you position:Home > us stock market live > us stock market live

Unlocking the Potential of Chevron US Stocks: A Comprehensive Guide

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving world of investments, Chevron US stocks have emerged as a compelling option for investors seeking stability and growth. With a history of resilience and innovation, Chevron, one of the world's largest integrated energy companies, offers a unique opportunity to tap into the global energy sector. This article delves into the key aspects of Chevron US stocks, providing a comprehensive guide for potential investors.

Understanding Chevron's Business Model

Chevron Corporation, often abbreviated as Chevron, operates in three main segments: Upstream, Midstream, and Downstream. The Upstream segment involves the exploration and production of crude oil and natural gas. The Midstream segment manages the transportation and storage of energy products, while the Downstream segment includes refining, marketing, and distributing fuels and other energy products.

What sets Chevron apart is its diversified business model, which allows it to weather market fluctuations more effectively than its peers. By operating across the entire energy value chain, Chevron can optimize its operations and capitalize on various market conditions.

The Performance of Chevron US Stocks

Over the years, Chevron US stocks have demonstrated strong performance, particularly in the face of industry challenges. During the 2020 oil crisis, when global demand plummeted due to the COVID-19 pandemic, Chevron's shares held their ground, showcasing the company's financial strength and resilience.

Investment Opportunities and Risks

Investing in Chevron US stocks presents several opportunities:

- Dividend Yield: Chevron has a long-standing history of paying dividends, making it an attractive option for income-seeking investors.

- Long-Term Growth: With a focus on sustainable energy solutions and technological advancements, Chevron is well-positioned for long-term growth.

- Market Resilience: As mentioned earlier, Chevron's diversified business model and global presence have helped it navigate market downturns effectively.

However, like any investment, there are risks involved:

- Energy Market Volatility: The energy sector is subject to significant price fluctuations, which can impact Chevron's financial performance.

- Regulatory Changes: Changes in government policies and regulations can affect Chevron's operations and profitability.

Case Study: Chevron's Response to the 2020 Oil Crisis

One of the most notable examples of Chevron's resilience is its response to the 2020 oil crisis. Despite the dramatic drop in oil prices, Chevron managed to maintain its dividend payments and continued investing in its business. This demonstrated the company's financial stability and commitment to long-term growth.

Conclusion

In conclusion, Chevron US stocks represent a compelling investment opportunity for those seeking stability and growth in the energy sector. With a diversified business model, strong financial performance, and a commitment to sustainable energy solutions, Chevron is well-positioned to thrive in the coming years. As always, it is essential for investors to conduct thorough research and consider their own risk tolerance before making any investment decisions.

so cool! ()

last:Real-Time US Stock Futures: A Comprehensive Guide

next:nothing

like

- Real-Time US Stock Futures: A Comprehensive Guide

- Title: "Tax Implications of Buying US Stocks: Everything You Need to Kno

- FDA Approval Press Release: A Game-Changer for US Traded Stocks

- Exploring Lufthansa's Dangerous Goods Policy and Pepsi Stock Trends

- Are There US Marijuana Stocks? A Comprehensive Guide

- Is the US Stock Market Open the Day After Thanksgiving?

- US Cellular Stock Drop: What's Behind the Decline?

- The Last of Us 2 Ellie Edition Stock: Your Ultimate Guide

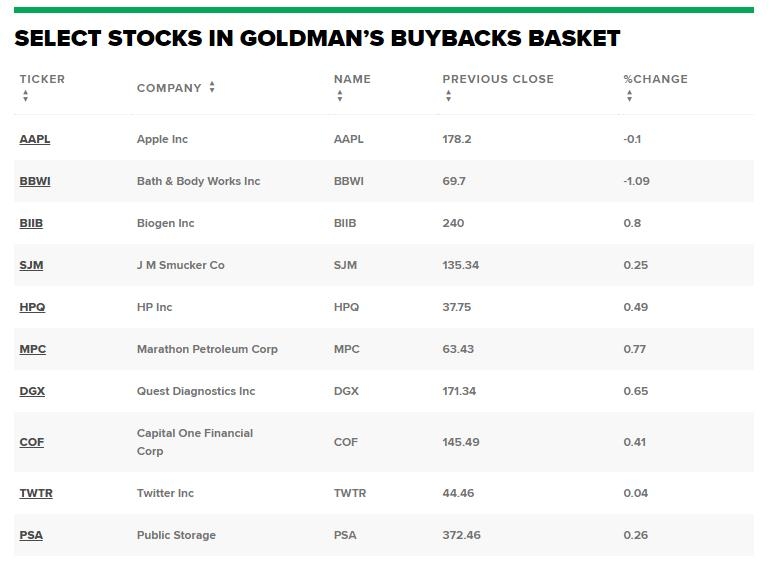

- Five US Tech Giants Spend $115B on Buying Back Stock: What Does It Mean for Inves

- Is the US Stock Market Open on December 31?

- US Historical Stock Market Crash: A Deep Dive into the Great Depression and Its L

- "BABA Stock Snapshot: Your Comprehensive Guide to Personal.vanguard.com’

hot stocks

Unlocking Potential: The Rise of Cannabis Stoc

Unlocking Potential: The Rise of Cannabis Stoc- Unlocking Potential: The Rise of Cannabis Stoc"

- Title: "Percentage of US Stocks Above"

- Title: "Is Today a US Stock Market Ho"

- Unlocking the Potential of Chevron US Stocks: "

- Free Stock: Contact Us for Unbeatable Imagery "

- US Graphite Stock: A Comprehensive Guide to In"

- ASX vs US Stocks: A Comprehensive Comparison f"

- Title: "US Stock Market Reacts to the"

recommend

Unlocking the Potential of Chevron US Stocks:

Unlocking the Potential of Chevron US Stocks:

Five US Tech Giants Spend $115B on Buying Back

Top US Mid-Cap Stocks: Investment Opportunitie

Coupang US Stock: A Deep Dive into the South K

Stock Image Join Us: Unlock the Power of Visua

How Many Different Stock Exchanges Are There i

Infosys Stock in US: A Comprehensive Guide to

Title: "Tax Implications of Buying US

Free Stock: Contact Us for Unbeatable Imagery

FDA Approval Press Release: A Game-Changer for

Title: Top 10 US Stocks for 2019: A Comprehens

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Title: Top 10 US Stocks for 2019: A Comprehens"

- Amazon Stock: The US Dollar Perspective"

- Title: "US Stock Market Reacts to the"

- Is the US Stock Market Open the Day After Than"

- Unlocking Profit Potential: The Rising Star of"

- Uncovering the Hidden Gems: Top US Defense Pen"

- Is the US Stock Market Open on December 31?"

- Coupang US Stock: A Deep Dive into the South K"

- Stock Image Join Us: Unlock the Power of Visua"

- Infosys Stock in US: A Comprehensive Guide to "