you position:Home > us stock market today > us stock market today

Is the US Stock Market Crashing? A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is a crucial indicator of a country's economic health, and the United States, being the world's largest economy, has a stock market that garners global attention. Lately, there has been a significant buzz about the potential of a stock market crash in the US. This article delves into the current situation, examines the factors contributing to the anxiety, and provides an in-depth analysis of the likelihood of a crash.

Historical Context and Market Trends

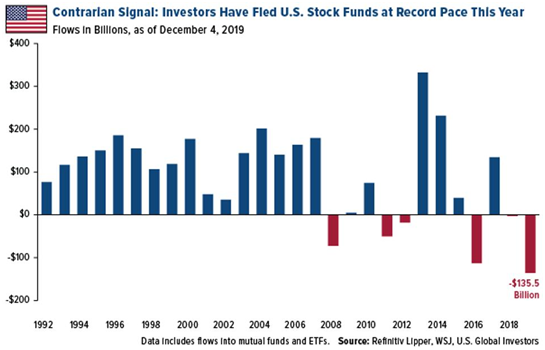

To understand the current situation, it's essential to look at the historical context and market trends. Over the past few years, the US stock market has seen unprecedented growth, with the S&P 500 index reaching new highs. However, this upward trend has not been without its share of volatility, and the market has faced several corrections along the way.

One significant factor contributing to the current anxiety is the unprecedented level of monetary stimulus provided by the Federal Reserve in response to the COVID-19 pandemic. This stimulus helped prop up the stock market, but it also led to inflationary pressures and concerns about the long-term sustainability of the current market conditions.

Factors Contributing to Market Anxiety

Several factors are currently contributing to the anxiety surrounding a potential stock market crash in the US:

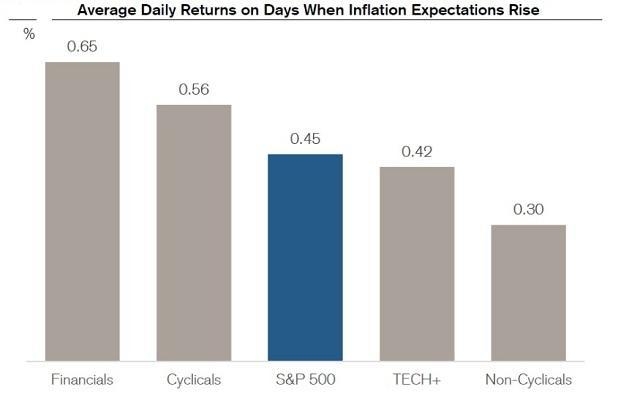

- Inflation: The current inflation rate is at a 40-year high, and the Federal Reserve is under immense pressure to control it. The recent hike in interest rates by the Fed has caused some concern, as higher interest rates can lead to increased borrowing costs and potentially dampen economic growth.

- Economic Uncertainty: The global economy is facing several challenges, including supply chain disruptions, rising energy costs, and geopolitical tensions. These uncertainties can lead to volatility in the stock market.

- Tech Stocks: The tech sector has been a major driver of the stock market's growth over the past few years, but it has also been a significant source of volatility. The recent pullback in tech stocks has raised concerns about the overall market's stability.

Likelihood of a Stock Market Crash

While the possibility of a stock market crash cannot be ruled out, it's essential to consider the factors that can mitigate the risk:

- Diversification: A well-diversified portfolio can help mitigate the impact of market volatility.

- Historical Performance: The stock market has historically recovered from corrections, and this time is no different.

- Economic Fundamentals: The US economy remains strong, with low unemployment and solid corporate earnings.

Case Studies: Past Stock Market Crashes

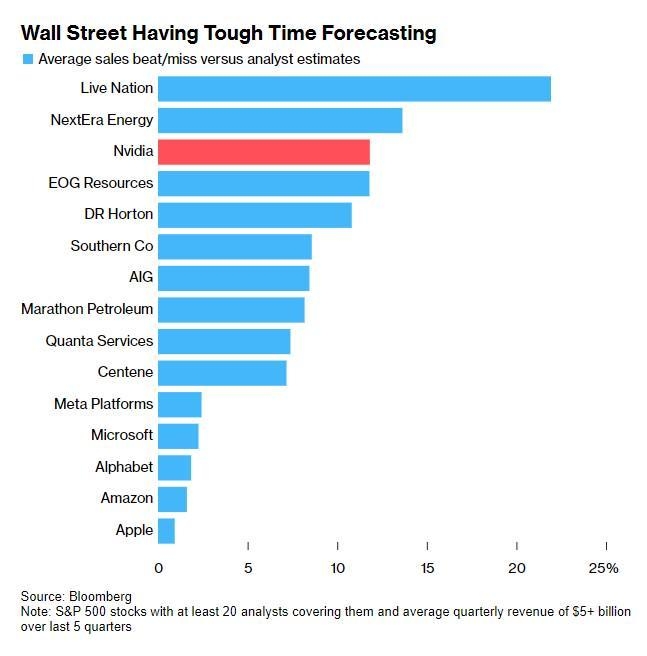

To put the current situation into perspective, let's look at some past stock market crashes:

- 2008 Financial Crisis: The stock market crash of 2008 was the worst since the Great Depression. It was primarily caused by the collapse of the housing market and the subsequent credit crunch.

- Dot-com Bubble Burst: The dot-com bubble burst in 2000, caused by the overvaluation of technology stocks. The market took several years to recover from the crash.

These historical examples show that stock market crashes are not uncommon, but they also demonstrate the market's ability to recover over time.

Conclusion

In conclusion, while the possibility of a stock market crash in the US cannot be entirely ruled out, there are several factors that can mitigate the risk. Diversification, historical performance, and economic fundamentals all suggest that the current market conditions are not indicative of an impending crash. As always, it's crucial to stay informed and make investment decisions based on thorough research and analysis.

so cool! ()

last:2025 Outlook: A Deep Dive into US Stocks

next:nothing

like

- 2025 Outlook: A Deep Dive into US Stocks

- Unlocking the Secrets of Market Returns: A Comprehensive Guide

- Hot Commodities: The Ultimate Guide to Investing in Today's Market

- Sco Us Stock Price: A Comprehensive Guide to Understanding and Analyzing"

- Stay Informed: The Ultimate Guide to MSNBC Stock Quotes

- S&P 500 Year to Date: Unveiling the Current Market Performance

- Genworth US Stock Price: Current Trends and Future Projections"

- How Will Brexit Affect the US Stock Market?

- Unlocking Value in the Small Cap US Stock Mutual Fund Market

- Unlocking the Future: Mastering the Art of Stock Market Projection

- Unlocking the Secrets of the Stock Market: A Comprehensive Guide

- Have International Stocks Ever Outperformed US Stocks? A Comprehensive Analysis

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

Is the US Stock Market Crashing? A Comprehensi

Is the US Stock Market Crashing? A Comprehensi

"Elliott Wave Theory and Its Implicat

Latest US Stock Market News: September 2025 Ro

Is the US Stock Market Open on December 31, 20

US Fund Managers Trim Bank Stocks Amid Market

Shariah-Compliant US Stocks: Bullish or Bearis

Ripple US Stock Market: Unveiling the Potentia

Canopy Growth Corp US Stock Symbol: A Comprehe

Unlocking Opportunities: A Comprehensive Guide

US Elections and Stocks: A Comprehensive Guide

Is the US Stock Market Open on New Year's

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- 2025 Outlook: A Deep Dive into US Stocks"

- Unlocking Profits with US Dollar Stock Index F"

- Is the US Stock Market Up or Down?"

- Title: Comprehensive Analysis of Sial Corporat"

- Scientific Games: A Leading Force in the US St"

- How Much Is an Amazon Stock Worth Today?"

- "Understanding the Tax Implications o"

- Unlocking the Potential of Adobe: A Deep Dive "

- Understanding Markets Indices: A Comprehensive"

- How Seed Stock Bulls Are Raised in the US"