you position:Home > us stock market live > us stock market live

Title: The Ultimate Guide to Buying US Stocks in Canada

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Are you a Canadian investor looking to expand your portfolio with US stocks? If so, you've come to the right place. In this comprehensive guide, we'll explore the best ways to buy US stocks in Canada, ensuring you make informed decisions and maximize your investment potential. From online brokers to tax considerations, we've got you covered.

Understanding the Process

Buying US stocks in Canada involves several steps. First, you need to choose a reliable online broker or investment platform. Then, you'll need to open an account, deposit funds, and execute your trades. Let's dive into the details.

1. Selecting the Right Broker

When it comes to buying US stocks in Canada, the choice of broker is crucial. Here are some key factors to consider:

- Regulatory Compliance: Ensure your broker is regulated by a reputable financial authority, such as the Investment Industry Regulatory Organization of Canada (IIROC) or the Ontario Securities Commission (OSC).

- Low Fees: Look for brokers with competitive fees, including commission rates, account maintenance fees, and currency conversion fees.

- User-Friendly Platform: A user-friendly platform will make the trading process smoother and more efficient.

Some popular brokers for Canadian investors include:

- Questrade: Known for its low fees and user-friendly platform, Questrade is a popular choice among Canadian investors.

- TD Direct Investing: TD offers a comprehensive range of investment options and a robust trading platform.

- Interactive Brokers: This broker is renowned for its advanced trading tools and competitive fees.

2. Opening an Account

Once you've chosen a broker, the next step is to open an account. This process typically involves:

- Providing Identification: You'll need to provide proof of identity and address, such as a driver's license or passport.

- Completing a Questionnaire: Answer a series of questions about your investment experience and goals.

- Funding Your Account: Deposit funds into your account using a bank transfer, credit card, or another payment method.

3. Executing Trades

Once your account is funded, you can start executing trades. Here's how to buy US stocks in Canada:

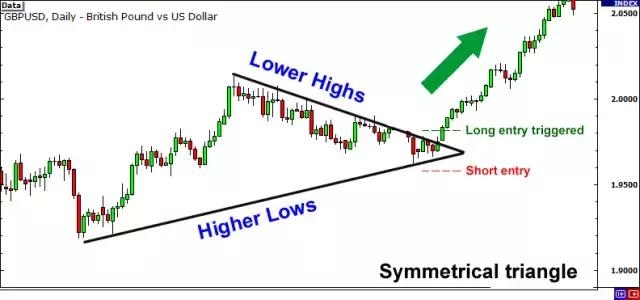

- Research: Conduct thorough research on the US stocks you're interested in, including their financial health, market trends, and potential risks.

- Place an Order: Use your broker's platform to place a buy order. You can choose between market orders (executed at the current market price) and limit orders (executed at a specific price or better).

- Monitor Your Investments: Keep an eye on your investments and adjust your strategy as needed.

Tax Considerations

When buying US stocks in Canada, it's important to understand the tax implications. Here's a breakdown:

- Withholding Tax: When you purchase US stocks, a 30% withholding tax is automatically deducted on dividends paid to Canadian residents.

- Tax Reporting: You'll need to report your US stock investments on your Canadian tax return using Form T3.

- Tax Credits: You may be eligible for a foreign tax credit to offset the withholding tax.

Conclusion

Buying US stocks in Canada can be a valuable addition to your investment portfolio. By following this guide, you can choose the right broker, open an account, and execute trades with confidence. Remember to stay informed about tax considerations and monitor your investments regularly. Happy investing!

so cool! ()

like

- Title: "Total Market Capitalization of US Stock Market 2025: Siblis Rese

- Military US Stock Footage: The Ultimate Resource for Authentic Content

- Unlocking the Potential of Airline Stocks: A Comprehensive Review

- BHP Billiton US Stock Price: A Comprehensive Analysis

- US Stock Exchange Hectic: The Pulse of the Financial World

- Build Quality Housing Stock: Germany, US, and China Compared

- Total US Stock Market Size: A Comprehensive Overview

- Panasonic Stock US Symbol: Everything You Need to Know

- Analytik Jena US LLC Stock: A Comprehensive Guide

- All Us Stocks Down: The Current State of the Market

- US Growth Stocks to Buy Now: Top Picks for 2023

- Can Non-Resident Invest in the US Stock Market? A Comprehensive Guide

hot stocks

Title: "Best Performing US Stocks: To

Title: "Best Performing US Stocks: To- Title: "Best Performing US Stocks: To"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Title: The Ultimate Guide to Buying US Stocks

Title: The Ultimate Guide to Buying US Stocks

How Many Stocks Were Sold in the US in 2018? A

Maximizing Returns with the Best Mutual Funds

Apple Stock Graph: A Deep Dive into the US Dol

Maximizing Returns: The Art of Allocation Betw

Can I Buy SK Hynix Stock in the US? A Comprehe

Buying US Stocks in Canada: A Comprehensive Gu

Fly Us Stocks GTA 5: Unleash Your Investment P

Title: "US Stock Market Reacts to the

Total Number of Trades Per Year on US Stock Ex

Real-Time US Stock Futures: A Comprehensive Gu

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Understanding Canadian Trading US Stocks Tax I"

- Chinese EV Stocks in the US: A Comprehensive G"

- Cheap US Stocks to Buy Now: Smart Investments "

- Common Stocks of Non-US Companies: A Comprehen"

- Best Performing US Stocks Last Hour: Dividend "

- Foreign Stocks vs. US Stocks: A Comprehensive "

- High Volatile US Stocks: Navigating the Turbul"

- The Evolution of the U.S. Stock Exchange: A Jo"

- Title: "Total US Stock Market Return:"

- Build Quality Housing Stock: Germany, US, and "