you position:Home > us stock market live > us stock market live

US Cellular Stock Drop: What's Behind the Decline?

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

The US Cellular Corporation has recently seen its stock price take a dive. This article delves into the reasons behind this sudden drop and what it could mean for the future of the company.

Understanding the Stock Price Decline

US Cellular's stock has been on a downward spiral, plummeting from its peak in recent months. Several factors have contributed to this decline, including:

- Competition in the Wireless Market: The US wireless market is incredibly competitive, with major players like AT&T, Verizon, and T-Mobile vying for market share. US Cellular has been struggling to keep up with these giants, leading to a loss of customers and revenue.

- Poor Financial Performance: The company has reported several quarters of disappointing financial results, including lower revenue and earnings. This has led investors to lose confidence in the company's future prospects.

- Regulatory Challenges: US Cellular has faced regulatory hurdles that have impacted its operations. These challenges have made it difficult for the company to expand its network and improve its service quality.

The Impact on Customers

The stock drop has raised concerns among US Cellular customers. Many are worried about the company's ability to invest in its network and improve service quality. This could lead to:

- Reduced Network Coverage: Without sufficient investment, US Cellular may struggle to maintain its current network coverage, leading to dropped calls and slower internet speeds.

- Increased Prices: The company may need to increase prices to make up for the decline in revenue, which could put a strain on customers' budgets.

Case Studies: Similar Stock Drops

To understand the potential impact of US Cellular's stock drop, let's look at some recent examples of similar situations:

- T-Mobile US Stock Drop: In 2018, T-Mobile's stock took a nosedive after the company reported disappointing financial results. The stock eventually recovered, but the incident highlights the volatility of the wireless market.

- AT&T Stock Drop: In 2019, AT&T's stock plummeted after the company acquired Time Warner. The acquisition was seen as overpriced, and investors were concerned about the company's future financial stability.

What Does the Future Hold for US Cellular?

The future of US Cellular remains uncertain. While the company has faced several challenges, it still has potential to turn things around. Here are some potential steps the company could take:

- Strategic Partnerships: US Cellular could form strategic partnerships with other companies to improve its network coverage and service quality.

- Innovation: The company could invest in new technologies and services to differentiate itself from its competitors.

- Cost Reduction: US Cellular could implement cost-cutting measures to improve its financial performance.

In conclusion, the recent stock drop for US Cellular is a cause for concern, but it's not the end of the road for the company. With strategic decisions and a focus on innovation, US Cellular could overcome its current challenges and secure a brighter future.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Baba Us Stock: The Ultimate Guide to Navigatin

Top 3 US Marijuana Stocks to Watch in 2023

Outlook for the US Stock Market on August 7th,

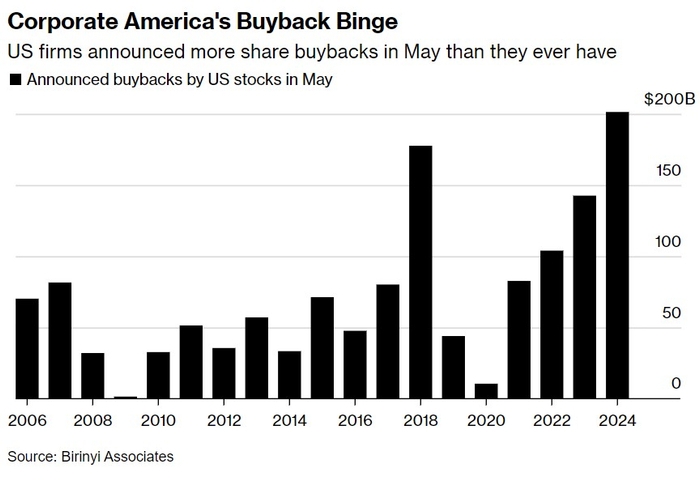

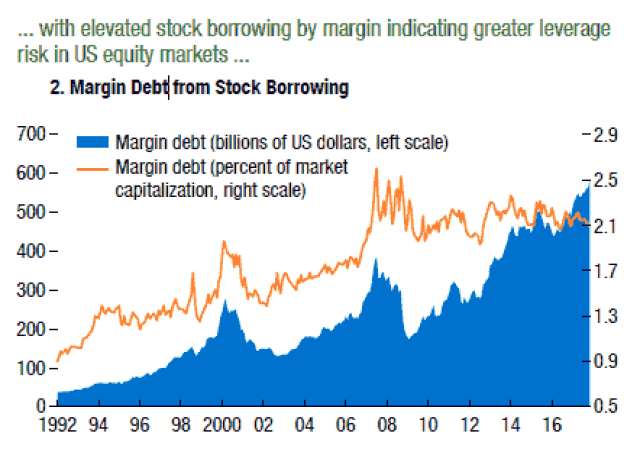

Graph of Us Stock Market Leverage: Understandi

The Evolution of the U.S. Stock Exchange: A Jo

Understanding the Dow Jones Total Stock Market

US Large Cap Value Stocks with Low PE Ratios:

Himalaya Capital: A Deep Dive into Their US St

Best US Total Stock Market Index Fund: Your Ul

2025 4 24 US Stock Market Summary: Key Insight

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Maximizing Growth with MGM US Stock: A Compreh"

- Understanding Canadian Trading US Stocks Tax I"

- Maximizing Total Return for US Stocks: Strateg"

- "Percentage of US Population with Sto"

- Top Preferred Stocks in the US: Your Ultimate "

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- Today's Top Momentum US Stocks: Unveiling"

- "Percentage of US Stocks Above 200-Da"

- "How Much of the U.S. Population Owns"