you position:Home > stock coverage > stock coverage

Unlocking the Power of Investment Share: A Comprehensive Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's fast-paced financial world, understanding the concept of investment share is crucial for anyone looking to grow their wealth. But what exactly is an investment share, and how can it benefit you? This article delves into the essentials of investment share, providing you with a clear and concise guide to help you make informed decisions.

What is an Investment Share?

An investment share, also known as a stock or equity, represents a portion of ownership in a company. When you purchase an investment share, you become a shareholder, and your share of the company's profits is directly proportional to the number of shares you own. This means that as the company grows and becomes more profitable, your investment share can increase in value.

Types of Investment Shares

There are two main types of investment shares: common shares and preferred shares. Common shares offer voting rights and the potential for dividends, but they also come with higher risk. Preferred shares, on the other hand, do not offer voting rights but provide a fixed dividend payment and a higher priority in the event of bankruptcy.

Benefits of Investing in Shares

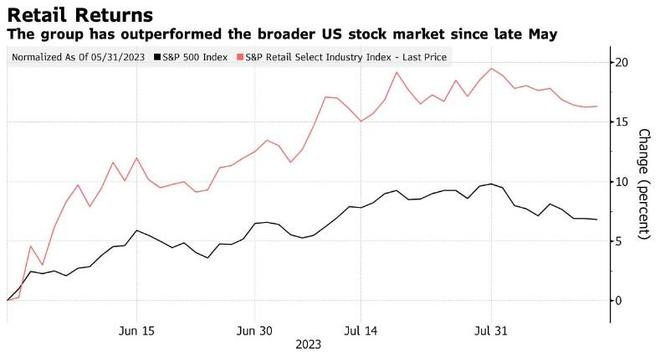

Potential for High Returns: One of the main advantages of investing in shares is the potential for high returns. Over the long term, shares have historically outperformed other investment vehicles like bonds and savings accounts.

Dividend Income: As a shareholder, you can receive dividends, which are a portion of the company's profits distributed to shareholders. This can provide a steady stream of income, especially if you invest in companies with a strong dividend history.

Liquidity: Shares are highly liquid, meaning you can buy and sell them quickly and easily. This allows you to access your investment capital whenever you need it.

Ownership: By investing in shares, you become a part owner of the company. This can give you a sense of satisfaction and a stake in the company's success.

How to Invest in Shares

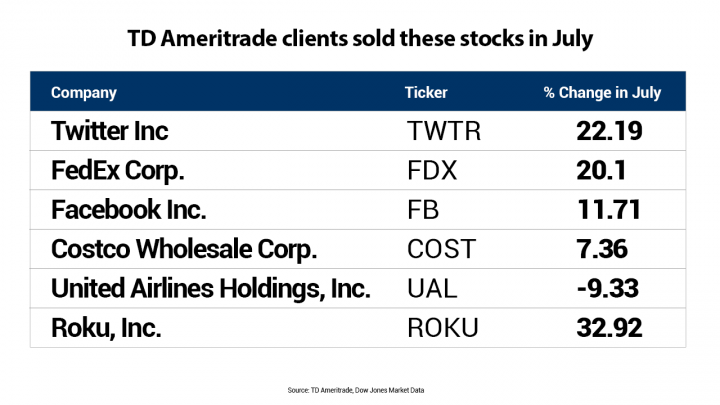

Research: Before investing, it's important to research the company thoroughly. Look at its financial statements, market position, and management team. Consider factors like revenue growth, profit margins, and debt levels.

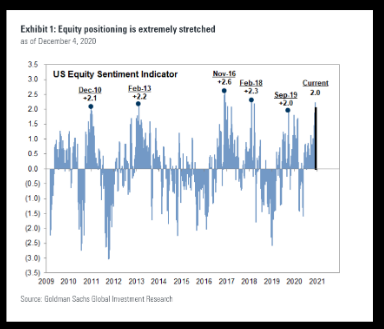

Diversify: Diversification is key to managing risk. Don't put all your money into one stock. Instead, invest in a mix of different shares across various industries and geographical locations.

Use a Broker: To buy and sell shares, you'll need to use a broker. Choose a reputable broker with low fees and good customer service.

Stay Informed: Keep up with the latest news and developments in the stock market and the companies you're invested in. This will help you make informed decisions and adjust your portfolio as needed.

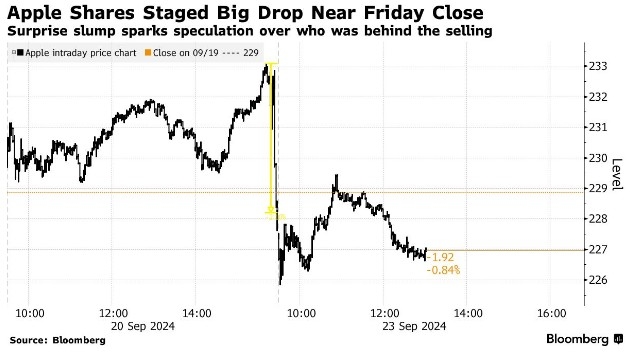

Case Study: Apple Inc.

One of the most successful companies in the world, Apple Inc., has seen its shares soar in value over the years. By investing in Apple's common shares, shareholders have enjoyed significant returns, along with regular dividend payments. This case study highlights the potential of investing in shares and the importance of choosing the right companies.

In conclusion, investment shares offer a powerful way to grow your wealth. By understanding the basics of investment share and following a disciplined approach, you can build a diversified portfolio that aligns with your financial goals. Remember to do your research, stay informed, and invest in companies with strong fundamentals. With the right strategy, investing in shares can be a rewarding and profitable endeavor.

so cool! ()

like

- Berkshire Hathaway's US Real Estate Stocks: A Strategic Investment Analysis

- The Current Stock Market: A Comprehensive Overview

- Top 500 Companies in the US Stock Daily Volume: A Comprehensive Analysis

- Dow Futures Stock Price: Understanding Market Trends and Investment Opportunities

- Contrarian Long Small Cap Stocks US: Navigating the Hidden Gems

- Standard Deviation of US Stock Market: Understanding Volatility and Investment Im

- Did the Stock Market Close Up or Down Today? A Detailed Look

- Google Share Price vs Yahoo: A Comprehensive Analysis"

- Biggest US Cannabis Stock: What You Need to Know

- Paper Trade US Stocks: A Risk-Free Investment Strategy

- Stock Statistics on the U.S. Government: Insights and Analysis

- Nasdaq Calendar: Your Ultimate Guide to Upcoming Market Events

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Unlocking the Power of Investment Share: A Com

Unlocking the Power of Investment Share: A Com

PlayStation 5 Stock Tracker US: The Ultimate G

US Stock Market Bull Market Status in May 2025

How Many Companies Are on the US Stock Market?

Unlocking the Potential of US Coin Stocks: A C

How 9/11 Affected the U.S. Stock Market: A Dec

Jan 17 US Stock Market: Key Highlights and Ins

Understanding the US Oil Stockpile: Its Signif

"Big Stock Brokers in the US: The Hea

Understanding the US Nuclear Energy Companies

"US Large Cap Stocks: Market Cap Over

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Jan 17 US Stock Market: Key Highlights and Ins"

- Understanding the Dynamics of US Bonds and Sto"

- Understanding the Put/Call Ratio: A Key Indica"

- Best Performing Large Cap US Stocks Past Week:"

- FOMC Meeting Minutes: A Key Indicator for US S"

- Master Your Inventory Management with a Stock "

- Closing Bell on Wall Street Today: Key Insight"

- Exploring the Current State of Crude Oil Stock"

- S&P 500 Index Values: Understanding th"

- Unlocking the Potential of US Conec Stock: A C"