US Total Stock Market Index Fund: Your Ultimate Guide to Investment Success

- Buying US Stocks in the UK: A Comprehensive Guide

- Buy Nestlé Stock US: A Smart Investment in Global Food Giant

- PS5 Stock in the US: A Comprehensive Guide to Availability and Strategies

- US Large Cap Stocks Momentum RSI Analysis: October 2025 Outlook

- Unlocking the Potential of NAK Stock: A Comprehensive Analysis

hot stocks

Title: "Best Performing US Stocks: To

Title: "Best Performing US Stocks: To- Title: "Best Performing US Stocks: To"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

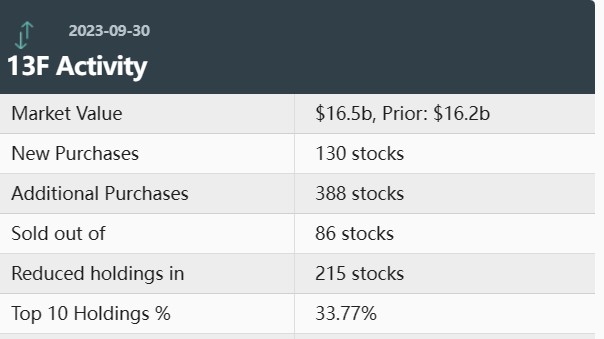

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Unlocking the Potential of CRCL Stock: A Compr

Unlocking the Potential of CRCL Stock: A Compr

China Deal Affecting US Stock Market: What Inv

Stock Market Hours: What You Need to Know Abou

Rubbermaid Commercial 4242-88-BLA 100 US Gallo

Top 3 US Marijuana Stocks to Watch in 2023

US Bank Stock Comparison: Top Picks for 2023

Title: The Future of Oil: Unraveling the US St

Buying US Stocks in Canada with Questrade: A C

How Do I Invest in the Top 1000 US Stocks? A C

The Last of Us 2 Ellie Edition Stock: Your Ult

February 2020 IPOs: A Deep Dive into the US St

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Stock Market Correlation with US Election Cycl"

- Best US Total Stock Market Index Fund: Your Ul"

- September 2019 IPO Calendar: A Comprehensive O"

- Best Performing US Large Cap Stocks Last Week:"

- Tesla Stock in US Dollars: A Comprehensive Ana"

- FDA Approval Press Release: A Game-Changer for"

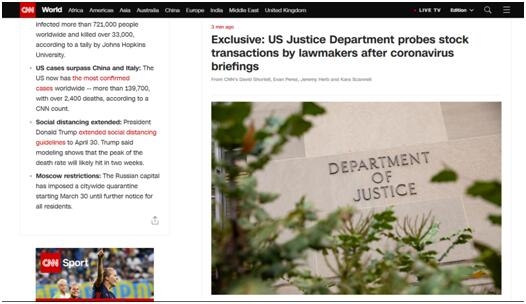

- Title: "Coronavirus US Stock Market: "

- New Millennium US Stock Price: Trends and Pred"

- Title: "US Cobalt Inc Stock Price: Cu"

- Title: "Top US-Based EV Stocks to Wat"