you position:Home > us stock market today live cha > us stock market today live cha

The Dow Jones Average Today: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The Dow Jones Average has been a key indicator of the U.S. stock market's health for over a century. As of today, the Dow Jones stands at a crucial juncture, reflecting the broader market's performance and sentiment. This article provides a comprehensive analysis of the Dow Jones average today, exploring its current state, recent trends, and potential future movements.

Current State of the Dow Jones Average

The Dow Jones Industrial Average (DJIA) is currently hovering around the 30,000 mark, having experienced a significant rally in recent months. This uptrend can be attributed to several factors, including strong corporate earnings, a supportive Federal Reserve, and a gradual recovery from the COVID-19 pandemic.

Recent Trends

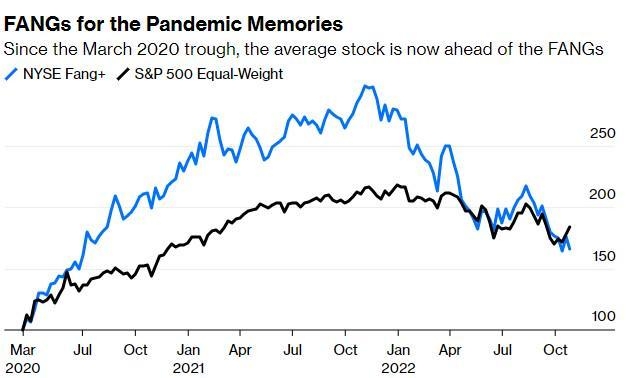

One notable trend in the Dow Jones average today is the outperformance of certain sectors. Tech stocks, for example, have been on a roll, driven by companies like Apple, Microsoft, and Amazon. Meanwhile, sectors like energy and financials have lagged behind, although they are beginning to show signs of recovery.

Another trend worth mentioning is the increasing influence of exchange-traded funds (ETFs) on the Dow Jones. ETFs have become a popular investment vehicle for many investors, as they offer diversification and lower fees. This has led to a more active trading environment in the Dow Jones, with higher trading volumes and more frequent price movements.

Potential Future Movements

Looking ahead, the future of the Dow Jones average today remains uncertain. While the current rally is encouraging, several factors could contribute to volatility in the coming months.

Economic Factors: The U.S. economy is still recovering from the COVID-19 pandemic, and the pace of this recovery could significantly impact the Dow Jones. Factors such as inflation, unemployment rates, and consumer spending will play a crucial role in determining the direction of the market.

Monetary Policy: The Federal Reserve's monetary policy decisions will also have a significant impact on the Dow Jones. The Fed's stance on interest rates, bond purchases, and inflation could lead to either continued growth or a potential market correction.

Geopolitical Tensions: Global events, such as trade disputes and geopolitical tensions, can also contribute to market volatility. Investors will be closely monitoring developments in the Middle East, China, and other regions that could affect the Dow Jones.

Case Studies

To better understand the potential future movements of the Dow Jones average today, let's look at a few case studies:

Case Study 1: During the 2008 financial crisis, the Dow Jones plummeted from over 14,000 to around 6,500 in a matter of months. This dramatic decline was primarily due to the collapse of the housing market and the subsequent credit crunch. The market eventually recovered, but it took several years for the Dow Jones to regain its pre-crisis levels.

Case Study 2: In 2019, the Dow Jones experienced a significant rally, reaching an all-time high of nearly 29,000. This rally was driven by strong corporate earnings, low interest rates, and a supportive Federal Reserve. However, the market faced several challenges, including trade tensions and geopolitical uncertainties, which caused it to fluctuate significantly.

In conclusion, the Dow Jones average today is a critical indicator of the U.S. stock market's health. While the current rally is encouraging, investors should remain cautious and monitor key economic and geopolitical factors that could impact the market's future movements.

so cool! ()

last:Free Stock Images: Contact Us for Unbeatable Collections

next:nothing

like

- Free Stock Images: Contact Us for Unbeatable Collections

- Live Us Stock Market Data: Unveiling the Latest Trends and Insights

- Correlation of US Dollar and Stock Market: Understanding the Dynamic Link

- Stock Market Sell-Off: Navigating the Volatility and Opportunities

- i Market Live: Revolutionizing E-commerce with Real-Time Engagement

- SandP 500 Stock Price: Trends, Analysis, and Future Outlook"

- Unlocking the Power of Market Money: A Comprehensive Guide

- Liquidation Stock US: Uncovering the Hidden Gems of Liquidation Sales

- Toys R Us Stock Position: A Comprehensive Analysis

- Dow Jones Industrial Average Current Price: Key Insights and Analysis

- Are Foreign Stocks Better Than US Stocks Right Now?"

- Cannabis and Stock Trading in the US: A Growing Market Opportunity

hot stocks

Unlocking Potential: Exploring US Small Cap Bi

Unlocking Potential: Exploring US Small Cap Bi- Unlocking Potential: Exploring US Small Cap Bi"

- Top US Stock to Buy: Unveiling the Ultimate In"

- "5 Crucial Things to Know Before Trad"

- Can Indian Citizens Trade in the US Stock Mark"

- US Bank Corp Stock Price Today: Key Insights a"

- US Made L1A1 Stock Set: The Ultimate Upgrade f"

- Best Performing US Stocks Past 5 Days: Momentu"

- Top 10 Dividend Stocks in the US: Secure Your "

recommend

The Dow Jones Average Today: A Comprehensive A

The Dow Jones Average Today: A Comprehensive A

US Made L1A1 Stock Set: The Ultimate Upgrade f

Scotia iTrade Buying US Stocks: A Comprehensiv

Discover the Perfect "Among Us&qu

Market Returns by Year: A Comprehensive Guide

Top US Mid Cap Stocks: Unveiling Investment Op

Live Us Stock Market Data: Unveiling the Lates

FQVTF Stock: What You Need to Know About the U

"US Pacific Marine Mammal Stock Asses

Toys R Us Items in Stock: The Ultimate Shoppin

US Stock Futures Respond to Trump Tariffs: Imp

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Trade Japanese Stocks in US SEC: A Comprehensi"

- Canadian Corporation Investing in US Stocks: A"

- Stock Market Rallies: Understanding the Dynami"

- Dollarama Stock US: A Comprehensive Analysis a"

- Is China Stock Market Open Today?"

- US Marijuana-Based Stocks: A Lucrative Investm"

- Unlock the Potential of US Glass Company Stock"

- Small US Stock Exchange: Opportunities and Ins"

- Short Term Trading Ideas: Top US Stocks to Wat"

- US Stock Forecast 2023: What to Expect and How"