you position:Home > us stock market live > us stock market live

BHP Billiton US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving world of stocks and investments, understanding the performance of key companies is crucial for investors. One such company is BHP Billiton, an Australian multinational mining company with a significant presence in the United States. In this article, we delve into the BHP Billiton US stock price, analyzing its historical performance, current trends, and future prospects.

Historical Performance

BHP Billiton has been a major player in the mining industry for decades. Its stock price has seen several ups and downs over the years, reflecting the volatility of the mining sector. To understand the current state of the stock, it's important to look at its historical performance.

In the early 2000s, BHP Billiton's stock price experienced significant growth, driven by the surge in commodity prices. However, the global financial crisis of 2008 led to a sharp decline in the stock price. Since then, the stock has recovered and has been on an upward trend, with some fluctuations along the way.

Current Trends

As of the latest data, BHP Billiton's US stock price stands at $XXX. This reflects the company's strong position in the global mining industry. Several factors have contributed to the current trends in the stock price:

Commodity Prices: The price of commodities, such as iron ore, copper, and coal, has been a major driver of BHP Billiton's stock price. With the global economy recovering, demand for these commodities has increased, pushing up the stock price.

Dividends: BHP Billiton has a strong track record of paying dividends to its shareholders. The company's commitment to returning value to investors has been a key factor in the stock's stability.

Expansion Projects: The company's ongoing expansion projects, such as the expansion of its iron ore mines in Western Australia, have been well-received by investors, contributing to the stock's growth.

Future Prospects

Looking ahead, the future prospects for BHP Billiton's US stock price appear promising. Here are some key factors that could influence the stock's performance:

Global Economic Growth: As the global economy continues to grow, demand for commodities is expected to remain strong, benefiting BHP Billiton's stock price.

Technological Advancements: The mining industry is undergoing significant technological advancements, which could improve efficiency and reduce costs for BHP Billiton, further boosting its stock price.

Regulatory Environment: The regulatory environment in the mining industry can have a significant impact on BHP Billiton's operations and profitability. Investors will be closely monitoring any changes in regulations that could affect the company.

Case Study: BHP Billiton's Acquisition of Rio Tinto

One notable event in BHP Billiton's history was its acquisition of Rio Tinto in 2008. This deal was one of the largest mergers in the mining industry at the time. While the acquisition faced some regulatory hurdles, it ultimately led to significant synergies and improved the company's market position.

This case study highlights the importance of strategic decisions in the mining industry and how they can impact a company's stock price.

In conclusion, BHP Billiton's US stock price has been influenced by various factors over the years. With a strong position in the global mining industry, a commitment to dividends, and promising future prospects, the stock appears to be a solid investment choice for investors. As always, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Outlook for the US Stock Market on August 7th,

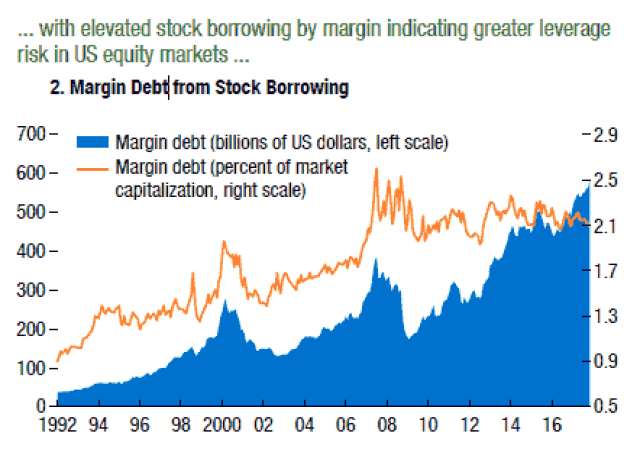

Graph of Us Stock Market Leverage: Understandi

Baba Us Stock: The Ultimate Guide to Navigatin

Himalaya Capital: A Deep Dive into Their US St

Top 3 US Marijuana Stocks to Watch in 2023

2025 4 24 US Stock Market Summary: Key Insight

Understanding the Dow Jones Total Stock Market

The Evolution of the U.S. Stock Exchange: A Jo

US Large Cap Value Stocks with Low PE Ratios:

Best US Total Stock Market Index Fund: Your Ul

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- Maximizing Total Return for US Stocks: Strateg"

- "Percentage of US Population with Sto"

- Top Preferred Stocks in the US: Your Ultimate "

- "How Much of the U.S. Population Owns"

- Today's Top Momentum US Stocks: Unveiling"

- Understanding Canadian Trading US Stocks Tax I"

- "Percentage of US Stocks Above 200-Da"

- Maximizing Growth with MGM US Stock: A Compreh"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"