you position:Home > us stock market live > us stock market live

Amazon Stock: The US Dollar Perspective

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving world of e-commerce, Amazon (NASDAQ: AMZN) has emerged as a dominant force. This article delves into the dynamics of Amazon's stock performance, focusing on its impact in the US dollar. Whether you're a seasoned investor or just dipping your toes into the stock market, understanding the nuances of Amazon's stock in relation to the US dollar is crucial.

Understanding Amazon's Stock Performance

Amazon's stock has seen its fair share of ups and downs over the years. Since its IPO in 1997, the company has grown exponentially, transforming from an online bookstore to a global retail giant. The stock's performance has been largely influenced by various factors, including market trends, economic conditions, and company-specific developments.

The US Dollar's Influence

The US dollar plays a pivotal role in the valuation of Amazon's stock. As a global company, Amazon's revenue is generated in various currencies. However, when it comes to reporting financials and valuing the stock, the US dollar is the primary currency of reference. This makes the exchange rate a critical factor in determining the stock's value.

Exchange Rate Fluctuations

Exchange rate fluctuations can have a significant impact on Amazon's stock. For instance, if the US dollar strengthens against other currencies, Amazon's revenue in those currencies will translate to fewer US dollars. This can lead to a decrease in the company's reported earnings and potentially impact the stock's price.

Conversely, if the US dollar weakens, Amazon's revenue in other currencies will translate to more US dollars, potentially boosting the company's reported earnings and stock price. This dynamic underscores the importance of keeping an eye on exchange rate movements.

Historical Analysis

Let's take a look at some historical examples to understand the relationship between the US dollar and Amazon's stock. In 2014, when the US dollar weakened, Amazon's stock experienced a significant surge. Conversely, in 2018, when the US dollar strengthened, the stock saw a decline.

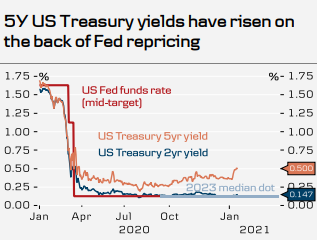

Case Study: Amazon's Stock Performance in 2020

One of the most notable examples of the US dollar's influence on Amazon's stock is the events of 2020. Amidst the COVID-19 pandemic, the US dollar weakened, and Amazon's stock soared. This was primarily due to the increased demand for online shopping and the company's ability to adapt to the changing market conditions.

Investing Strategies

Understanding the relationship between the US dollar and Amazon's stock can help investors develop more informed strategies. Here are a few key considerations:

- Monitor Exchange Rates: Keep an eye on exchange rate movements, especially if you're considering investing in Amazon or other global companies.

- Diversify Your Portfolio: Diversifying your portfolio can help mitigate the risk associated with exchange rate fluctuations.

- Focus on Long-Term Growth: While short-term fluctuations can be unpredictable, focusing on the long-term growth potential of Amazon can provide more stable returns.

Conclusion

In conclusion, the relationship between Amazon's stock and the US dollar is a complex one. By understanding this relationship, investors can make more informed decisions and potentially capitalize on market opportunities. As the e-commerce landscape continues to evolve, staying informed about the factors that influence Amazon's stock performance is essential for any investor.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Top 3 US Marijuana Stocks to Watch in 2023

Best US Total Stock Market Index Fund: Your Ul

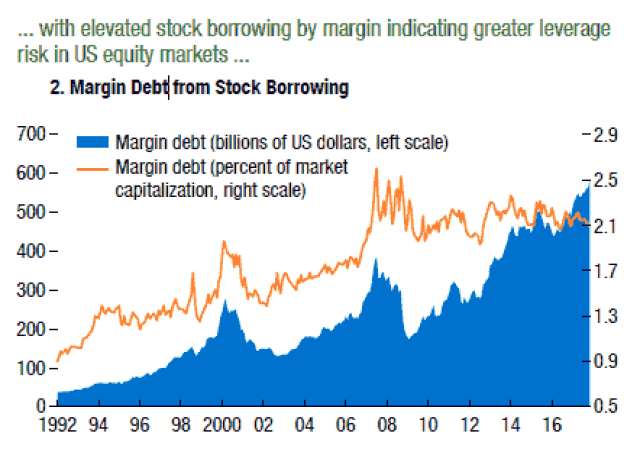

Graph of Us Stock Market Leverage: Understandi

Baba Us Stock: The Ultimate Guide to Navigatin

US Large Cap Value Stocks with Low PE Ratios:

Outlook for the US Stock Market on August 7th,

Himalaya Capital: A Deep Dive into Their US St

The Evolution of the U.S. Stock Exchange: A Jo

2025 4 24 US Stock Market Summary: Key Insight

Understanding the Dow Jones Total Stock Market

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- "Percentage of US Population with Sto"

- Top Preferred Stocks in the US: Your Ultimate "

- Understanding Canadian Trading US Stocks Tax I"

- "How Much of the U.S. Population Owns"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- "Percentage of US Stocks Above 200-Da"

- Today's Top Momentum US Stocks: Unveiling"

- Maximizing Growth with MGM US Stock: A Compreh"

- Maximizing Total Return for US Stocks: Strateg"