you position:Home > us stock market live > us stock market live

Unlocking the Potential of Capital Stock in the US Market

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the dynamic landscape of the US financial market, capital stock plays a pivotal role in the growth and development of companies. This article delves into the significance of capital stock, its impact on the market, and how investors can leverage this knowledge to make informed decisions. From understanding the basics of capital stock to exploring its role in market dynamics, we provide a comprehensive overview.

What is Capital Stock?

Capital stock refers to the total value of a company's shares outstanding. It is a critical component of a company's financial structure and reflects the ownership interest of shareholders. When a company issues shares, it increases its capital stock, which can be used for various purposes, including expansion, research and development, and debt repayment.

The Role of Capital Stock in the US Market

Investor Confidence: Capital stock serves as a measure of a company's financial health. A higher capital stock often indicates a stronger financial position, which can boost investor confidence and attract more investors.

Market Capitalization: Market capitalization is the total value of a company's outstanding shares and is calculated by multiplying the number of shares by the stock's price. A higher capital stock can lead to a higher market capitalization, which can enhance a company's reputation and make it more attractive to potential investors.

Leveraging Growth Opportunities: Companies with a substantial capital stock can tap into growth opportunities more effectively. They can use the capital to invest in new projects, acquire other businesses, or expand their operations.

Key Factors Influencing Capital Stock

Earnings: Earnings play a crucial role in determining the value of a company's shares. Companies with strong earnings tend to have a higher capital stock, as investors are willing to pay more for shares that offer potential for future growth.

Dividends: Dividends are payments made to shareholders from a company's profits. Companies that consistently pay dividends can attract income-seeking investors, which can increase their capital stock.

Market Conditions: Market conditions can significantly impact the value of a company's shares. During periods of economic growth, capital stock tends to increase, while during economic downturns, it may decline.

Case Studies

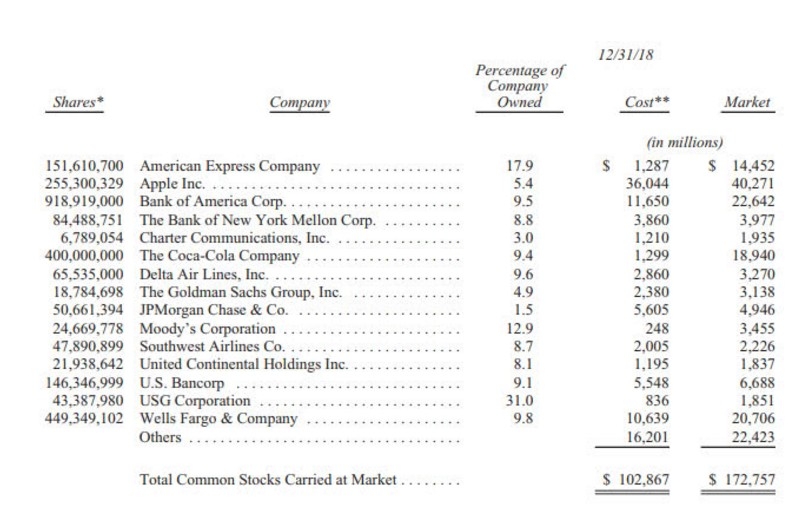

Apple Inc.: Apple is a prime example of a company with a substantial capital stock. Its strong financial performance, innovative products, and consistent dividend payments have contributed to its high capital stock and market capitalization.

Amazon.com Inc.: Amazon has experienced significant growth in its capital stock due to its impressive earnings and expansion into various markets. The company's ability to leverage its capital stock for new ventures has made it one of the most valuable companies in the world.

Conclusion

Understanding the dynamics of capital stock is crucial for investors and companies alike. By analyzing the factors that influence capital stock, investors can make informed decisions and identify companies with strong growth potential. Companies can also use this knowledge to enhance their financial position and attract more investors. As the US market continues to evolve, capital stock will remain a key factor in determining the success of businesses.

so cool! ()

last:Top Apps to Buy Stocks: Simplify Your Investment Journey

next:nothing

like

- Top Apps to Buy Stocks: Simplify Your Investment Journey

- Title: "Rank of U.S. Stock Exchanges by Average Daily Volume: A Comprehe

- Title: "Ishares US Preferred Stock ETF Holdings: Unveiling the Powerhous

- Title: "Coronavirus US Stock Market: Impact, Recovery, and Future Outloo

- US Nuclear Stock Price: A Comprehensive Guide to Understanding the Market Dynamic

- The Ultimate Guide to the Biggest US Cannabis Stock

- Maximizing Returns: The Power of US Banking Stocks

- Top Preferred Stocks in the US: Your Ultimate Guide to High-Yield Investments

- Title: "How to Invest in the US Stock Market from Indonesia"

- High Dividend Stocks in the US: Top Picks for Income Investors

- US Materials Stocks: A Comprehensive Guide to Investing in the Industry

- Best Performing US Large Cap Stocks in Recent Days: A Deep Dive

hot stocks

Silver Spot Prices: A Comprehensive Guide to U

Silver Spot Prices: A Comprehensive Guide to U- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- New Millennium US Stock Price: Trends and Pred"

- Top Trending Stocks US Today: Unveiling the Ma"

- US Border Patrol 28 1/24 Scale Stock Car: The "

- Title: "Percentage of US Stocks Above"

- The Ultimate Guide to the Biggest US Cannabis "

recommend

Unlocking the Potential of Capital Stock in th

Unlocking the Potential of Capital Stock in th

Exploring Lufthansa's Dangerous Goods Pol

Common Stocks of Non-US Companies: A Comprehen

Unlocking the Potential of Capital Stock in th

Title: "Tax Implications of Buying US

Cheap US Stocks to Buy Now: Smart Investments

Title: "Understanding the Sectors: A

Can I Buy SK Hynix Stock in the US? A Comprehe

Top Preferred Stocks in the US: Your Ultimate

Title: "Percentage of US Stocks Above

Title: "Is Today a US Stock Market Ho

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Real-Time US Stock Futures: A Comprehensive Gu"

- Cheap US Stocks to Buy Now: Smart Investments "

- New Millennium US Stock Price: Trends and Pred"

- The Ultimate Guide to the Biggest US Cannabis "

- Coupang US Stock: A Deep Dive into the South K"

- Exploring Lufthansa's Dangerous Goods Pol"

- Top Trending Stocks US Today: Unveiling the Ma"

- Title: "Huge Stock US: Exploring the "

- US Magnet Stocks: Top Picks for High-Tech Inve"

- Title: "Percentage of US Population w"