you position:Home > us stock market live > us stock market live

New Millennium US Stock Price: Trends and Predictions

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

The turn of the millennium marked a significant shift in the landscape of the US stock market. As we delve into the new millennium, it's essential to understand the trends and predictions that shape the stock prices today. This article explores the evolution of the US stock market, its current trends, and potential future directions.

Evolution of the US Stock Market

In the late 1990s, the US stock market experienced a period of remarkable growth. The technology sector, particularly, saw unprecedented expansion. The NASDAQ Composite Index, which tracks technology stocks, reached an all-time high in March 2000. However, the dot-com bubble burst in 2000, leading to a significant decline in stock prices.

Post-2000, the US stock market experienced a gradual recovery. The financial crisis of 2008 was a pivotal moment that reshaped the market. The S&P 500, a widely followed index that tracks the performance of 500 large companies, fell by approximately 57% between October 2007 and March 2009. Since then, the market has recovered and reached new highs.

Current Trends in US Stock Prices

Diversification: Investors have increasingly been diversifying their portfolios to mitigate risks. This includes investing in different sectors, geographical regions, and asset classes.

Technology and Innovation: The technology sector continues to dominate the US stock market. Companies like Apple, Microsoft, and Amazon have seen significant growth in their stock prices.

Economic Recovery: The US economy has been gradually recovering from the impact of the COVID-19 pandemic. This has positively impacted the stock market, as companies have started reporting improved financial results.

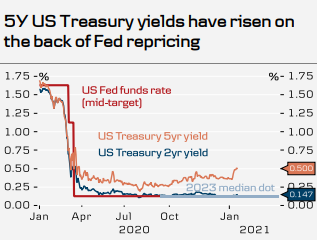

Low Interest Rates: The Federal Reserve has kept interest rates low to stimulate economic growth. This has made stocks more attractive compared to fixed-income investments like bonds.

Predictions for the Future

Volatility: The US stock market is likely to remain volatile in the short term. Factors such as political uncertainties, economic fluctuations, and global events can cause stock prices to fluctuate.

Tech Sector Dominance: The technology sector is expected to continue its growth trajectory. Companies that invest in innovation and expand their market presence will likely see significant gains.

Economic Recovery: The economic recovery is expected to continue, leading to improved financial results for companies. This should positively impact stock prices.

Inflation: The Federal Reserve's response to inflation could impact the stock market. Companies that can pass on increased costs to consumers or those with pricing power are likely to perform better.

Case Study: Amazon

Amazon, the e-commerce giant, has seen remarkable growth in its stock price since the turn of the millennium. The company's initial public offering (IPO) in 1997 was priced at

The success of Amazon can be attributed to its focus on innovation, expansion into new markets, and efficient logistics. The company has also been successful in diversifying its revenue streams, including cloud computing and streaming services.

In conclusion, the US stock market has evolved significantly over the past two decades. Understanding the current trends and predictions can help investors make informed decisions. While the market remains volatile, technology and innovation are likely to play a key role in shaping the future of stock prices.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Graph of Us Stock Market Leverage: Understandi

Understanding the Dow Jones Total Stock Market

The Evolution of the U.S. Stock Exchange: A Jo

Himalaya Capital: A Deep Dive into Their US St

Top 3 US Marijuana Stocks to Watch in 2023

2025 4 24 US Stock Market Summary: Key Insight

Best US Total Stock Market Index Fund: Your Ul

US Large Cap Value Stocks with Low PE Ratios:

Baba Us Stock: The Ultimate Guide to Navigatin

Outlook for the US Stock Market on August 7th,

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "Percentage of US Population with Sto"

- Understanding Canadian Trading US Stocks Tax I"

- Maximizing Total Return for US Stocks: Strateg"

- Top Preferred Stocks in the US: Your Ultimate "

- "Percentage of US Stocks Above 200-Da"

- Today's Top Momentum US Stocks: Unveiling"

- Maximizing Growth with MGM US Stock: A Compreh"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- "How Much of the U.S. Population Owns"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"