you position:Home > us stock market live > us stock market live

Bull Run on Stock Markets Pause Ahead of US Data

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The bull run on stock markets has been a remarkable phenomenon, with investors eagerly seeking opportunities for growth and profit. However, recent developments indicate that this upward trend may be pausing as traders await crucial data from the United States. This article delves into the reasons behind this pause and examines the potential impact on the global market.

Reasons for the Pause

The primary reason for the pause in the bull run is the anticipation of significant economic data from the United States. This data, which includes employment figures, inflation rates, and consumer spending, is crucial for investors to make informed decisions. With the Federal Reserve closely monitoring these indicators, any unexpected results could lead to a shift in monetary policy, affecting stock market trends.

Employment Figures

One of the most closely watched indicators is the unemployment rate. A lower unemployment rate suggests a strong labor market, which can boost consumer spending and corporate profits. Conversely, a higher unemployment rate can signal economic weakness, leading to a decline in stock prices. As investors await the latest employment figures, they are cautious about making significant investments.

Inflation Rates

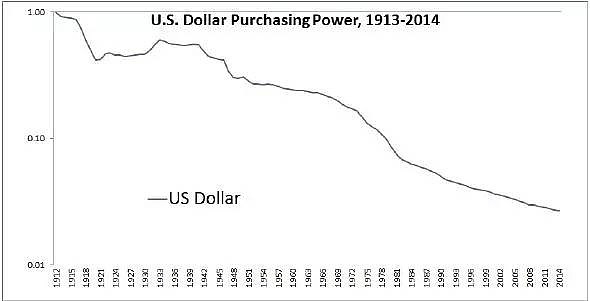

Inflation is another critical factor that can influence stock market trends. The Federal Reserve has been closely monitoring inflation rates to ensure they remain within a target range. If inflation shows signs of accelerating, the Fed may raise interest rates to control it, which could negatively impact stock prices. Investors are therefore closely watching inflation data to gauge the likelihood of such a move.

Consumer Spending

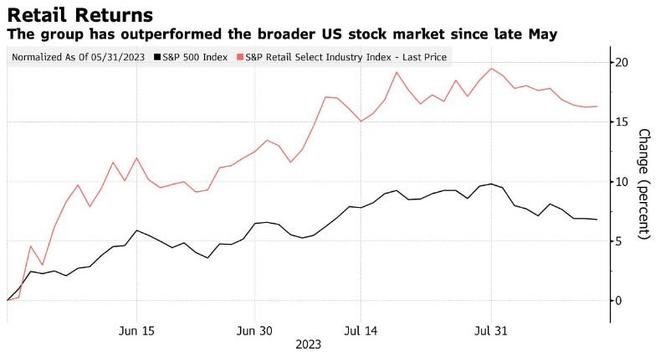

Consumer spending is a key driver of economic growth, and it has been on the rise in recent months. However, any signs of a slowdown in consumer spending could indicate a weakening economy, leading to a pause in the bull run. Investors are closely monitoring retail sales and consumer confidence data to assess the health of the consumer sector.

Impact on Global Markets

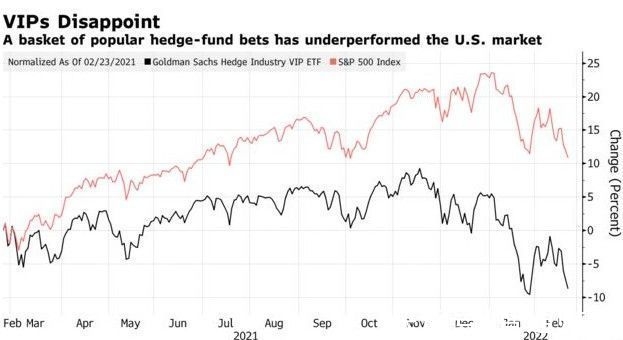

The pause in the bull run on stock markets in the United States is likely to have a ripple effect on global markets. Investors around the world are closely watching the developments in the US, as they often serve as a bellwether for global economic trends. A slowdown in the US could lead to a similar trend in other major economies, potentially causing a broader market correction.

Case Study: The 2015 Stock Market Correction

A notable example of the impact of economic data on stock markets is the 2015 stock market correction. In April 2015, the S&P 500 experienced a sharp decline of nearly 10% in just a few days. The trigger for this correction was a combination of factors, including concerns about global economic growth and a surprise increase in the unemployment rate. This event highlights the importance of economic data in driving stock market trends.

Conclusion

The bull run on stock markets has paused as investors await crucial economic data from the United States. With employment figures, inflation rates, and consumer spending data on the horizon, traders are cautious about making significant investments. The potential impact on global markets is significant, and investors are closely monitoring these indicators to make informed decisions.

so cool! ()

last:Stock Symbol for US Oil: Your Ultimate Guide to Trading Energy

next:nothing

like

- Stock Symbol for US Oil: Your Ultimate Guide to Trading Energy

- Unlocking the Potential of US Large Group Company Stock

- Total US Stock Market Value in 2025: Predictions and Analysis

- HSBC US Stock Trading Fees: What You Need to Know

- Toys "R" Us: The Stock, the Crew, and the Legacy

- Best Platform to Invest in US Stocks: Top Picks for 2023

- In-Depth Analysis of XLE: The Energy Sector's Powerhouse

- Top Losers in the US Stock Market: 2023's Unfortunate Performers

- US-Made L1A1 Stock Set: The Ultimate Upgrade for Your Rifle

- US H-1B Visa Fee Hike Impacts Indian IT Stocks

- Publicly Traded Marijuana Stocks: A Guide to US Investments

- LG Chem Stock: A Comprehensive Analysis in the US

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Bull Run on Stock Markets Pause Ahead of US Da

Bull Run on Stock Markets Pause Ahead of US Da

US Small Cap Stocks Performance 2025: A Compre

Top Trending Stocks US Today: Unveiling the Ma

Best US Cannabis Stocks to Buy in 2020: A Comp

US Bank Stock Comparison: Top Picks for 2023

"Navigating the US Recession: How It

Society as a Joint Stock Company: The Modern A

Can Non-Resident Invest in the US Stock Market

Is the US Stock Market Open on December 31?

Maximizing Total Return for US Stocks: Strateg

Toys "R" Us: The Stock, the

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- "US Stock Index: Comprehensive Guide "

- The Future of Oil: Unraveling the US Stock Mar"

- Uncovering the Hidden Gems: Top US Defense Pen"

- Cannabis Companies Listing on U.S. Stock Excha"

- Best Small Cap Stocks in the US Market: Unveil"

- High Dividend Stocks in the US: Top Picks for "

- PS5 Stock in the US: A Comprehensive Guide to "

- Recent Momentum Stocks: US Tech's Rising "

- Understanding Shell Stock Symbol: US Insights"

- Quantum Stocks in the US: The Future of Innova"