you position:Home > us stock market live > us stock market live

Airline Stocks in the US Stock Market: A Comprehensive Overview

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving world of the stock market, airline stocks have always been a topic of interest for investors. The US airline industry, in particular, has seen its fair share of ups and downs, making it a dynamic and exciting sector to watch. This article provides a comprehensive overview of airline stocks in the US stock market, highlighting key trends, major players, and potential investment opportunities.

Understanding the US Airline Industry

The US airline industry is one of the largest in the world, with numerous airlines operating domestic and international routes. The industry has faced significant challenges over the years, including rising fuel costs, economic downturns, and fierce competition. Despite these challenges, many airlines have managed to thrive and become major players in the stock market.

Major Airlines in the US Stock Market

Several airlines have a significant presence in the US stock market. Some of the most notable include:

American Airlines Group (AAL): As one of the largest airlines in the world, American Airlines Group has a strong presence in the US stock market. The company operates a vast network of domestic and international routes and has a diverse fleet of aircraft.

Delta Air Lines (DAL): Delta Air Lines is another major player in the US airline industry. The company has a robust network and offers a wide range of services, including international, domestic, and regional flights.

United Airlines Holdings (UAL): United Airlines Holdings is a leading airline in the US, offering extensive domestic and international routes. The company has a diverse fleet and has made significant investments in technology and customer service.

Southwest Airlines (LUV): Southwest Airlines is known for its low-cost business model and has a strong presence in the US stock market. The company operates a large network of domestic routes and has a reputation for excellent customer service.

Trends in the US Airline Industry

Several key trends have shaped the US airline industry in recent years:

Rising Fuel Costs: Fuel costs have been a significant challenge for airlines, but many have managed to mitigate the impact through fuel hedging and other strategies.

Economic Downturns: Economic downturns have had a negative impact on the airline industry, but airlines have adapted by cutting costs and improving efficiency.

Fierce Competition: The US airline industry is highly competitive, with numerous airlines vying for market share. This competition has led to lower fares and improved service quality.

Technological Innovation: Many airlines have invested in technology to improve customer experience and operational efficiency. This includes mobile check-in, online boarding, and advanced reservation systems.

Investment Opportunities in Airline Stocks

Investing in airline stocks can be a lucrative opportunity, but it also comes with its own set of risks. Here are some key factors to consider when investing in airline stocks:

Company Performance: Evaluate the financial performance of the airline, including revenue growth, profitability, and debt levels.

Market Trends: Stay informed about market trends, such as fuel prices, economic conditions, and industry competition.

Management Team: Assess the strength and experience of the airline's management team.

Dividend Yield: Consider the dividend yield of the airline, as some airlines offer regular dividends to shareholders.

Case Study: American Airlines Group (AAL)

American Airlines Group is a prime example of a major airline that has adapted to the challenges of the industry. The company has implemented several strategies to improve its financial performance, including:

Fuel Hedging: American Airlines Group has used fuel hedging to mitigate the impact of rising fuel costs.

Cost Reduction: The company has cut costs through various initiatives, including reducing aircraft maintenance and improving operational efficiency.

Investment in Technology: American Airlines Group has invested in technology to improve customer experience and operational efficiency.

In conclusion, airline stocks in the US stock market offer exciting investment opportunities, but they also come with their own set of risks. By understanding the industry, evaluating company performance, and staying informed about market trends, investors can make informed decisions when investing in airline stocks.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

- Evergrande Stock Symbol in US: Everything You Need to Know

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Himalaya Capital: A Deep Dive into Their US St

The Evolution of the U.S. Stock Exchange: A Jo

Outlook for the US Stock Market on August 7th,

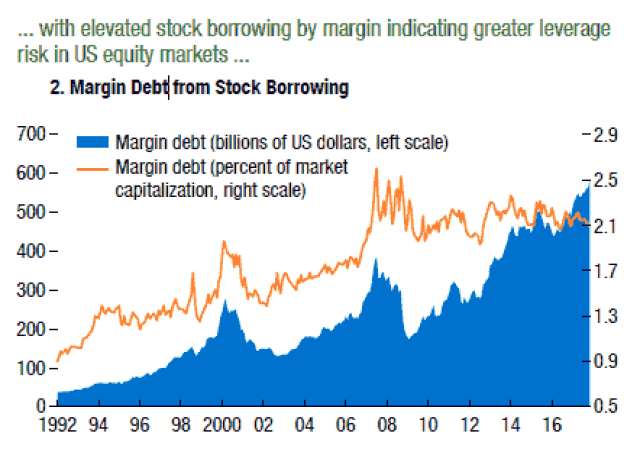

Graph of Us Stock Market Leverage: Understandi

Baba Us Stock: The Ultimate Guide to Navigatin

2025 4 24 US Stock Market Summary: Key Insight

Understanding the Dow Jones Total Stock Market

Top 3 US Marijuana Stocks to Watch in 2023

Best US Total Stock Market Index Fund: Your Ul

US Large Cap Value Stocks with Low PE Ratios:

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "How Much of the U.S. Population Owns"

- Maximizing Growth with MGM US Stock: A Compreh"

- Today's Top Momentum US Stocks: Unveiling"

- Understanding Canadian Trading US Stocks Tax I"

- "Percentage of US Population with Sto"

- Maximizing Total Return for US Stocks: Strateg"

- Top Preferred Stocks in the US: Your Ultimate "

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- "Percentage of US Stocks Above 200-Da"