you position:Home > us stock market live > us stock market live

US Large Cap Stocks Momentum RSI Analysis: October 2025 Outlook

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, understanding the momentum and technical indicators is crucial for investors. One such indicator that has gained significant attention is the Relative Strength Index (RSI). This article delves into the analysis of US large cap stocks using the RSI momentum indicator, providing insights into the market trends expected in October 2025.

Understanding RSI and Its Significance

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is commonly used to identify overbought or oversold conditions in a trading asset. The RSI ranges from 0 to 100, with readings above 70 indicating an overbought condition, and readings below 30 indicating an oversold condition.

Analyzing US Large Cap Stocks Using RSI

In October 2025, the RSI analysis of US large cap stocks reveals several key trends:

1. Tech Sector Leading the Charge

The technology sector, which includes giants like Apple, Microsoft, and Amazon, has been a major driver of the US stock market. The RSI analysis indicates that these stocks are currently in an overbought condition, suggesting a potential pullback in the near term. However, long-term investors may see this as an opportunity to enter or increase their positions.

2. Healthcare Sector Showing Strength

The healthcare sector, particularly pharmaceutical companies and biotech firms, has shown remarkable resilience. The RSI analysis indicates that these stocks are currently in a strong uptrend, with a reading above 70. This suggests that the healthcare sector may continue to outperform in the coming months.

3. Energy Sector on the Verge of Breakout

The energy sector, which includes oil and gas companies, has been underperforming in recent months. However, the RSI analysis indicates that these stocks are currently in an oversold condition, with a reading below 30. This suggests a potential breakout in the near future, making it an attractive sector for investors looking for value.

Case Study: Apple Inc.

Let's take a closer look at Apple Inc., one of the leading tech companies in the US. As of October 2025, the RSI for Apple stands at 72, indicating an overbought condition. Historically, when the RSI reaches this level, it has been followed by a pullback in the stock price. However, considering Apple's strong fundamentals and market position, investors may choose to hold onto their positions or even add to them.

Conclusion

The RSI analysis of US large cap stocks in October 2025 reveals a diverse set of trends across various sectors. While the technology sector may experience a pullback, the healthcare and energy sectors appear to be strong performers. Investors should carefully consider these trends and conduct their own analysis before making investment decisions.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Outlook for the US Stock Market on August 7th,

2025 4 24 US Stock Market Summary: Key Insight

Best US Total Stock Market Index Fund: Your Ul

Understanding the Dow Jones Total Stock Market

Baba Us Stock: The Ultimate Guide to Navigatin

Top 3 US Marijuana Stocks to Watch in 2023

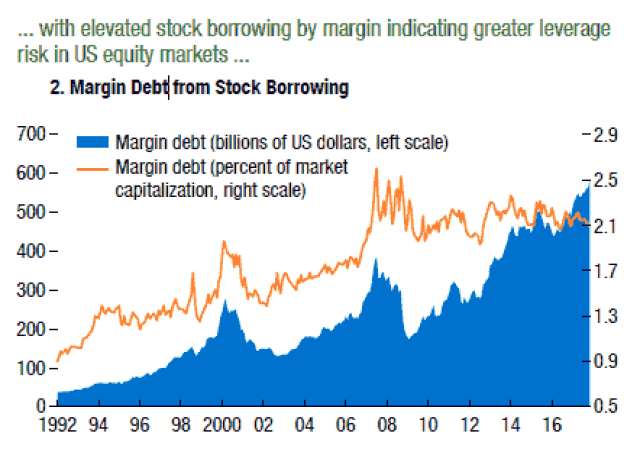

Graph of Us Stock Market Leverage: Understandi

The Evolution of the U.S. Stock Exchange: A Jo

Himalaya Capital: A Deep Dive into Their US St

US Large Cap Value Stocks with Low PE Ratios:

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "How Much of the U.S. Population Owns"

- "Percentage of US Stocks Above 200-Da"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Understanding Canadian Trading US Stocks Tax I"

- Maximizing Total Return for US Stocks: Strateg"

- Maximizing Growth with MGM US Stock: A Compreh"

- Today's Top Momentum US Stocks: Unveiling"

- "Percentage of US Population with Sto"

- Top Preferred Stocks in the US: Your Ultimate "