you position:Home > us stock market today > us stock market today

How Will Brexit Affect the US Stock Market?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The recent Brexit vote in the United Kingdom has sent shockwaves through the global financial markets, and investors are now grappling with the potential impact on the US stock market. This article delves into the various factors at play and offers insights into how Brexit might affect US investors.

Brexit Basics

Brexit stands for "British Exit," referring to the United Kingdom's decision to leave the European Union. The vote, which took place on June 23, 2016, was a significant event, with 52% of voters choosing to leave the EU, marking the first time a country has voted to leave a supranational organization in its history.

Potential Impact on the US Stock Market

The impact of Brexit on the US stock market is complex and multifaceted. Here are some of the key factors to consider:

1. Currency Fluctuations

The British pound has been plummeting since the Brexit vote, which has led to a weaker pound against the US dollar. This has had a positive effect on US companies with significant operations in the UK, as their revenues in pounds translate into more dollars. However, a weaker pound can also have negative implications for US consumers, as imports from the UK become more expensive.

2. Trade Relationships

The UK's departure from the EU could lead to changes in trade relationships, potentially impacting US companies that do business with both the UK and the EU. Companies like Boeing and General Motors, which have significant operations in the UK, could be affected by changes in trade policies. Additionally, the uncertainty surrounding the future of trade relationships could lead to a slowdown in global economic growth, impacting the US stock market.

3. Market Sentiment

Brexit has created uncertainty in the global markets, which can lead to volatility in the US stock market. Investors may become more risk-averse, leading to a sell-off in stocks. However, history has shown that markets often recover from such events, and some investors may see opportunities in the aftermath of Brexit.

4. Geopolitical Tensions

Brexit could also lead to increased geopolitical tensions, as other EU member states may consider holding referendums on their own memberships. This could lead to further uncertainty and volatility in the global markets, including the US stock market.

Case Studies

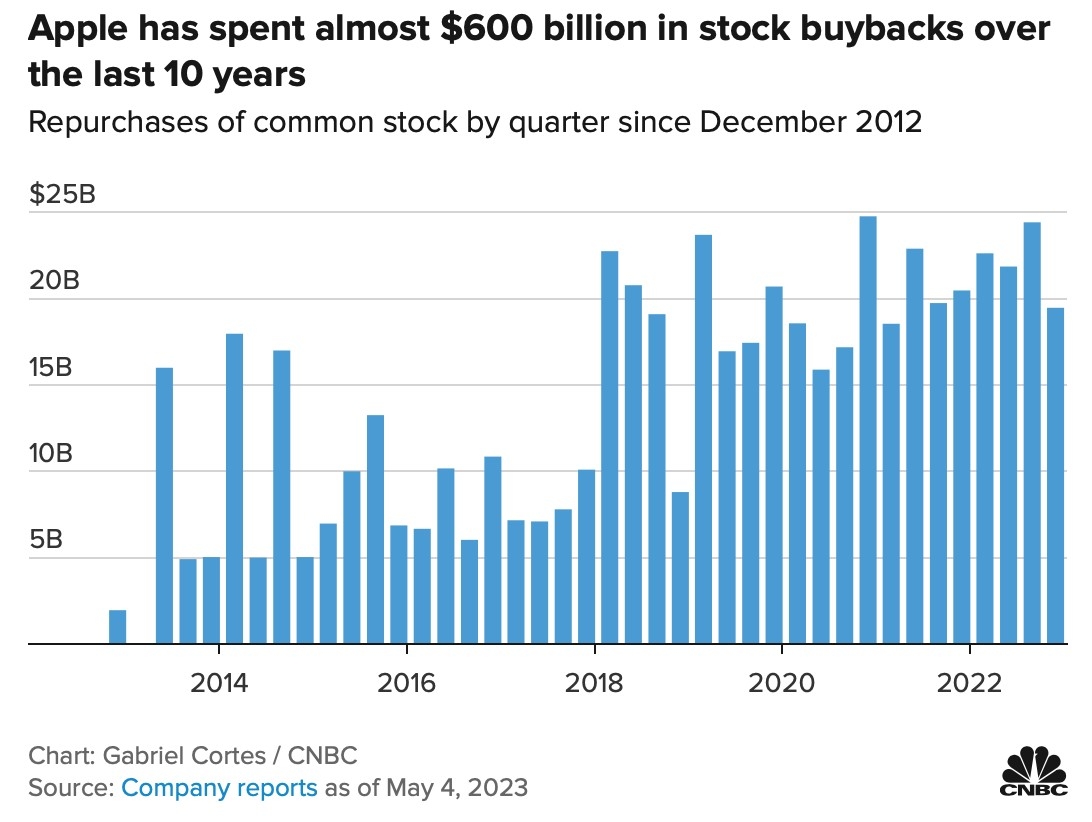

One of the most notable impacts of Brexit on the US stock market has been seen in the technology sector. Companies like Apple and Microsoft, which have significant operations in the UK, have seen their shares fluctuate in response to currency movements and trade uncertainty.

Conclusion

While it is difficult to predict the exact impact of Brexit on the US stock market, it is clear that there are several factors at play. Investors should be aware of the potential risks and opportunities presented by Brexit and consider their investments accordingly. As with any significant global event, it is crucial to stay informed and adapt to changing market conditions.

so cool! ()

last:Unlocking Value in the Small Cap US Stock Mutual Fund Market

next:nothing

like

- Unlocking Value in the Small Cap US Stock Mutual Fund Market

- Unlocking the Future: Mastering the Art of Stock Market Projection

- Unlocking the Secrets of the Stock Market: A Comprehensive Guide

- Have International Stocks Ever Outperformed US Stocks? A Comprehensive Analysis

- US Elections and Stocks: A Comprehensive Guide to Understanding the Impact

- Maximize Your Financial Potential with MoneyCentral: A Comprehensive Guide&qu

- Best Performing US Stocks Last 5 Trading Days: July 2025 Insight

- Canada Buy Us Stocks: A Comprehensive Guide to Investing Across Borders"

- "US Bank Stock: A Comprehensive Guide on Yahoo Finance"

- Best US Stocks to Buy Under $5: Uncovering Hidden Gems

- The Cheapest US Stock to Buy: A Smart Investment Opportunity

- Understanding the Us Stock Futures Ticker: A Comprehensive Guide

hot stocks

Maximizing Returns: Exploring General Electric

Maximizing Returns: Exploring General Electric- Maximizing Returns: Exploring General Electric"

- US Copper Stocks to Buy: Top Picks for Investo"

- Meip-US Stock Price: A Comprehensive Analysis"

- Ammunition Stocks: The Comprehensive Guide for"

- Buying US Stocks as a Foreigner: A Comprehensi"

- Monthly US Dividend Stocks: Your Guide to Cons"

- http stocks.us.reuters.com stocks fulldescript"

- US Pre-Market Stock: A Comprehensive Guide to "

recommend

How Will Brexit Affect the US Stock Market?

How Will Brexit Affect the US Stock Market?

Understanding the Minimum Investment Requireme

Unlocking the Potential of AI Stocks in the US

Best Performing US Stocks: Recent Performance

Canopy Growth Corp US Stock Symbol: A Comprehe

Unlocking the Potential of Sina's US Stoc

Unlock the Potential of a 5% US Dividend Stock

Invest in US Stocks: A Comprehensive Guide to

Stock Ticker for US Concrete: Unveiling the Be

"Us Highland Inc Stock: A Comprehensi

Unlocking the Potential of DF: A Deep Dive int

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Understanding the 1929 Stock Market Crash: A D"

- The Best Way to Short the US Stock Market: A C"

- NIO Stock: A Smart Investment in the US Electr"

- Have International Stocks Ever Outperformed US"

- "US Stock Breakdown by Sector: A Comp"

- Dow Jones US Completion Total Stock Market Ind"

- Unlocking the Potential of DF: A Deep Dive int"

- Maximizing Returns with BTQ US Stock: A Compre"

- Unlock the Power of Stock Trading Forums in th"

- "Understanding the Tax Implications o"