you position:Home > us stock market live > us stock market live

Investing in US Stocks from Australia: A Comprehensive Guide

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Embarking on the journey of investing in US stocks from Australia can be both exhilarating and challenging. With the global economy becoming increasingly interconnected, Australian investors now have access to a wide array of investment opportunities across the Atlantic. This guide will help you navigate through the complexities of investing in US stocks from Australia, ensuring that you make informed decisions.

Understanding the Basics

1. US Stock Market Overview The US stock market, represented by indices like the S&P 500 and the NASDAQ, is the largest and most influential in the world. It hosts numerous companies across various sectors, making it an attractive destination for international investors.

2. Currency Conversion When investing in US stocks from Australia, it's crucial to consider currency conversion. The AUD/USD exchange rate can fluctuate, impacting your investment returns. Keep an eye on economic indicators and forecasts to make informed decisions.

3. Regulatory Considerations Australian investors need to be aware of regulatory requirements. The Australian Securities and Investments Commission (ASIC) provides guidelines for foreign investment, ensuring compliance with local and international regulations.

Strategies for Successful Investing

1. Diversification Diversifying your portfolio is key to mitigating risks. Consider investing in different sectors, industries, and geographical regions. This approach can help you capitalise on various market conditions.

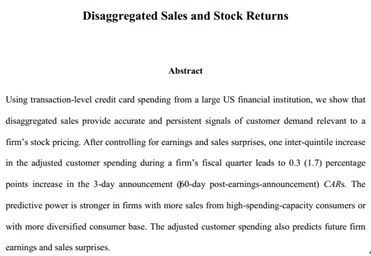

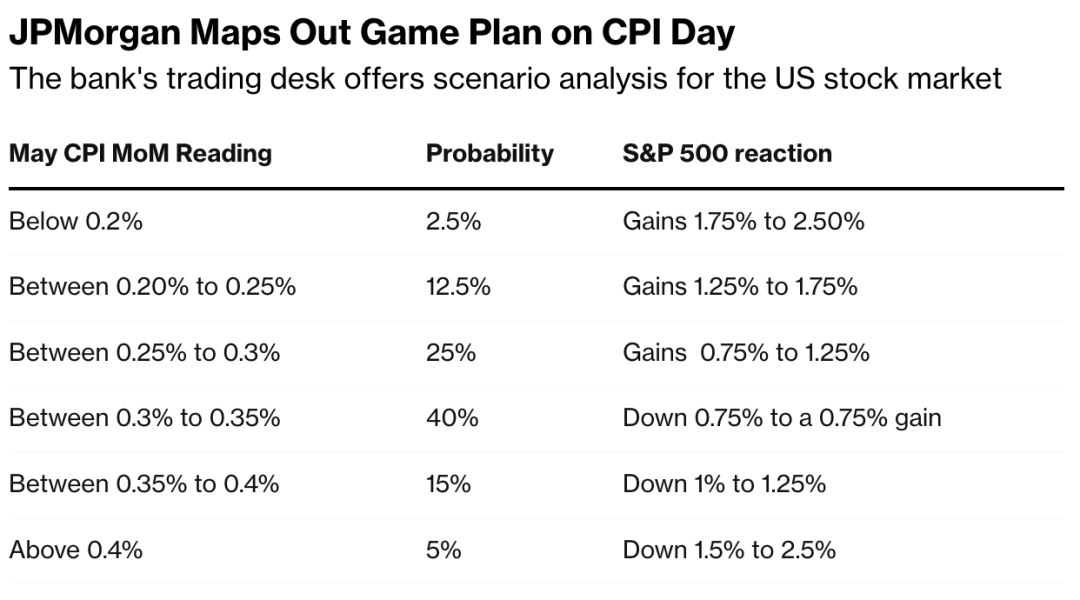

2. Research and Analysis Conduct thorough research and analysis before investing. Utilize financial news, reports, and analytical tools to gain insights into potential investments.

3. Tax Implications Be aware of the tax implications of investing in US stocks from Australia. The Australian Taxation Office (ATO) provides guidelines on tax obligations for foreign investments.

Top US Stocks for Australian Investors

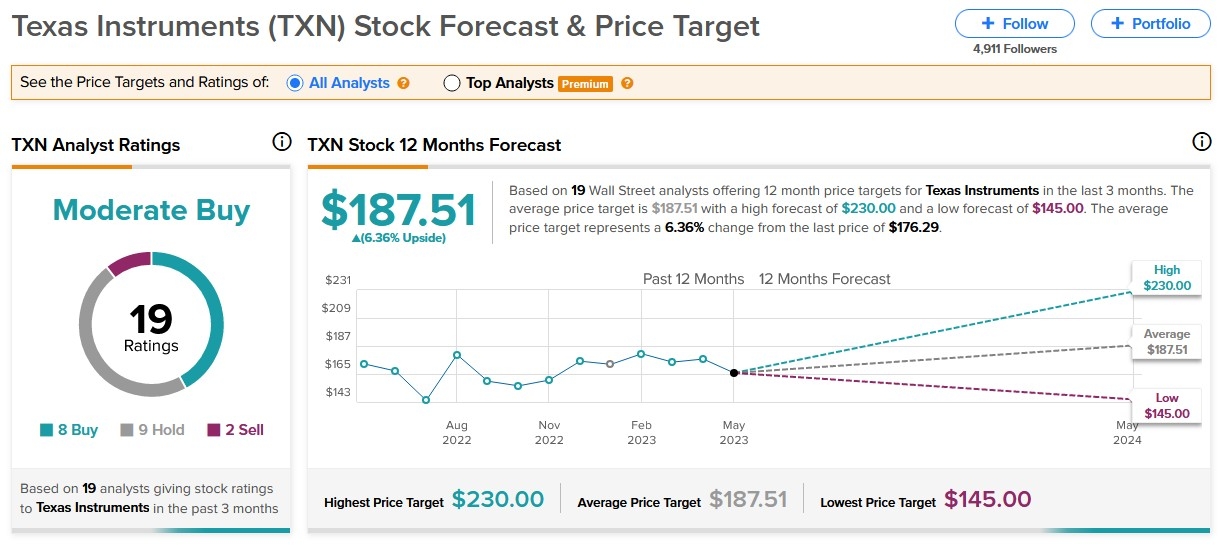

1. Technology Giants Technology companies like Apple (AAPL) and Microsoft (MSFT) have consistently delivered strong returns. These companies are leaders in their respective sectors and offer stability and growth potential.

2. Healthcare Innovators The healthcare sector has seen significant growth in recent years. Companies like Johnson & Johnson (JNJ) and Pfizer (PFE) are renowned for their innovation and market dominance.

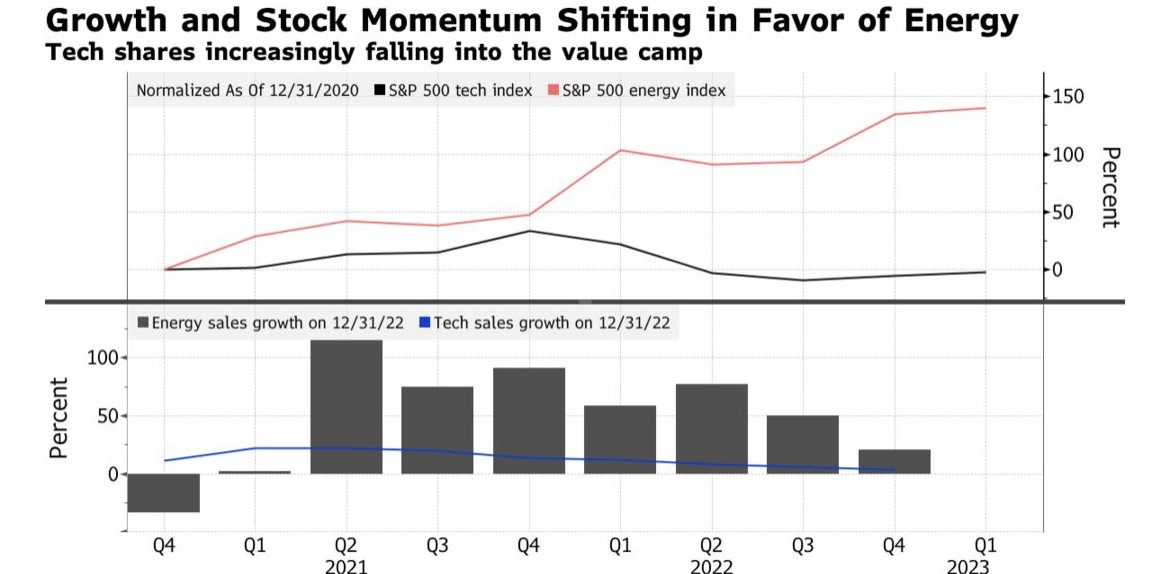

3. Energy Majors Energy companies like ExxonMobil (XOM) and Chevron (CVX) are well-established players in the global energy market. They offer stability and potential for long-term growth.

Case Studies

1. Investing in Tesla (TSLA) Australian investor Sarah invested in Tesla (TSLA) after thorough research and analysis. Within a year, her investment grew by 50%, showcasing the potential of investing in cutting-edge technology companies.

2. Investing in Johnson & Johnson (JNJ) Australian investor Mark diversified his portfolio by investing in Johnson & Johnson (JNJ). Over a period of five years, his investment in JNJ provided consistent returns, demonstrating the benefits of investing in well-established companies.

Conclusion

Investing in US stocks from Australia can be a rewarding venture if approached with careful planning and research. By understanding the basics, implementing effective strategies, and staying informed about market trends, you can maximise your investment potential. Remember to consider currency conversion, regulatory requirements, and tax implications. Happy investing!

so cool! ()

last:Market Cap US Stock Market Total: A Comprehensive Guide

next:nothing

like

- Market Cap US Stock Market Total: A Comprehensive Guide

- Title: Unlocking the Secrets of Fit Stock Price in the US Market

- Best US Total Stock Market Index Fund: Your Ultimate Guide to Investment Success

- Buying US Stocks in the UK: A Comprehensive Guide

- Buy Nestlé Stock US: A Smart Investment in Global Food Giant

- PS5 Stock in the US: A Comprehensive Guide to Availability and Strategies

- US Large Cap Stocks Momentum RSI Analysis: October 2025 Outlook

- Unlocking the Potential of NAK Stock: A Comprehensive Analysis

- ADS US Stocks: The Ultimate Guide to Investing in American Stocks Through ADTs

- Title: Contact London Stock Exchange: A Comprehensive Guide for US Investors

- Title: In-Depth Analysis of FRBA.O: A Leading Stock in the Reuters US Stocks Data

- Title: The Ultimate Guide to Buying US Stocks in Canada

hot stocks

Title: "Best Performing US Stocks: To

Title: "Best Performing US Stocks: To- Title: "Best Performing US Stocks: To"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Investing in US Stocks from Australia: A Compr

Investing in US Stocks from Australia: A Compr

ASX US Stock: A Comprehensive Guide to Investi

US Large Cap Value Stocks with Low PE Ratios:

Henry Us Survival Rifle Stocks: The Ultimate G

Understanding US Soybean Stocks: Market Insigh

Title: "Decline in the US Stock Marke

Stock Market Correlation with US Election Cycl

Apple Stock Graph: A Deep Dive into the US Dol

Futu US Stock Commission: How to Save on Your

Top Apps to Buy Stocks: Simplify Your Investme

Title: "Percentage of US Stocks Above

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Amazon Stock: The US Dollar Perspective"

- US Materials Stocks: A Comprehensive Guide to "

- PS5 Stock in the US: A Comprehensive Guide to "

- Title: Top Gold Mining Stocks in the US: Inves"

- US Growth Stocks to Buy Now: Top Picks for 202"

- Can Canadians Invest in U.S. Stocks? A Compreh"

- Title: "Total Market Capitalization o"

- Unlocking Potential: The Rise of Cannabis Stoc"

- Title: "Decline in the US Stock Marke"

- Title: In-Depth Analysis of FRBA.O: A Leading "