you position:Home > us stock market live > us stock market live

Factors Impacting Stock Price: What You Need to Know

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Understanding the factors that impact stock prices is crucial for investors looking to make informed decisions. In this article, we delve into the key factors that can influence stock prices, as highlighted by US News. From economic indicators to company performance, we'll explore the various elements that can shape the value of a stock.

Economic Indicators

One of the most significant factors affecting stock prices is the overall economic environment. Key economic indicators such as GDP growth, unemployment rates, and inflation can have a profound impact on the market. For instance, when the economy is growing, companies tend to perform better, leading to higher stock prices. Conversely, during economic downturns, stock prices may decline.

Company Performance

The financial performance of a company is another critical factor that influences stock prices. Investors closely monitor metrics such as revenue, earnings per share (EPS), and profit margins. A strong financial performance can lead to increased investor confidence and higher stock prices, while poor performance can result in a decline.

Market Sentiment

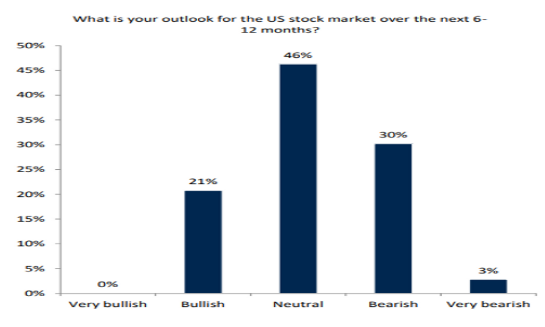

Market sentiment plays a crucial role in determining stock prices. This refers to the overall mood or attitude of investors towards the market. Factors such as news, rumors, and political events can all contribute to market sentiment. For example, positive news about a company or industry can boost investor confidence and drive up stock prices, while negative news can have the opposite effect.

Dividends

Dividends are another important factor to consider when evaluating stock prices. Dividends are payments made by a company to its shareholders, typically as a portion of its profits. Companies with a strong dividend history tend to be more attractive to investors, as they provide a steady stream of income. This can lead to higher stock prices.

Supply and Demand

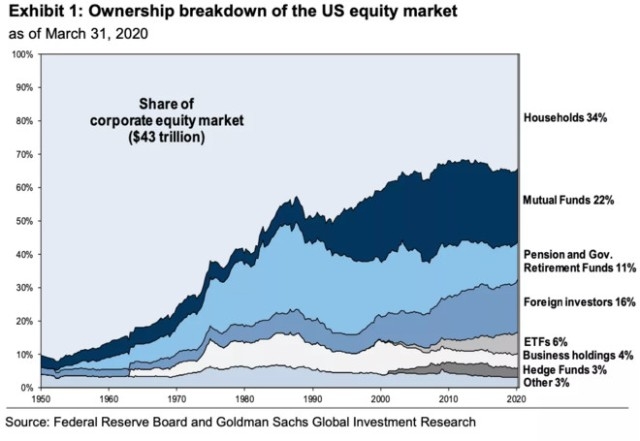

The basic principles of supply and demand also apply to the stock market. When there is high demand for a stock, prices tend to rise. Conversely, when there is an oversupply of a stock, prices may fall. Factors such as corporate buybacks, new investor interest, and institutional ownership can all influence supply and demand dynamics.

Sector and Industry Trends

The performance of a stock can also be influenced by broader sector and industry trends. For example, the technology sector has been a strong performer in recent years, driving up the prices of tech stocks. Similarly, the energy sector may be affected by global oil prices, which can have a significant impact on the prices of energy stocks.

Case Study: Apple Inc.

A prime example of how these factors can impact stock prices is the case of Apple Inc. Over the past few years, Apple has consistently reported strong financial performance, leading to higher stock prices. Additionally, the company's dividend payments and strong market sentiment have further contributed to its rising stock price.

In conclusion, understanding the various factors that impact stock prices is essential for investors. By considering economic indicators, company performance, market sentiment, dividends, supply and demand, and sector trends, investors can make more informed decisions and potentially achieve better returns.

Note: This article is for informational purposes only and should not be considered financial advice.

so cool! ()

like

- SMIC Stock US: A Comprehensive Analysis of Semiconductor Manufacturing Internatio

- Stonk of Stocks: Unveiling the Powerhouse of Growth Stocks

- Is the US Stock Market Open on Saturday? A Comprehensive Guide

- Dow Jones Today Now Chart: A Comprehensive Guide to Understanding the Stock Marke

- Toys R Us Overnight Stock Crew: The Unsung Heroes of Retail

- Buy Stocks: Navigating the US Stock Market with Confidence"

- How Bad Is the Stock Market? A Comprehensive Analysis

- How Much Profit the US Made Selling GM Stock

- Unlocking the Power of the New York Stock Exchange: A Comprehensive Guide

- Tomorrow Stock Picks: Top 5 Stocks to Watch in the Upcoming Week

- Tesla Yahoo Finance Chart: A Deep Dive into the Electric Vehicle Giant's Sto

- FDA Approval: A Game-Changer for Small Cap US Stocks

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

recommend

Factors Impacting Stock Price: What You Need t

Factors Impacting Stock Price: What You Need t

Buy Stocks in US from India: A Comprehensive G

Trade US Stocks from Malaysia: Your Ultimate G

Tomorrow Stock Picks: Top 5 Stocks to Watch in

"DJ US Total Stock Market Index Retur

Stock Market Impact of the 2016 US Election: A

Quantum Stocks in the US: The Future of Innova

Buying US Stocks in Canada with Questrade: A C

How Much Was the Dow Down Yesterday?

US Large Cap Value Stocks with Low PE Ratios:

Amazon Stock: The US Dollar Perspective

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "Tech Stocks US Indexes Lower: What Y"

- Unlocking the Potential of VVUS.O: A Deep Dive"

- US Stock Exchange Gold Prices: A Comprehensive"

- Today Share Market Open or Not: A Comprehensiv"

- Investing in US Stocks from Australia: A Compr"

- How to Invest in the US Stock Market from Jama"

- "Toys 'R' Us Not in Stock: "

- Military US Stock Footage: The Ultimate Resour"

- PFIZER STOCK PRICE US: What You Need to Know"

- "How to Invest in the US Stock Market"