you position:Home > us stock market live > us stock market live

How Bad Is the Stock Market? A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market has always been a topic of intense interest and concern for investors and traders alike. With its volatile nature, many often wonder, "How bad is the stock market?" This article delves into the current state of the stock market, providing a comprehensive analysis to help you understand the current situation.

Understanding the Current Market Conditions

As of [current date], the stock market has experienced a significant downturn. This decline can be attributed to several factors, including economic uncertainty, geopolitical tensions, and rising inflation. The S&P 500, a widely followed index that tracks the performance of the 500 largest companies in the United States, has seen a notable drop in its value.

Economic Uncertainty

One of the primary reasons for the stock market's decline is economic uncertainty. The ongoing trade war between the United States and China has created a climate of uncertainty, causing investors to become cautious. Additionally, the COVID-19 pandemic has continued to disrupt global economies, further contributing to market volatility.

Geopolitical Tensions

Geopolitical tensions have also played a significant role in the stock market's decline. The conflict between Russia and Ukraine has raised concerns about energy prices and global stability. These tensions have led to increased volatility in the market, as investors react to the latest news and developments.

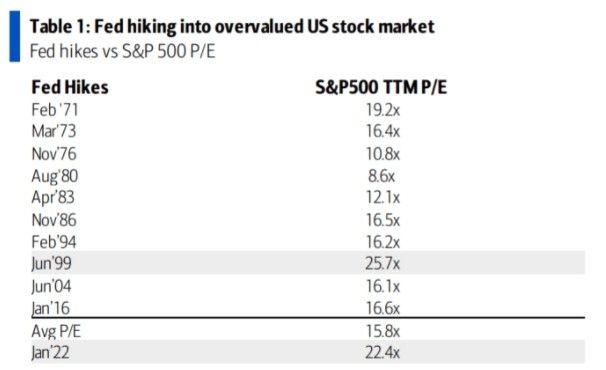

Rising Inflation

Rising inflation has been another major factor affecting the stock market. The Consumer Price Index (CPI) has shown a steady increase, leading to concerns about the future purchasing power of consumers. This has prompted investors to sell off stocks, seeking safer investments such as bonds or real estate.

Case Studies

To better understand the impact of these factors on the stock market, let's take a look at a few case studies:

Tesla (TSLA): Tesla's stock has seen significant volatility in recent months. The company's strong performance in the electric vehicle market has been overshadowed by concerns about supply chain disruptions and rising production costs.

Apple (AAPL): Apple's stock has also been affected by the global economic uncertainty. Despite the company's strong financial performance, investors remain cautious due to the ongoing trade war and rising inflation.

Microsoft (MSFT): Microsoft's stock has remained relatively stable despite the market downturn. The company's diversified business model and strong cash flow have helped mitigate the impact of economic uncertainty.

Conclusion

In conclusion, the stock market's current state can be described as volatile and challenging. Economic uncertainty, geopolitical tensions, and rising inflation have all contributed to the market's decline. While it is difficult to predict the future, investors should remain cautious and focus on long-term investments that can withstand market volatility.

Remember, the stock market is always subject to change. Staying informed and making informed decisions is key to navigating these challenging times.

so cool! ()

last:How Much Profit the US Made Selling GM Stock

next:nothing

like

- How Much Profit the US Made Selling GM Stock

- Unlocking the Power of the New York Stock Exchange: A Comprehensive Guide

- Tomorrow Stock Picks: Top 5 Stocks to Watch in the Upcoming Week

- Tesla Yahoo Finance Chart: A Deep Dive into the Electric Vehicle Giant's Sto

- FDA Approval: A Game-Changer for Small Cap US Stocks

- Stock Ticker on Desktop: The Ultimate Guide to Real-Time Market Updates"

- Unlocking the Potential of LUK Stock: A Comprehensive Analysis

- How U.S. Elections Affect the Stock Market

- List NASDAQ Stocks: A Comprehensive Guide to the Top Companies on the NASDAQ Stoc

- Target Elysian Archetype 43 Darts in Stock: Your Ultimate Darting Experience in t

- Stocking Us: The Ultimate Guide to Finding the Perfect Stockings for Every Occasi

- US Stock Market Crash in April 2025: Unveiling the Reasons

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

recommend

How Bad Is the Stock Market? A Comprehensive A

How Bad Is the Stock Market? A Comprehensive A

Nasdaq: HIT - A Deep Dive into the Impact of t

Top Losers in the US Stock Market: 2023's

Cotton Stocks: The Ultimate Guide to Understan

Toys "R" Us Stock Position:

"The Historical Stock Ownership Perce

Us Army Stocking: The Essential Guide to Milit

Maximizing Total Return for US Stocks: Strateg

Delisting of Chinese Stocks on US Exchanges: I

Martin Luther King Day: How It Impacts the US

US Price for ACB Stock: Comprehensive Guide an

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US Stock Drop Today: Understanding the Market "

- Stock Checker Toys "R" Us: Y"

- "Unlocking Profit Potential: Top US G"

- Understanding Shell Stock Symbol: US Insights"

- Exploring the Full Description of EPI Stock: A"

- "US Cobalt Inc Stock Price: Current T"

- Top 10 US Stocks for 2019: A Comprehensive Gui"

- Publicly Traded Marijuana Stocks: A Guide to U"

- How to Trade Stocks in the US from Canada: A C"

- US Stock Live Chart: Real-Time Insights for In"