you position:Home > us stock market today > us stock market today

2025 Outlook: A Deep Dive into US Stocks

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

As we approach the final quarter of 2024, investors are eagerly eyeing the 2025 outlook for US stocks. The market's trajectory over the past few years has been unpredictable, and many are wondering what the future holds. This article delves into the key factors that could shape the US stock market in 2025, offering insights and analysis to help investors make informed decisions.

Economic Factors to Consider

The economic landscape is a crucial factor to consider when looking at the 2025 outlook for US stocks. Key economic indicators, such as GDP growth, inflation rates, and unemployment rates, can significantly impact stock prices. Here are some key economic factors to keep an eye on:

- GDP Growth: A strong GDP growth rate indicates a healthy economy, which can be positive for stocks. However, if growth is too rapid, it may lead to inflationary pressures, which can be detrimental to stock prices.

- Inflation Rates: High inflation can erode purchasing power and lead to lower stock prices. The Federal Reserve's policies on interest rates will play a crucial role in controlling inflation.

- Unemployment Rates: A low unemployment rate can be a sign of a strong economy, which is generally positive for stocks. However, if unemployment rates fall too low, it may lead to wage inflation and higher production costs.

Sector Analysis

Different sectors of the US stock market are likely to perform differently in 2025. Here's a breakdown of some key sectors to watch:

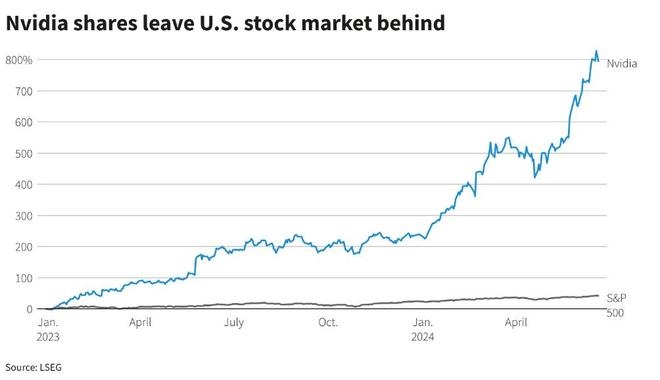

- Technology: The technology sector has been a major driver of stock market growth over the past few years. Companies like Apple, Microsoft, and Google have seen significant gains. However, increasing regulatory scrutiny and cybersecurity threats could pose challenges.

- Healthcare: The healthcare sector is expected to see steady growth in 2025, driven by an aging population and advancements in medical technology. Companies like Johnson & Johnson and Pfizer are likely to benefit.

- Energy: The energy sector has seen a resurgence in recent years, thanks to increased production of oil and natural gas. As the world transitions to renewable energy sources, companies in this sector may face challenges. However, those with a diversified portfolio of energy sources are likely to weather the transition better.

Market Trends

Several market trends could impact the 2025 outlook for US stocks:

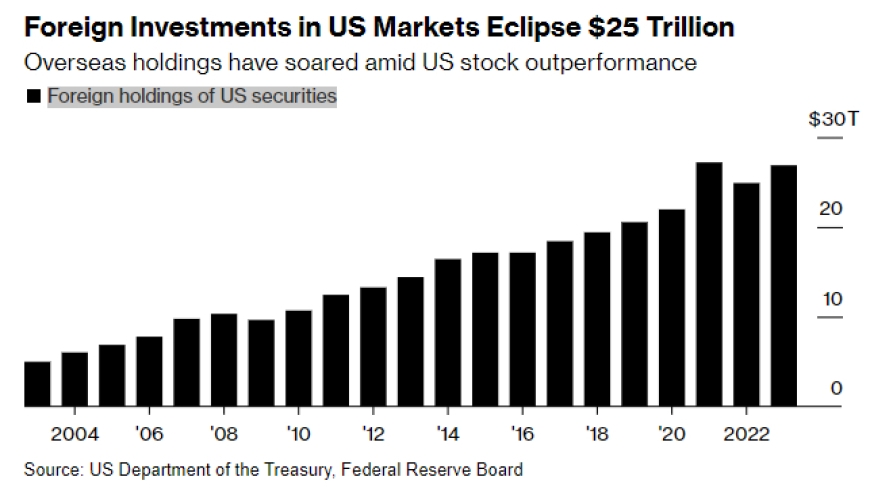

- Globalization: The global economy is becoming increasingly interconnected, which can create opportunities as well as risks. Companies with a global presence are likely to benefit from this trend.

- Technological Innovation: Advances in technology are driving innovation across various sectors, creating new opportunities for growth.

- Sustainability: Investors are increasingly concerned about sustainability, and companies that prioritize environmental, social, and governance (ESG) factors are likely to attract more investment.

Case Studies

To illustrate the potential impact of these factors on the stock market, let's consider a few case studies:

- Tesla: As a leader in the electric vehicle (EV) market, Tesla has seen significant growth in recent years. However, regulatory scrutiny and competition from other EV manufacturers could pose challenges.

- Amazon: The e-commerce giant has dominated the retail industry, but increasing competition from other online retailers and brick-and-mortar stores could impact its growth.

- Pfizer: As a leader in the pharmaceutical industry, Pfizer has seen steady growth in recent years. However, the company faces challenges from generic drug manufacturers and increasing competition in the biotech sector.

In conclusion, the 2025 outlook for US stocks is shaped by a complex interplay of economic factors, sector trends, and market trends. By understanding these factors and staying informed, investors can make informed decisions and position themselves for success in the years ahead.

so cool! ()

last:Unlocking the Secrets of Market Returns: A Comprehensive Guide

next:nothing

like

- Unlocking the Secrets of Market Returns: A Comprehensive Guide

- Hot Commodities: The Ultimate Guide to Investing in Today's Market

- Sco Us Stock Price: A Comprehensive Guide to Understanding and Analyzing"

- Stay Informed: The Ultimate Guide to MSNBC Stock Quotes

- S&P 500 Year to Date: Unveiling the Current Market Performance

- Genworth US Stock Price: Current Trends and Future Projections"

- How Will Brexit Affect the US Stock Market?

- Unlocking Value in the Small Cap US Stock Mutual Fund Market

- Unlocking the Future: Mastering the Art of Stock Market Projection

- Unlocking the Secrets of the Stock Market: A Comprehensive Guide

- Have International Stocks Ever Outperformed US Stocks? A Comprehensive Analysis

- US Elections and Stocks: A Comprehensive Guide to Understanding the Impact

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

2025 Outlook: A Deep Dive into US Stocks

2025 Outlook: A Deep Dive into US Stocks

Total US Stock Market Mutual Funds: A Comprehe

Nice.O: A Deep Dive into the Potential of This

Japan Stock ETFs in the US: A Comprehensive Gu

Can I Buy US Stocks in Australia? A Comprehens

How Much Is US Bank Stock Worth?

Best Small US Stocks to Buy: Top Picks for Inv

Market Close Today: Stock Analysis and Insight

Stock Market on 1/20/25: Key Developments and

How Many US Stock Tickers Are There?

US Stock Exchange Opens: Key Insights and Mark

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Comparative Analysis of Canadian and US Stock "

- Unlocking Opportunities: A Comprehensive Guide"

- How High Will the US Stock Market Go? A Compre"

- Unlocking the Potential of US Large-Cap Stock "

- Navigating Gift Tax Implications for Non-US Ci"

- Unlocking Profits: Understanding Dividend-Payi"

- NIO Stock: A Smart Investment in the US Electr"

- Today's News on Wall Street: Key Developm"

- Have International Stocks Ever Outperformed US"

- Unlocking the Potential of Adobe: A Deep Dive "