you position:Home > us stock market live > us stock market live

Aritzia Stock US: A Comprehensive Analysis for Investors

![]() myandytime2026-01-19【us stock market today live cha】view

myandytime2026-01-19【us stock market today live cha】view

info:

Aritzia, a leading fashion retailer in Canada, has been making waves in the fashion industry, and its stock has caught the attention of many investors in the United States. In this article, we delve into a comprehensive analysis of Aritzia stock, exploring its performance, potential, and what investors should consider before making their move.

Understanding Aritzia's Stock Performance

Aritzia's stock (TSX: ARZ) has experienced a rollercoaster ride over the years. After its initial public offering (IPO) in 2015, the stock surged, reaching a high of

Several factors have contributed to Aritzia's stock performance. One of the main drivers has been the company's strong brand presence and its ability to adapt to changing consumer trends. Aritzia has managed to maintain a unique and fashionable image, which has helped it stand out in a crowded market.

Market Potential and Growth Opportunities

Aritzia has been expanding its presence in the United States, which presents significant growth opportunities. The company has already opened several stores across the country and has plans to further expand its retail footprint. This expansion is expected to drive sales and increase the company's market share.

Additionally, Aritzia's focus on sustainability has been a key differentiator. The company has been investing in eco-friendly materials and practices, which has resonated with environmentally conscious consumers. This commitment to sustainability could potentially open up new markets and customer segments.

Key Factors to Consider Before Investing

Before investing in Aritzia stock, it's important to consider several key factors:

Financial Health: Aritzia has shown a strong financial performance, with consistent revenue growth and a healthy balance sheet. However, it's crucial to analyze its financial statements to understand its profitability and cash flow.

Competitive Landscape: The fashion industry is highly competitive, with numerous players vying for market share. It's essential to assess Aritzia's competitive position and its strategies to maintain its market edge.

Economic Factors: Economic conditions can significantly impact the fashion industry. Factors such as consumer spending, interest rates, and inflation should be considered when evaluating Aritzia's stock.

Management and Strategy: The company's management team and its strategic direction are crucial in determining its long-term success. Evaluate the management's track record and their vision for the future.

Case Study: Aritzia's Expansion in the US

Aritzia's expansion into the United States is a prime example of its growth potential. The company opened its first store in New York City in 2017 and has since opened several more locations across the country. This expansion has been well-received by consumers, with sales at these stores growing at a rapid pace.

The success of Aritzia's U.S. expansion can be attributed to several factors, including its unique product offerings, strong brand identity, and effective marketing strategies. By leveraging these strengths, Aritzia has been able to establish a solid presence in the U.S. market.

In conclusion, Aritzia stock presents an intriguing opportunity for investors. With a strong brand, a commitment to sustainability, and a growing presence in the United States, Aritzia has the potential to continue its upward trajectory. However, as with any investment, it's important to conduct thorough research and consider the various factors that can impact the company's performance.

so cool! ()

like

- US Steel Companies Stocks: A Comprehensive Analysis

- Best Performing Large Cap US Stock in Q2 2025: NXTT Shines Bright

- How to Buy Stock in Dinglong Culture Co., Ltd. (US)

- "Ingenix (INGN.O): A Deep Dive into the Full Description of This Stock&a

- Pharmacare US Inc Stock: A Deep Dive into the Future of Healthcare

- Airline Stocks in the US Stock Market: A Comprehensive Overview

- How to Invest in the US Stock Market from Jamaica: A Comprehensive Guide

- US Oil Prices Stock: What You Need to Know

- "Shorting US Stocks: A Strategic Approach to Investment"

- Unlocking the Potential of CRCL Stock: A Comprehensive Analysis

- "S&P 500's Influence on US Stock Market Capitalization in 2

- "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&sy

hot stocks

"Best Performing US Stocks: Top 5 fro

"Best Performing US Stocks: Top 5 fro- "Best Performing US Stocks: Top 5 fro"

- Silver Spot Prices: A Comprehensive Guide to U"

- Best Cheap US Stocks: Discover Hidden Gems for"

- Unlocking Potential: The Rise of Cannabis Stoc"

- The Largest Stock Exchange in the US: A Compre"

- Momentum Stocks: A 5-Day Performance Review in"

- Himalaya Capital: A Deep Dive into Their US St"

- Sprint US Stock: The Ultimate Guide to Investi"

recommend

US Steel Companies Stocks: A Comprehensive Ana

US Steel Companies Stocks: A Comprehensive Ana

Baba Us Stock: The Ultimate Guide to Navigatin

US Large Cap Value Stocks with Low PE Ratios:

Outlook for the US Stock Market on August 7th,

2025 4 24 US Stock Market Summary: Key Insight

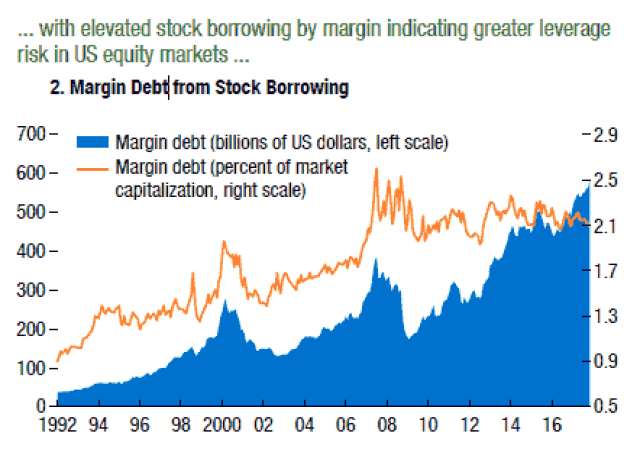

Graph of Us Stock Market Leverage: Understandi

Best US Total Stock Market Index Fund: Your Ul

Understanding the Dow Jones Total Stock Market

Himalaya Capital: A Deep Dive into Their US St

Top 3 US Marijuana Stocks to Watch in 2023

The Evolution of the U.S. Stock Exchange: A Jo

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- 5110 Overseas Hwy, Stock Island, FL 33040: A P"

- "How Much of the U.S. Population Owns"

- Top Preferred Stocks in the US: Your Ultimate "

- Understanding Canadian Trading US Stocks Tax I"

- Maximizing Growth with MGM US Stock: A Compreh"

- Rubbermaid Commercial 4242-88-BLA 100 US Gallo"

- Today's Top Momentum US Stocks: Unveiling"

- Maximizing Total Return for US Stocks: Strateg"

- "Percentage of US Stocks Above 200-Da"

- "Percentage of US Population with Sto"