you position:Home > us stock market live > us stock market live

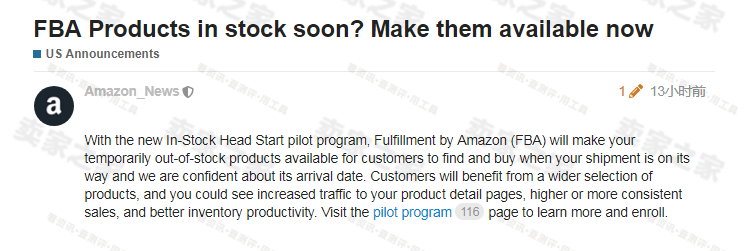

High Volatile US Stocks: Navigating the Turbulent Waters

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, certain companies stand out for their high volatility. These stocks, often referred to as "high volatile US stocks," can offer significant gains but also come with substantial risk. In this article, we delve into what makes these stocks volatile, how to identify them, and provide some key strategies for navigating their turbulent waters.

Understanding High Volatility

High volatility refers to the degree of variation in a stock's price over a specific period. Stocks with high volatility tend to experience rapid and significant price swings, often driven by various factors such as market sentiment, news, and economic data. These stocks can be both opportunities and pitfalls for investors.

Identifying High Volatile US Stocks

Identifying high volatile US stocks involves analyzing several factors, including:

- Market Capitalization: Smaller companies with lower market capitalization often exhibit higher volatility compared to larger, more established companies.

- Sector: Certain sectors, such as technology and biotech, are known for their high volatility due to rapid technological advancements and regulatory changes.

- Financial Health: Companies with poor financial health or those undergoing significant changes, such as mergers or acquisitions, may experience higher volatility.

- News and Events: Companies that are frequently in the news or affected by significant events may experience higher volatility.

Key Strategies for Navigating High Volatile US Stocks

Risk Management: High volatile stocks can be unpredictable, so it's crucial to implement proper risk management strategies. This includes diversifying your portfolio to reduce exposure to a single stock and setting strict stop-loss orders to limit potential losses.

Thorough Research: Conduct thorough research on the companies you're considering investing in. This includes analyzing their financial statements, understanding their business models, and staying informed about industry trends and news.

Use of Technical Analysis: Technical analysis can be a valuable tool for identifying high volatile stocks. By analyzing historical price patterns and trading volumes, investors can gain insights into potential future price movements.

Stay Informed: Keeping up-to-date with the latest news and economic data can help you make informed decisions. This includes staying aware of any potential risks or opportunities that may affect the stock's price.

Patient Approach: High volatile stocks can be unpredictable, so it's important to have a patient approach. Avoid making impulsive decisions based on short-term price movements and focus on your long-term investment strategy.

Case Study: Tesla, Inc.

A prime example of a high volatile US stock is Tesla, Inc. (TSLA). Since its inception, Tesla has experienced significant price volatility, driven by various factors such as technological advancements, regulatory changes, and market sentiment. Despite the high volatility, Tesla has managed to become one of the most valuable companies in the world. Investors who were able to navigate the turbulent waters and stay committed to their long-term strategy have reaped substantial gains.

In conclusion, high volatile US stocks can offer significant opportunities but also come with substantial risk. By understanding the factors that contribute to volatility, implementing proper risk management strategies, and staying informed, investors can navigate the turbulent waters and potentially reap substantial gains from these high volatile stocks.

so cool! ()

last:Momentum Stocks: A 5-Day Performance Review in the US Market

next:nothing

like

- Momentum Stocks: A 5-Day Performance Review in the US Market

- September 2019 IPO Calendar: A Comprehensive Overview of the US Stock Market'

- Title: "Top US-Based EV Stocks to Watch in 2023"

- Enamine BB US Stock: The Ultimate Guide to Investing in Enamine's American D

- Unveiling the Power of US Stock Broker Research Reports

- Buying US Stocks in Canada with Questrade: A Comprehensive Guide

- Tesla Stock in US Dollars: A Comprehensive Analysis

- Maximizing Growth with MGM US Stock: A Comprehensive Guide

- August 24, 2025: US Stock Market News Roundup

- Title: "How Much of the U.S. Population Owns Stocks: A Comprehensive Loo

- US Bank Stock Comparison: Top Picks for 2023

- Best Trading Platform for US Stocks from India: A Comprehensive Guide

hot stocks

Silver Spot Prices: A Comprehensive Guide to U

Silver Spot Prices: A Comprehensive Guide to U- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

- The Future of the U.S. Stock Market: Trends an"

- New Millennium US Stock Price: Trends and Pred"

recommend

High Volatile US Stocks: Navigating the Turbul

High Volatile US Stocks: Navigating the Turbul

Are There US Marijuana Stocks? A Comprehensive

Stocks That Benefit from U.S. Interest Rate Cu

Baba Us Stock: The Ultimate Guide to Navigatin

US Historical Stock Market Crash: A Deep Dive

Amazon Stock: The US Dollar Perspective

US Cellular Stock Drop: What's Behind the

Momentum Stocks: A 5-Day Performance Review in

US Large Cap Value Stocks with Low PE Ratios:

Unlocking the Potential of Capital Stock in th

Real-Time US Stock Futures: A Comprehensive Gu

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- China Deal Affecting US Stock Market: What Inv"

- Title: "Tech Stocks US Indexes Lower:"

- Top 3 US Marijuana Stocks to Watch in 2023"

- Today's US Stock Market Graph: A Comprehe"

- Toys "R" Us Stock Position: "

- Infosys Stock in US: A Comprehensive Guide to "

- The Impact of Sino-US Talks on Stocks: A Compr"

- Unlocking the Potential of Capital Stock in th"

- Maximizing Returns: A Comprehensive Guide to F"

- CNR Stock Quote in US Dollars: A Comprehensive"