you position:Home > us stock market live > us stock market live

Oil Prices Extend Previous Gains on US Stocks Decline

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In a remarkable twist of financial markets, oil prices have extended their previous gains despite a decline in the US stock market. This unexpected resilience in the oil sector has caught the attention of investors and market analysts alike. The article delves into the factors contributing to this trend and offers insights into the broader implications for the global economy.

Factors Contributing to the Rise in Oil Prices

The surge in oil prices can be attributed to several key factors:

- Supply Constraints: Ongoing geopolitical tensions and disruptions in oil-producing regions have led to supply constraints. For instance, the conflict in Ukraine has significantly impacted oil supplies from Russia, one of the world's largest oil exporters.

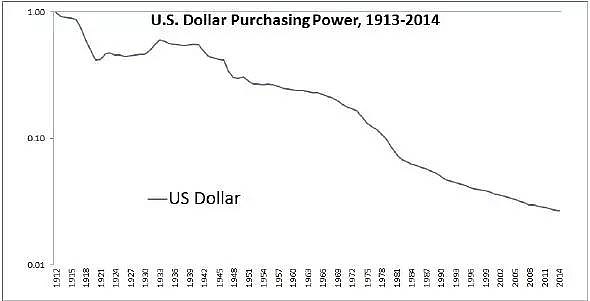

- Weak US Dollar: The US dollar has weakened in recent months, making oil more affordable for investors holding other currencies. This has led to increased demand for oil and contributed to its price rise.

- Economic Recovery: As the global economy continues to recover from the COVID-19 pandemic, demand for oil has also risen. This increased demand has put upward pressure on prices.

US Stock Market Decline

In contrast, the US stock market has experienced a decline in recent weeks. This decline can be attributed to several factors:

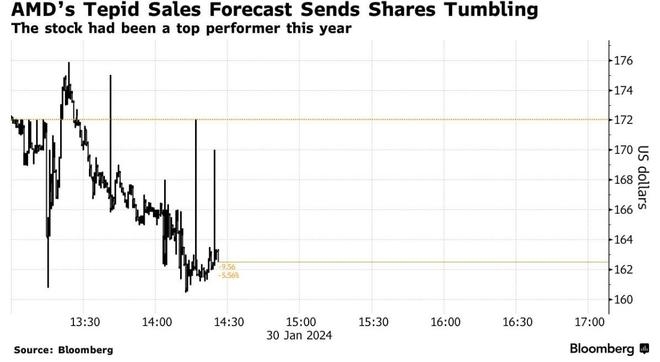

- Economic Concerns: Rising inflation and the potential for higher interest rates have raised concerns about the health of the US economy. This has led to a sell-off in stocks, particularly in sectors like technology and consumer discretionary.

- Corporate Earnings: Some companies have reported weaker-than-expected earnings, further contributing to the decline in the stock market.

- Geopolitical Tensions: The conflict in Ukraine has also raised concerns about global economic stability and has contributed to the decline in the stock market.

The Implications for the Global Economy

The current trend of rising oil prices and a declining US stock market has several implications for the global economy:

- Inflation: Rising oil prices can lead to higher inflation, as the cost of goods and services increases. This can put pressure on consumers and businesses.

- Economic Growth: Higher oil prices can also dampen economic growth, as businesses face increased costs and consumers have less disposable income.

- Currency Fluctuations: The weak US dollar has made oil more affordable for investors holding other currencies. However, it has also raised concerns about the strength of the US economy.

Case Study: The Oil Price Volatility of 2020

One notable example of oil price volatility is the dramatic decline in oil prices in early 2020, following the COVID-19 pandemic. This decline was driven by a combination of reduced demand and increased supply. However, as the global economy began to recover, oil prices stabilized and even rose.

This case study highlights the importance of considering both supply and demand factors when analyzing oil prices. It also underscores the potential impact of geopolitical events on oil markets.

In conclusion, the current trend of rising oil prices and a declining US stock market reflects the complex interplay of various economic and geopolitical factors. As investors and policymakers navigate this uncertain landscape, it is crucial to understand the broader implications of these trends for the global economy.

so cool! ()

last:Best Stock Footage of Rotating Earth: A Visual Journey to the Stars

next:nothing

like

- Best Stock Footage of Rotating Earth: A Visual Journey to the Stars

- Stocks for US Media Group: A Comprehensive Guide to Investment Opportunities

- Exploring the US and Canada Versions of Stock Market Opportunities"

- Us Army Stocking: The Essential Guide to Military Issue Socks

- Bull Run on Stock Markets Pause Ahead of US Data

- Stock Symbol for US Oil: Your Ultimate Guide to Trading Energy

- Unlocking the Potential of US Large Group Company Stock

- Total US Stock Market Value in 2025: Predictions and Analysis

- HSBC US Stock Trading Fees: What You Need to Know

- Toys "R" Us: The Stock, the Crew, and the Legacy

- Best Platform to Invest in US Stocks: Top Picks for 2023

- In-Depth Analysis of XLE: The Energy Sector's Powerhouse

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Oil Prices Extend Previous Gains on US Stocks

Oil Prices Extend Previous Gains on US Stocks

Unlocking the Potential of Large Cap Stocks in

Coupang US Stock: A Deep Dive into the South K

Is the Stock Market Just the US?

Mounjaro Out of Stock in the US: What You Need

Stocks That Benefit from U.S. Interest Rate Cu

Unlocking the Potential of US Battery Stocks:

Understanding Shell Stock Symbol: US Insights

Toys "R" Us Stock Crew Team

How to Buy Raspberry Pi Stock in the US: A Com

High Dividend Stocks in the US: Top Picks for

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Maximizing Total Return for US Stocks: Strateg"

- Silver Spot Prices: A Comprehensive Guide to U"

- Top Gold Mining Stocks in the US: Investing Op"

- "Ingenix (INGN.O): A Deep Dive into t"

- Maximizing Returns: The Art of Allocation Betw"

- Gilead Sciences: A Deep Dive into US Stock Per"

- US Bank Stock Comparison: Top Picks for 2023"

- US Magnet Stocks: Top Picks for High-Tech Inve"

- Best Performing US Stocks Last Hour: Dividend "

- Best Stock Footage of Rotating Earth: A Visual"