you position:Home > us stock market live > us stock market live

Stock Down Today: Understanding the Market Volatility

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's fast-paced financial world, the phrase "stock down today" is a common occurrence. This article delves into the reasons behind the downward trend and offers insights into what it means for investors and the market as a whole.

What Causes a Stock to Drop?

Several factors can contribute to a stock's decline. Understanding these factors is crucial for investors looking to make informed decisions. Here are some of the most common reasons for a stock to fall:

Economic Indicators: Economic reports, such as GDP growth, unemployment rates, and inflation, can significantly impact stock prices. Negative economic news can lead to a stock's decline.

Company News: Negative news from a company, such as a profit warning, layoffs, or a recall, can cause its stock to drop.

Market Sentiment: Investor sentiment can drive stock prices. If investors are pessimistic about the market or a particular sector, it can lead to a decline in stock prices.

Political Events: Political instability, such as elections or policy changes, can cause uncertainty and lead to a drop in stock prices.

Market Volatility: In times of high market volatility, stock prices can fluctuate significantly, often leading to a downward trend.

How to React to a Stock's Decline

When a stock you own falls, it's essential to remain calm and assess the situation. Here are some steps to consider:

Analyze the Reason: Determine why the stock is falling. Is it due to a temporary event or a more significant issue?

Review the Company's Financial Health: Look at the company's financial statements and assess its long-term prospects.

Stay Diversified: Diversifying your portfolio can help mitigate the impact of a falling stock.

Consider Selling: If the stock is falling due to a significant issue, it may be time to consider selling.

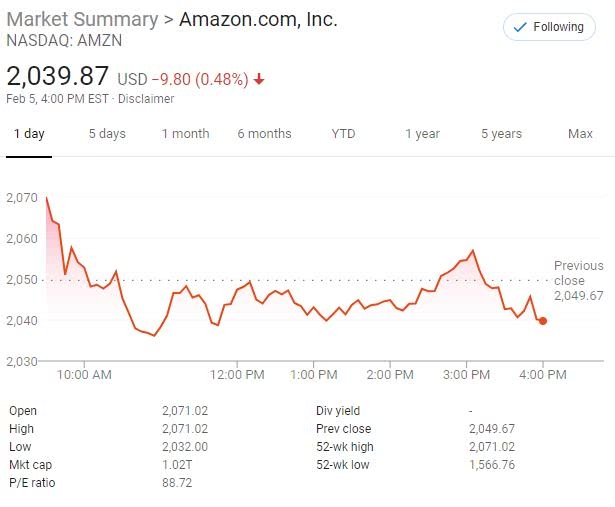

Case Study: Apple's Stock Decline in 2020

In April 2020, Apple's stock took a significant hit due to the COVID-19 pandemic. While the stock eventually recovered, the decline was a prime example of how external factors can impact a company's stock price.

Apple's stock fell because of several reasons:

Economic Uncertainty: The pandemic created economic uncertainty, leading to a sell-off in the stock market.

Supply Chain Disruptions: Apple's supply chain was disrupted due to the pandemic, which affected its ability to produce and sell products.

Market Sentiment: Investors were pessimistic about the market's future, leading to a sell-off in tech stocks, including Apple.

Conclusion

The phrase "stock down today" is a reminder of the volatility in the stock market. Understanding the reasons behind a stock's decline and how to react can help investors navigate the market's ups and downs. By remaining calm, analyzing the situation, and staying diversified, investors can make informed decisions and protect their investments.

so cool! ()

last:DPW Jones Today: Unveiling the Latest Insights and Trends

next:nothing

like

- DPW Jones Today: Unveiling the Latest Insights and Trends

- How Much Money Has the Stock Market Lost Since Trump's Presidency?"

- Today's Top Momentum Stocks: US Market Insights

- December 2022 IPOs: A Look at the US Stock Market Companies List

- Understanding the Stock Market to GDP Ratio in the US

- Carnival Corporation & PLC: A Deep Dive into the US Stock Market

- Dow Jones Real Time Chart: Unveiling the Financial Pulse

- Recent News on Penny Stocks: A Glimpse into the US Market

- Stock Market in USA Today: Key Trends and Predictions

- Dow Jones Premarket Today: A Comprehensive Guide to Today's Market Trends

- Stock Market Now CNN: Your Ultimate Guide to Understanding the Latest Trends and

- Mastering Stock Market Equity: Your Ultimate Guide to Financial Success"

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Buying U.S. Stocks from Australia: A Guide for"

- New US Stocks 2020: Exploring the Emerging Opp"

recommend

Stock Down Today: Understanding the Market Vol

Stock Down Today: Understanding the Market Vol

"Toys 'R' Us Not in Stock:

Joint-Stock Definition: A Pivotal Moment in U.

Unlocking the Potential of DRNK.PK: A Deep Div

HTC Stock US: A Comprehensive Analysis of the

Best US Income Stocks: Top Investments for Con

US H-1B Visa Fee Hike Impacts Indian IT Stocks

FDA Approval Press Release: A Game-Changer for

Momentum Stocks: A 5-Day Performance Review in

How to Buy Oil Stocks in the US: A Comprehensi

US Oil Prices Stock: What You Need to Know

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US Oil Prices Stock: What You Need to Know"

- How Many Stocks Trade in US Exchanges?"

- Can Canadians Invest in U.S. Stocks? A Compreh"

- "Stock Informer Co US Checker: Unveil"

- Factors Impacting Stock Price: What You Need t"

- Understanding Shell Stock Symbol: US Insights"

- Airline Stocks in the US Stock Market: A Compr"

- Top Non-US Stocks to Watch in 2023"

- Tesla Stock in US Dollars: A Comprehensive Ana"

- Today's Top Momentum US Stocks: Unveiling"