you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Understanding BOFA Hartnett US Stock Flows: A Comprehensive Insight

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The Importance of BOFA Hartnett US Stock Flows

In the ever-evolving landscape of financial markets, understanding stock flows is crucial for investors and analysts. One key player in this domain is BOFA Hartnett, a division of Bank of America that offers insightful data and analysis on the US stock market. This article delves into the significance of BOFA Hartnett US stock flows, providing a comprehensive understanding of how this data can shape investment decisions.

What Are BOFA Hartnett US Stock Flows?

BOFA Hartnett US stock flows refer to the movement of money in and out of various sectors within the US stock market. This data helps investors track the direction of capital flows, identify trends, and make informed investment choices. By analyzing these flows, investors can gain insights into market sentiment and potential market movements.

Key Aspects of BOFA Hartnett US Stock Flows

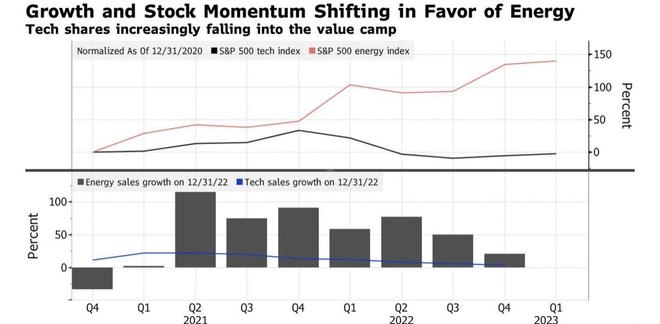

Sector Analysis: One of the primary uses of BOFA Hartnett US stock flows is to analyze sector movements. By examining which sectors are receiving the most capital inflows and which are seeing outflows, investors can identify which sectors are in favor and which may be underperforming.

Market Sentiment: Stock flows can provide a glimpse into market sentiment. For instance, if there is a significant outflow from technology stocks, it could indicate that investors are becoming cautious or shifting their focus to other sectors.

Investment Strategies: Understanding stock flows can help investors develop more effective strategies. By identifying sectors that are attracting capital, investors can allocate their resources accordingly.

Recent Trends in BOFA Hartnett US Stock Flows

Tech Sector Dominance

Over the past few years, the technology sector has been a significant recipient of capital inflows, as per BOFA Hartnett data. This trend is primarily driven by the rapid growth of companies in sectors such as cloud computing, artificial intelligence, and fintech.

Shift Towards Value Stocks

In recent months, there has been a notable shift towards value stocks. BOFA Hartnett US stock flows show that investors are increasingly moving away from growth stocks and towards stocks with a lower price-to-earnings ratio.

Case Study: Netflix and Amazon

A prime example of how stock flows can impact market movements is the case of Netflix and Amazon. BOFA Hartnett data shows that Netflix has experienced significant outflows, while Amazon has seen increased capital inflows. This shift in sentiment has led to a divergence in the performance of these two giants.

Conclusion

BOFA Hartnett US stock flows are a valuable tool for investors looking to stay ahead of market trends and make informed decisions. By analyzing sector movements, market sentiment, and investment strategies, investors can gain a deeper understanding of the US stock market and make more informed decisions. Stay tuned for more insights into the world of stock flows.

so cool! ()

last:Cheapest US Stock: Unveiling the Best Investment Opportunities

next:nothing

like

- Cheapest US Stock: Unveiling the Best Investment Opportunities

- Is US Steel's Stock Worth Buying?

- Daily US Stock Market Sell Recommendations: How to Make Informed Decisions

- Stock Trading for Non-US Residents: A Comprehensive Guide"

- Is the US Stock Market Open on Monday? A Comprehensive Guide

- Top Undervalued Small Cap US Stocks in 3D Printing for 2025

- Stock Market Just Crashed in the US: What You Need to Know

- "In-Depth Analysis: TRV Stock's Performance on Reuters - What You N

- "Can I Buy US Stocks from India?" A Comprehensive Guide

- Understanding the Definition of the US Stock Exchange

- How Many People Over 21 in the US Own Stock? A Deep Dive"

- http www.reuters.com article us-under-armour-stocks-iduskcn1b92bg: A Deep Dive in

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

- Best Widow and Orphan Stocks in the US Now: To"

- Unlocking the Potential of US Industrials Stoc"

recommend

Understanding BOFA Hartnett US Stock Flows: A

Understanding BOFA Hartnett US Stock Flows: A

Merck US Pharma Stocks: A Comprehensive Guide

Daylight Saving Time: How Does It Impact the U

Google Understanding Options in the US Stock M

Best Broker for US Stocks: Top Picks for 2023

"US Antibiotics Stock: A Comprehensiv

Best App for US Stock Trading: Unveiling the U

Anaplan US Stocks: Top Opportunities for Inves

Best US Stock Brokers Platform: Your Ultimate

Unlocking the Potential of Among Us Stocks: A

2017 US Stock Market: The Fraction of Institut

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Top 10 Most Valuable Companies in the US Stock"

- Stocks US History: A Journey Through Time and "

- US Stock Earnings Report: Unveiling the Financ"

- Aphria Stock: What You Need to Know About Inve"

- "Understanding the Surging US Househo"

- Daily US Stock Market Sell Recommendations: Ho"

- TSMC US Stock Price Chart: A Comprehensive Ana"

- Daylight Saving Time: How Does It Impact the U"

- "Navigating Canada Taxes on US Stocks"

- "Can I Buy US Stocks from India?&"