you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Short Sellers Target High-Flying US Technology Stocks

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, short sellers have set their sights on some of the highest-flying US technology stocks. This strategic move has sparked debates among investors and market analysts, as they weigh the potential risks and rewards. This article delves into the reasons behind this targeted approach and examines the implications for the technology sector.

Understanding Short Selling

Before diving into the specifics, it's essential to understand what short selling entails. Unlike traditional stock purchases, where investors buy shares with the expectation of selling them at a higher price, short sellers borrow shares from a broker and sell them at the current market price. They then aim to buy back the shares at a lower price, returning them to the broker, and pocketing the difference.

Why Target Technology Stocks?

Several factors have contributed to the growing interest of short sellers in high-flying US technology stocks. Here are some key reasons:

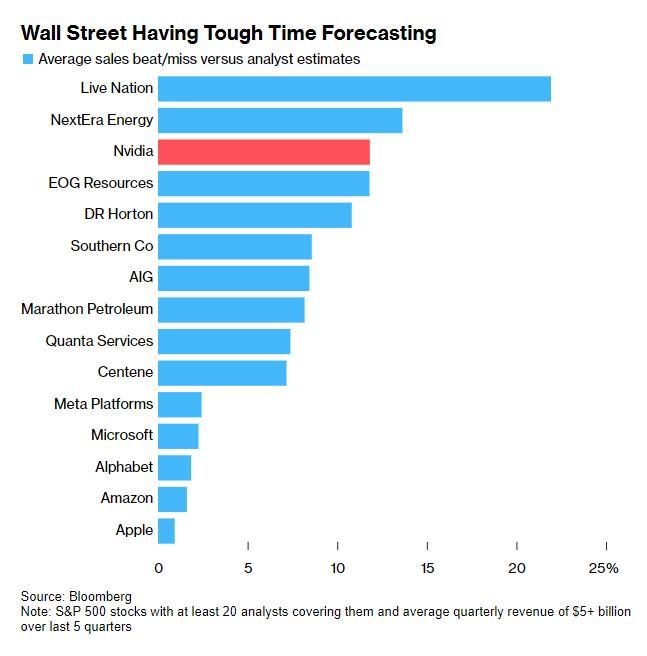

Overvaluation: Many technology stocks have seen significant growth in recent years, leading to concerns about overvaluation. Short sellers believe that these stocks are trading at prices that do not reflect their underlying fundamentals, making them prime targets for shorting.

Economic Uncertainty: The global economy has faced numerous challenges, including rising inflation, supply chain disruptions, and geopolitical tensions. These factors have raised concerns about the sustainability of the strong performance of technology stocks.

Regulatory Scrutiny: The technology sector has come under increased scrutiny from regulators, with concerns about antitrust issues, data privacy, and market manipulation. Short sellers see this regulatory pressure as a potential catalyst for downward pressure on technology stocks.

Case Studies

Several high-profile technology stocks have caught the attention of short sellers. Here are a few examples:

Tesla (TSLA): Tesla has been a favorite target for short sellers, with concerns about its valuation and the sustainability of its growth. Short sellers argue that Tesla's market capitalization is not justified by its fundamentals, particularly its high debt levels and reliance on government subsidies.

Facebook (META): Once known as Facebook, this social media giant has faced criticism over its data privacy practices and antitrust concerns. Short sellers believe that these issues could impact the company's revenue and user growth, leading to a decline in its stock price.

Amazon (AMZN): Amazon has also been targeted by short sellers, with concerns about its high valuation and the potential for increased competition in the e-commerce market. Critics argue that Amazon's growth may be slowing, and the company may face challenges in maintaining its market dominance.

The Impact on the Technology Sector

The targeting of high-flying US technology stocks by short sellers has sparked discussions about the impact on the broader technology sector. While short selling can create downward pressure on stock prices, it can also lead to increased scrutiny and regulatory attention.

Conclusion

As short sellers target high-flying US technology stocks, investors and market analysts will be closely monitoring the implications for the sector. While short selling can create volatility and uncertainty, it also serves as a valuable tool for identifying potential risks and opportunities in the market.

so cool! ()

last:Unlocking the Potential of Markewt: A Comprehensive Guide

next:nothing

like

- Unlocking the Potential of Markewt: A Comprehensive Guide

- The Intricate Connection Between Stock Market Performance and the US Economy&

- Discover the Best Online Stock Brokers for Non-US Citizens"

- ETP Stock Price in US Dollars: What You Need to Know"

- Toys R Us Stock Price in 2018: A Comprehensive Analysis

- Stock Market Returns 2025: Predictions, Trends, and Opportunities

- Market Rally: Why Investors Are Excited and How to Capitalize on It"

- The Ultimate Guide to the Best Stock Tracker Site

- Understanding TH Stock Ticker: Key Insights for Investors"

- Understanding the US 10-Year Treasury Stock: Insights and Investment Strategies

- The Most Expensive Stock Per Share in the US: A Deep Dive"

- Toys "R" Us Super Nintendo Stock: A Deep Dive

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

recommend

Short Sellers Target High-Flying US Technology

Short Sellers Target High-Flying US Technology

Buy Us Stocks from Overseas: A Guide to Global

Best US Dividend Stocks to Buy: Top 5 Picks fo

US Marine Stock A: Unveiling the Elite Force&#

Best US Stock Today: Top Picks for Investors

Trading U.S. Stocks from Canada: A Comprehensi

iShares US Technology ETF Stock: A Comprehensi

US Stock Market Analysis: Key Insights for Aug

"2018-2019 US Government Shutdown: A

What Is a Good Stock Price? A Comprehensive Gu

Merck US Pharma Stocks: A Comprehensive Guide

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- US Interest Rate Cut Impact on Japanese Stocks"

- Current State of US Stock Market July 2025 Out"

- Recent High Momentum Stocks: A Deep Dive into "

- Us Pipe and Foundry Stock: A Comprehensive Gui"

- How Did the US Stock Market Close Today? A Com"

- Understanding Incentive Stock Options (ISOs) a"

- Unlocking the Potential of SI US Stock: A Comp"

- Understanding BOFA Hartnett US Stock Flows: A "

- Momentum Stocks: Top Performers in the US Mark"

- US Stock Calendar 2021: Key Dates and Events Y"