you position:Home > can foreigners buy us stocks > can foreigners buy us stocks

Cheapest US Stock: Unveiling the Best Investment Opportunities

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you looking for the cheapest US stock to invest in? In today's volatile market, finding a stock that offers the best value can be a daunting task. However, with a bit of research and knowledge, you can uncover hidden gems that could potentially yield substantial returns. This article will guide you through the process of identifying the cheapest US stock and provide insights into some of the best investment opportunities available.

Understanding the Cheapest US Stock

When we refer to the "cheapest US stock," we are essentially looking for stocks that are trading at a low price relative to their intrinsic value. These stocks are often undervalued and may have the potential for significant growth. It's important to note that the cheapest stock may not always be the best investment. Instead, you should focus on stocks that align with your investment strategy and offer long-term potential.

Key Factors to Consider

To identify the cheapest US stock, several key factors should be taken into account:

- Market Capitalization: This measures the total value of a company's outstanding shares. A lower market capitalization can indicate a smaller company with potential for growth.

- Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its earnings per share. A low P/E ratio can suggest that a stock is undervalued.

- Dividend Yield: This measures the return on investment in the form of dividends. A high dividend yield can be an attractive feature for income-oriented investors.

- Financial Health: Analyze a company's financial statements to assess its profitability, debt levels, and cash flow.

Top Cheapest US Stocks to Consider

Here are some of the cheapest US stocks that have caught our attention:

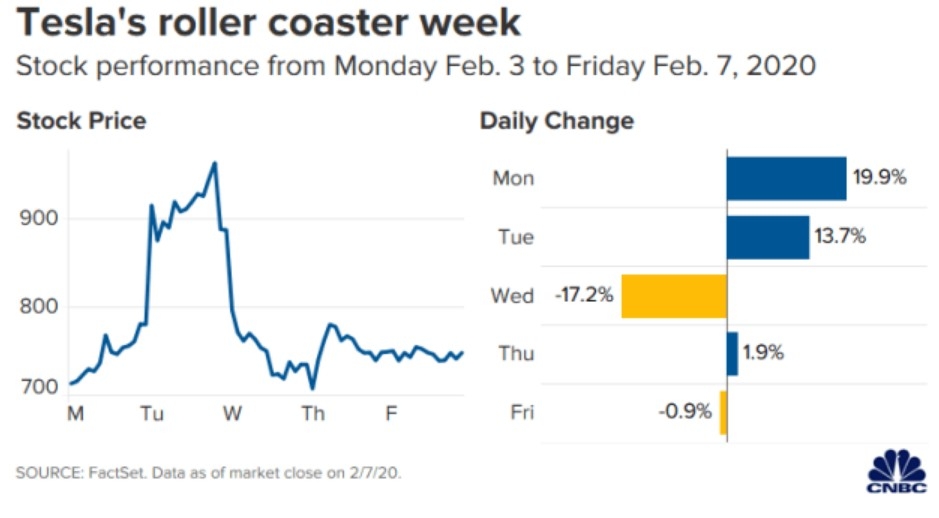

- Tesla (TSLA): Although TSLA has seen significant volatility, it remains one of the cheapest stocks in the tech sector. With a low P/E ratio and a promising future in electric vehicles, it could be a great long-term investment.

- Facebook (META): Despite recent controversies, META continues to be one of the cheapest stocks in the tech industry. Its strong presence in social media and advertising makes it a solid investment for growth.

- Amazon (AMZN): Despite its high market capitalization, AMZN remains one of the cheapest stocks in the retail sector. Its expansion into various markets and continued growth in e-commerce make it a compelling investment.

- Microsoft (MSFT): MSFT has a strong track record of profitability and growth. With a low P/E ratio and a high dividend yield, it's an attractive investment for long-term investors.

Conclusion

Finding the cheapest US stock requires careful research and analysis. By considering factors such as market capitalization, P/E ratio, dividend yield, and financial health, you can identify undervalued stocks with potential for growth. Remember to align your investment strategy with your long-term goals and seek professional advice if necessary. With the right approach, you can uncover hidden gems that could lead to significant returns.

so cool! ()

last:Is US Steel's Stock Worth Buying?

next:nothing

like

- Is US Steel's Stock Worth Buying?

- Daily US Stock Market Sell Recommendations: How to Make Informed Decisions

- Stock Trading for Non-US Residents: A Comprehensive Guide"

- Is the US Stock Market Open on Monday? A Comprehensive Guide

- Top Undervalued Small Cap US Stocks in 3D Printing for 2025

- Stock Market Just Crashed in the US: What You Need to Know

- "In-Depth Analysis: TRV Stock's Performance on Reuters - What You N

- "Can I Buy US Stocks from India?" A Comprehensive Guide

- Understanding the Definition of the US Stock Exchange

- How Many People Over 21 in the US Own Stock? A Deep Dive"

- http www.reuters.com article us-under-armour-stocks-iduskcn1b92bg: A Deep Dive in

- Title: Cipla Stock US: A Comprehensive Analysis

hot stocks

Pre-Market US Stock Movers: Key Insights and A

Pre-Market US Stock Movers: Key Insights and A- Pre-Market US Stock Movers: Key Insights and A"

- Among Us Christmas Stockings: Uniquely Celebra"

- Samsung Note 12.2 P900 Stock ROM US: A Compreh"

- Total Market Capitalization of US Stocks: A Co"

- "Unveiling the Excitement of US New S"

- Buy Stocks Outside US: A Guide to Global Inves"

- Best Widow and Orphan Stocks in the US Now: To"

- Unlocking the Potential of US Industrials Stoc"

recommend

Cheapest US Stock: Unveiling the Best Investme

Cheapest US Stock: Unveiling the Best Investme

Oil Companies That Drill in the US with Stock:

Hand Sanitizer Companies Stock in US: A Growin

Fly Us GTA 5 Stock: The Ultimate Guide to Maxi

Good US Stocks to Buy in 2017: Top Picks for I

OnePlus X Out of Stock in the US: What You Nee

T-Mobile US Historical Stock Price: January 3,

Understanding the Differences: Stock-Based Com

"Best US Dividend Aristocrats Stocks:

Us Pot Stocks 2021: The Year of Cannabis Inves

"Us Pot Stocks Reddit: A Comprehensiv

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- GG US Stock Price: What You Need to Know"

- Exploring the Labu US Stock Market: Opportunit"

- iShares US Preferred Stock ETF: Your Guide to "

- Maximizing Returns with US Direct B Stock Inve"

- US Mid Cap Stock Index: A Comprehensive Guide "

- "Percentage of US Population in the S"

- Loc Silk Stocking Clark's LA, US: A Fashi"

- Do You Need US Citizenship to Buy Stock?"

- Top Brokers for US Stocks: Your Ultimate Guide"

- Unlocking the Potential of SI US Stock: A Comp"