you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Understanding the US 10-Year Treasury Stock: Insights and Investment Strategies

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The US 10-Year Treasury Stock, often referred to as the "10-Year Note," is a highly sought-after investment product. This article aims to provide a comprehensive understanding of the 10-Year Treasury Stock, its significance, and the investment strategies associated with it.

What is the US 10-Year Treasury Stock?

The US 10-Year Treasury Stock represents a bond issued by the United States Treasury Department with a maturity of ten years. Investors purchase these bonds, effectively lending money to the government for a fixed period. In return, they receive periodic interest payments and the principal amount at maturity.

Why is the 10-Year Treasury Stock Significant?

The 10-Year Treasury Stock holds significant importance in the financial markets due to several factors:

- Interest Rate Benchmark: The 10-Year Treasury Yield serves as a benchmark for various interest rates, including mortgage rates and corporate bond yields. It is closely monitored by investors and policymakers alike.

- Risk-Free Asset: The 10-Year Treasury Stock is considered a risk-free asset because the US government has a virtually zero chance of defaulting on its debt. This makes it a popular choice for conservative investors seeking safety.

- Market Indicators: The performance of the 10-Year Treasury Stock can indicate market sentiment and economic conditions. For instance, a rising yield often suggests improving economic outlook, while a falling yield may reflect market uncertainty or economic slowdown.

Investment Strategies for the US 10-Year Treasury Stock

- Income Investing: Investors looking for regular income can invest in the 10-Year Treasury Stock, as they receive periodic interest payments. The interest rate is fixed for the life of the bond, providing predictable income.

- Interest Rate Arbitrage: Traders can exploit the difference in interest rates between the 10-Year Treasury Stock and other financial instruments, such as corporate bonds. This strategy involves buying the 10-Year Treasury Stock and simultaneously selling a similar-maturity corporate bond with a higher yield.

- Diversification: Including the 10-Year Treasury Stock in a diversified investment portfolio can reduce overall risk, as it tends to move inversely to stocks. When stock markets are volatile, the 10-Year Treasury Stock can act as a hedge against potential losses.

- Inflation-Protected Bonds: For investors concerned about inflation, inflation-protected Treasury bonds (TIPS) can be a suitable alternative. These bonds adjust their principal value to keep pace with inflation, providing a hedge against rising prices.

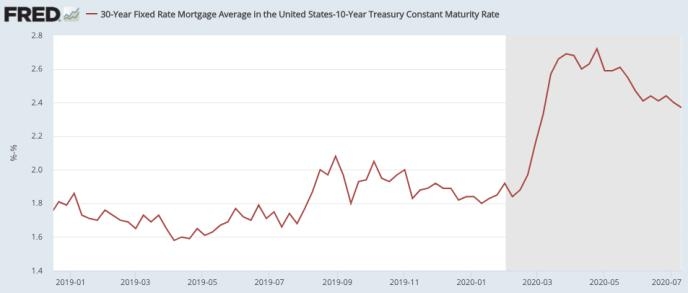

Case Study: Impact of the 10-Year Treasury Yield on the Stock Market

In February 2020, the 10-Year Treasury Yield fell below 1.5% for the first time since the financial crisis. This decline was driven by global economic uncertainty and the COVID-19 pandemic. The stock market, which had been on an upward trajectory, experienced a significant correction during this period. However, as the yield stabilized and the economy started to recover, the stock market also rebounded.

In conclusion, the US 10-Year Treasury Stock is a crucial investment product that offers safety, predictability, and various investment strategies. By understanding its significance and employing appropriate investment strategies, investors can optimize their portfolio and potentially achieve their financial goals.

so cool! ()

last:The Most Expensive Stock Per Share in the US: A Deep Dive"

next:nothing

like

- The Most Expensive Stock Per Share in the US: A Deep Dive"

- Toys "R" Us Super Nintendo Stock: A Deep Dive

- US Fuel Oil Stocks: A Comprehensive Guide to Current Trends and Analysis

- Agriculture Stock: A Growing Investment Opportunity in the US

- Maximizing Your Investment Potential: A Comprehensive Guide to Trading on the US

- Understanding the US EIA Crude Oil Stocks: Key Insights and Analysis"

- Fox Stock Market Report: Unveiling the Latest Trends and Insights

- Us Pipe and Foundry Stock: A Comprehensive Guide to Quality Metal Products

- Trade U.S. Stock in Australia: A Comprehensive Guide

- Stock Market Week: Top Trends and Predictions

- Understanding the Concept of "Tanking the Stock Market": A Comp

- Us Stock Broker Comparison: Choosing the Right Partner for Your Investments

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Top US Cannabis Stocks to Buy in 2023: A Guide"

- Is the US Stock Market Open on Election Day 20"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

recommend

Understanding the US 10-Year Treasury Stock: I

Understanding the US 10-Year Treasury Stock: I

Does the US Stock Exchange Use IFRS? Understan

RSI Technical Indicators for US Large Cap Stoc

Loc Silk Stocking Clark's LA, US: A Fashi

Should Female Workers Be Expected to Work Over

"Best US Dividend Aristocrats Stocks:

Indian ADRs in the US Stock Market: A Comprehe

"Understanding the Surging US Househo

Best US Airline Stocks: Top Picks for Investor

Fear and Greed Index: A Key Indicator for the

Unlocking the Potential of US Nuclear Power St

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding Samsung's Impact on the US "

- Total Market Capitalization of US Stocks: A Co"

- Understanding the US Stock Market: A Comprehen"

- Amazon Stock Price on July 19, 2025: What to E"

- T-Mobile US Historical Stock Price: January 3,"

- Understanding the US 10-Year Treasury Stock: I"

- China Companies on US Stock Exchange: Opportun"

- Best US Penny Stocks Under $1: Uncovering Hidd"

- Stock Market in US Today: Current Trends and F"

- Does the US Stock Exchange Use IFRS? Understan"