you position:Home > us stock market live > us stock market live

US Stock Market Crash in April 2025: Unveiling the Reasons

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In April 2025, the US stock market experienced a sudden and dramatic crash, sending shockwaves through the financial community. This article delves into the possible reasons behind the crash, analyzing a mix of economic, political, and technical factors.

Economic Factors

One of the primary reasons for the crash was the sudden slowdown in the US economy. Economic indicators such as GDP growth, consumer spending, and industrial production had started to show signs of deceleration. This decline in economic activity led to concerns about the overall health of the economy, prompting investors to sell off their stocks.

Another crucial factor was the rising inflation rates. The Federal Reserve had been raising interest rates to combat inflation, but the aggressive stance had unintended consequences. Higher interest rates make borrowing more expensive, leading to reduced consumer spending and investment. This, in turn, contributed to the stock market crash.

Political Factors

The political landscape also played a significant role in the stock market crash. Tensions between the US and other major economies, particularly China, had escalated. Trade disputes and geopolitical tensions led to uncertainty, causing investors to become more risk-averse. This uncertainty was reflected in the stock market, as investors sold off their holdings to mitigate potential losses.

Moreover, the election cycle in the US added to the volatility. As the country approached the presidential election, political polarization and the potential for policy changes created uncertainty. This uncertainty led to a loss of confidence in the market, resulting in the crash.

Technical Factors

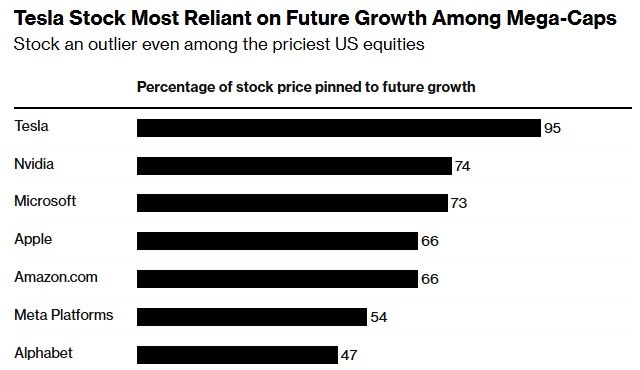

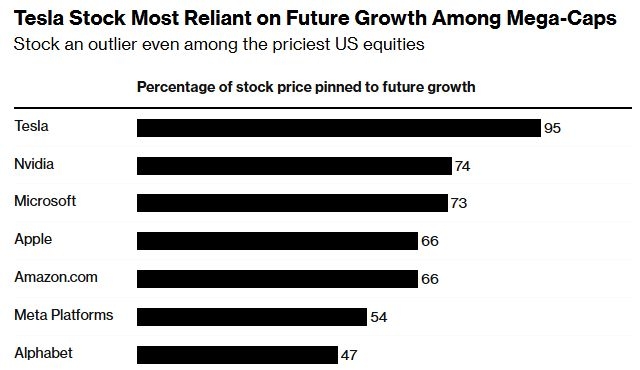

Technical factors also contributed to the stock market crash. The market had been on a bull run for several years, leading to overvaluation of many stocks. When the crash occurred, many investors were caught off guard, leading to a rapid sell-off. Additionally, the use of high-frequency trading and algorithmic trading exacerbates market volatility, as these systems can amplify price movements.

Case Studies

One notable case study is the tech sector, which had been one of the main drivers of the stock market's growth. However, in April 2025, many tech stocks experienced significant declines. This was partly due to concerns about antitrust investigations and the potential for stricter regulations in the industry.

Another example is the decline in energy stocks. As geopolitical tensions rose, concerns about oil supply and demand increased. This led to a decline in oil prices, affecting the valuations of energy companies and, in turn, the stock market.

Conclusion

The stock market crash in April 2025 was a result of a perfect storm of economic, political, and technical factors. The crash served as a reminder of the interconnectedness of global financial markets and the importance of diversifying investments. As investors and policymakers reflect on the crash, they must address these underlying factors to prevent future market turmoil.

so cool! ()

last:Best App to Invest in US Stocks from UAE: Your Ultimate Guide

next:nothing

like

- Best App to Invest in US Stocks from UAE: Your Ultimate Guide

- US Stocks Today: A Comprehensive Overview of the Market Trends

- Stock R Us: Your Ultimate Guide to Investment Success

- US Housing vs Stock Market Appreciation: Which Investment is Best for You?

- Market Cap US Stock Market Total: The Comprehensive Guide

- Stock Market Graph Last Year: Analyzing Trends and Insights"

- US Energy Stock News: Key Developments and Investment Insights

- Unlocking the Potential of US Postal Service Stocks

- CNN Share Market: Navigating the Stock Landscape with Confidence"

- Top 5 US Marijuana Stocks to Buy for 2023

- Stock Futures MarketWatch: Your Ultimate Guide to Navigating the Futures Market

- Understanding the AVGO US Stock Price: A Comprehensive Guide

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Percentage of South Koreans Investing in US St"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

recommend

US Stock Market Crash in April 2025: Unveiling

US Stock Market Crash in April 2025: Unveiling

Unlocking the Potential of US Boxcar Stock: A

Gilead Sciences: A Deep Dive into US Stock Per

Tencent Stock US: How Robinhood Investors Can

Unlocking the Potential of CRCL Stock: A Compr

2025 US Stock Market Sector Performance: A Com

"Us Stock Exchange Holidays: What You

Unlocking Opportunities in US Marijuana Stocks

The Largest Stock Exchange in the US: A Compre

Understanding the AVGO US Stock Price: A Compr

Common Stocks of Non-US Companies: A Comprehen

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- The Last of Us 2 Ellie Edition Stock: Your Ult"

- Baba Us Stock: The Ultimate Guide to Navigatin"

- Top Performing US Stocks Past 5 Days: July 202"

- PFIZER STOCK PRICE US: What You Need to Know"

- Five US Tech Giants Spend $115B on Buying Back"

- Can Canadians Invest in U.S. Stocks? A Compreh"

- US Election Sends Stocks Down and Mortgage Rat"

- "US Stock Market Reacts to the Corona"

- Buying US Stocks in Canada with Questrade: A C"

- ADS US Stocks: The Ultimate Guide to Investing"