you position:Home > us stock market live > us stock market live

Aramco US Stock: Understanding the Investment Opportunity

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

The Saudi Arabian Oil Company (Aramco) has long been a cornerstone of the global energy industry. As one of the world's largest oil producers, Aramco's stock has been a topic of interest for investors worldwide. This article delves into the details of Aramco's US stock, providing a comprehensive overview of the investment opportunity.

Understanding Aramco's Background

Aramco, officially known as the Saudi Arabian Oil Company, is the national oil company of Saudi Arabia. It was established in 1938 and has since become one of the largest oil companies in the world. The company is responsible for the exploration, production, refining, and distribution of oil and natural gas in Saudi Arabia.

Aramco's US Stock

Aramco's stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol "ARAMCO." The company's initial public offering (IPO) in December 2019 was the largest in history, raising over $29 billion. This IPO marked a significant step for Aramco, as it allowed the company to diversify its funding sources and increase its global visibility.

Investment Opportunities

Investing in Aramco's US stock offers several opportunities:

- Strong Financial Performance: Aramco has a strong track record of financial performance, with significant revenue and profit margins. The company's robust financials make it an attractive investment for investors seeking stable returns.

- Market Leader: As one of the world's largest oil producers, Aramco has a significant market presence. This position allows the company to influence global oil prices and maintain a competitive edge.

- Dividend Yield: Aramco has a history of paying dividends to its shareholders. The company's strong financial performance has supported its ability to provide attractive dividend yields, making it an appealing investment for income-seeking investors.

Risks to Consider

While investing in Aramco's US stock offers numerous opportunities, it's important to consider the associated risks:

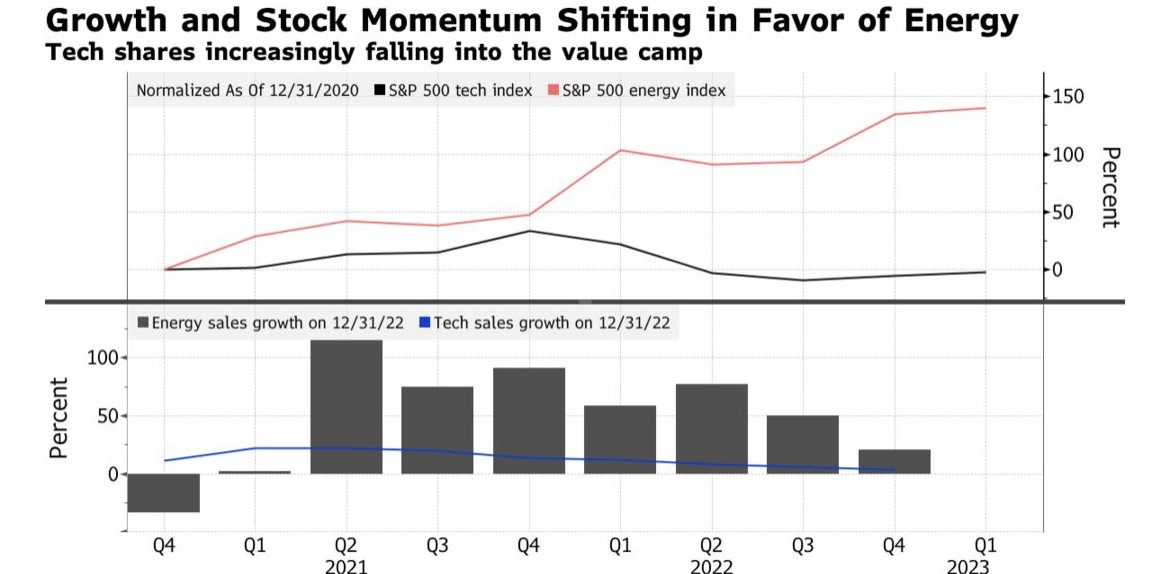

- Energy Sector Volatility: The oil and gas industry is subject to volatility due to factors such as geopolitical events, changes in supply and demand, and technological advancements. These factors can impact Aramco's financial performance and, consequently, its stock price.

- Regulatory Changes: Changes in regulations and policies related to energy production and environmental protection can impact Aramco's operations and profitability.

- Political Risks: Aramco operates in a politically sensitive region, which can lead to instability and impact the company's operations.

Case Study: Aramco's IPO

Aramco's IPO in 2019 was a significant event for the global financial markets. The company's decision to list its stock on the NYSE marked a shift in its approach to global investment. The IPO was successfully completed, raising billions of dollars and positioning Aramco as a key player in the global energy market.

Conclusion

Investing in Aramco's US stock offers a unique opportunity to gain exposure to one of the world's largest oil producers. While there are risks to consider, the company's strong financial performance, market leadership, and dividend yield make it an attractive investment for many investors. As with any investment, it's important to conduct thorough research and consider your own risk tolerance before making a decision.

so cool! ()

last:Top News Stocks to Watch in the US Market

next:nothing

like

- Top News Stocks to Watch in the US Market

- Us Elections on Stock Market: How Political Shifts Impact Financial Outcomes

- List of US Marijuana Stocks: Top 5 Investments to Watch

- Understanding the UK Tax on US Stocks: What You Need to Know

- US Alternative Energy Stocks: Your Guide to Investing in Renewable Energy

- US Dividend Stocks Smoked by Higher Yields: What Investors Need to Know

- How to Trade Stocks in the US from Canada: A Comprehensive Guide"

- Oil Prices Extend Previous Gains on US Stocks Decline

- Best Stock Footage of Rotating Earth: A Visual Journey to the Stars

- Stocks for US Media Group: A Comprehensive Guide to Investment Opportunities

- Exploring the US and Canada Versions of Stock Market Opportunities"

- Us Army Stocking: The Essential Guide to Military Issue Socks

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

Aramco US Stock: Understanding the Investment

Aramco US Stock: Understanding the Investment

US Dividend Stocks Smoked by Higher Yields: Wh

HTC Stock US: A Comprehensive Analysis of the

Stock Market Hours: What You Need to Know Abou

Free Us Stock Screener: Your Ultimate Tool for

Henry Us Survival Rifle Stocks: The Ultimate G

Circuit Breaker in the US Stock Market 2020: A

Unlocking Profits: The Potential of Oil Refine

Best Performing Large Cap US Stock in Q2 2025:

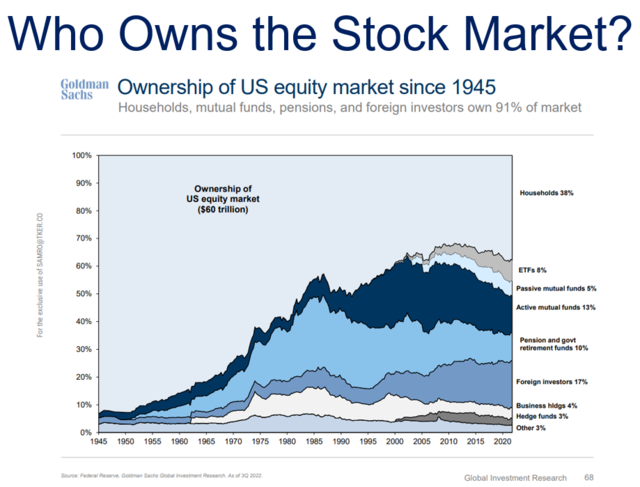

"The Historical Stock Ownership Perce

US Large Cap Stocks Momentum RSI Analysis: Oct

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Enamine BB US Stock: The Ultimate Guide to Inv"

- Unlocking the Secrets of Fit Stock Price in th"

- Overhead US Bank Stadium Stock Footage: Captur"

- ASX vs US Stocks: A Comprehensive Comparison f"

- The Future of Oil: Unraveling the US Stock Mar"

- Top Momentum Stocks in the US Market: A 5-Day "

- Unveiling the Power of US Government Stock Foo"

- Aritzia Stock US: A Comprehensive Analysis for"

- HTC Stock US: A Comprehensive Analysis of the "

- Colony Capital US Real Estate Stocks: A Lucrat"