you position:Home > us stock market live > us stock market live

Gilead Sciences: A Deep Dive into US Stock Performance

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

In the bustling world of biotechnology, Gilead Sciences stands as a prominent figure, with its US stock performance often a topic of interest among investors. This article delves into the factors influencing Gilead’s stock market performance, offering insights into its growth trajectory and potential future prospects.

Understanding Gilead Sciences

Gilead Sciences, Inc. is a biopharmaceutical company that specializes in the research, development, and commercialization of innovative medicines to treat life-threatening diseases. The company is known for its groundbreaking treatments in the fields of HIV/AIDS, liver diseases, and oncology. Its US stock, listed on the NASDAQ under the ticker symbol GILD, has seen significant fluctuations over the years.

Historical Stock Performance

Gilead’s stock has experienced both peaks and valleys since its inception. The company’s initial public offering (IPO) in 2004 saw the stock price soar, reflecting investor optimism about its potential. However, the stock faced challenges in the following years, particularly in the face of generic competition and pricing pressures.

Factors Influencing Stock Performance

Several key factors have influenced Gilead’s stock performance:

- Product Pipeline: Gilead’s robust product pipeline has been a major driver of its stock performance. The company has a strong track record of bringing innovative drugs to market, which has helped maintain investor confidence.

- Regulatory Approvals: The approval of new drugs by regulatory authorities, such as the FDA, can significantly impact Gilead’s stock. Positive news regarding new drug approvals often leads to a surge in stock prices.

- Market Trends: Changes in market trends, such as shifts in consumer preferences and healthcare policies, can also affect Gilead’s stock performance.

- Economic Factors: Economic conditions, including interest rates and inflation, can influence the stock market as a whole and, by extension, Gilead’s stock.

Recent Developments and Future Prospects

In recent years, Gilead has faced challenges, including increased competition and patent expirations for some of its key products. However, the company has made strategic moves to diversify its portfolio and strengthen its position in the market.

One notable development is the acquisition of Kite Pharma, a leader in cell therapy, for $11.9 billion in 2017. This acquisition has expanded Gilead’s reach into the cancer treatment space and has the potential to drive future growth.

Looking ahead, Gilead’s future prospects appear promising. The company continues to invest in research and development, with a focus on developing new treatments for HIV/AIDS, liver diseases, and oncology. Additionally, the company’s strong financial position and experienced management team provide a solid foundation for future success.

Case Study: Sovaldi and Harvoni

Two of Gilead’s most successful products, Sovaldi and Harvoni, exemplify the company’s ability to develop groundbreaking treatments. Sovaldi, a hepatitis C virus (HCV) treatment, was approved by the FDA in December 2013 and quickly became a blockbuster drug. Harvoni, a combination of Sovaldi and ledipasvir, was approved in October 2014 and has since become the leading HCV treatment.

The success of these products has contributed significantly to Gilead’s stock performance. In fact, Harvoni alone has generated billions in revenue for the company, helping to offset the impact of patent expirations for other products.

Conclusion

Gilead Sciences has a complex stock performance, influenced by a variety of factors. While the company has faced challenges in recent years, its strong product pipeline, strategic acquisitions, and experienced management team provide a solid foundation for future growth. As investors continue to monitor the biopharmaceutical industry, Gilead’s US stock remains a key area of interest.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Top 3 US Marijuana Stocks to Watch in 2023

Himalaya Capital: A Deep Dive into Their US St

Baba Us Stock: The Ultimate Guide to Navigatin

Understanding the Dow Jones Total Stock Market

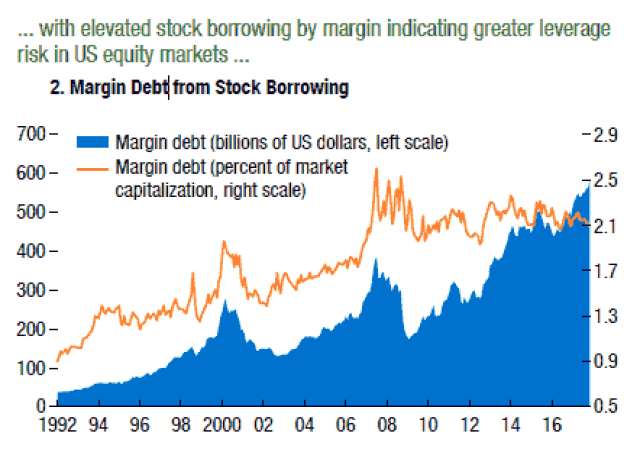

Graph of Us Stock Market Leverage: Understandi

US Large Cap Value Stocks with Low PE Ratios:

2025 4 24 US Stock Market Summary: Key Insight

Best US Total Stock Market Index Fund: Your Ul

Outlook for the US Stock Market on August 7th,

The Evolution of the U.S. Stock Exchange: A Jo

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- "Percentage of US Stocks Above 200-Da"

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- Top Preferred Stocks in the US: Your Ultimate "

- "Percentage of US Population with Sto"

- "How Much of the U.S. Population Owns"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- Today's Top Momentum US Stocks: Unveiling"

- Maximizing Total Return for US Stocks: Strateg"

- Understanding Canadian Trading US Stocks Tax I"

- Maximizing Growth with MGM US Stock: A Compreh"