you position:Home > stock coverage > stock coverage

Stock Statistics on the U.S. Government: Insights and Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the vast landscape of financial markets, understanding the stock statistics on the U.S. government is crucial for investors and financial analysts alike. This article delves into the intricacies of U.S. government stocks, offering insights, analysis, and real-world examples to help readers make informed decisions.

Understanding U.S. Government Stocks

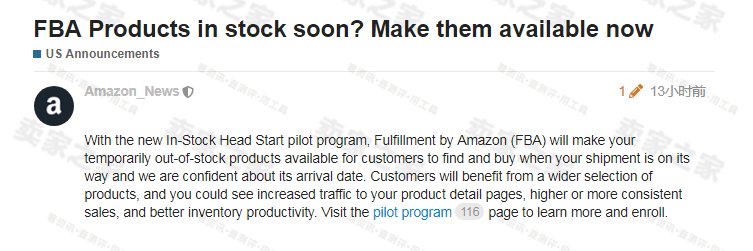

The U.S. government issues various types of securities, including Treasury bills, notes, and bonds. These securities are considered safe investments due to the backing of the U.S. government. However, understanding their performance and market trends is essential for investors.

Performance Overview

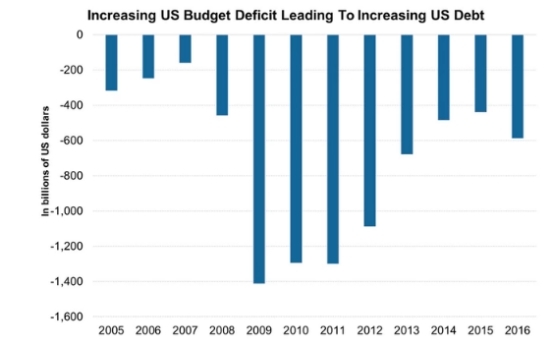

Over the years, U.S. government stocks have shown a consistent performance, offering stability and low risk. According to the U.S. Treasury Department, the average return on U.S. government securities over the past decade has been around 3-4%. This indicates a reliable and predictable investment option for those seeking stability.

Market Trends

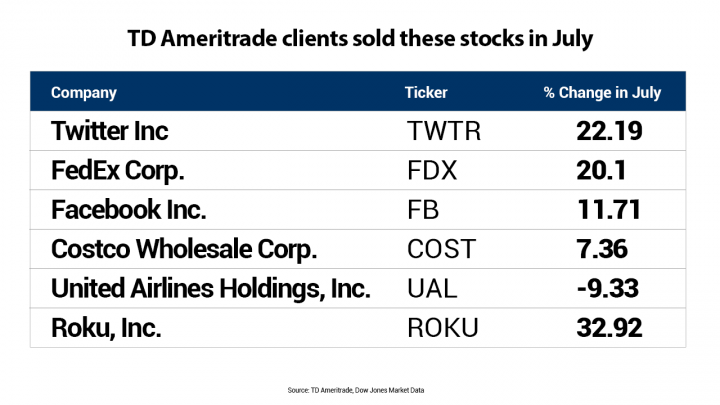

Market trends in U.S. government stocks can be influenced by various factors, including economic conditions, political events, and interest rate changes. For instance, during periods of economic uncertainty, investors often turn to U.S. government securities for safety, leading to increased demand and higher prices.

Interest Rate Impact

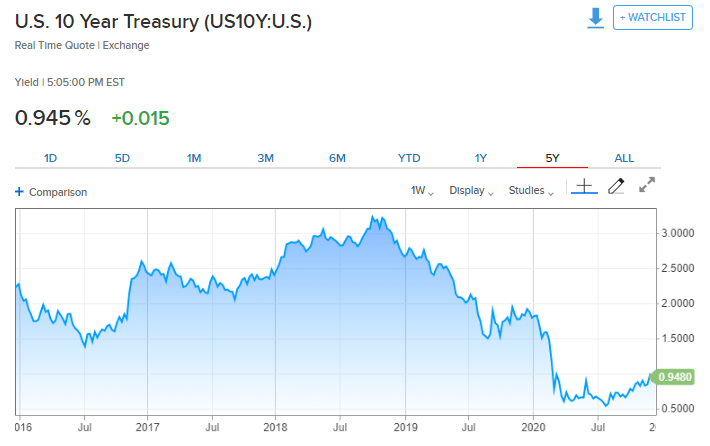

One of the most significant factors affecting U.S. government stocks is interest rates. As interest rates rise, the prices of existing securities typically fall, as new securities offer higher yields. Conversely, when interest rates fall, the prices of existing securities tend to rise.

Real-World Example: 2020 Economic Crisis

A notable example of the impact of market trends on U.S. government stocks is the 2020 economic crisis. As the COVID-19 pandemic spread, investors sought refuge in U.S. government securities, leading to increased demand and higher prices. This trend highlights the importance of staying informed about market dynamics and economic conditions.

Investment Strategies

When investing in U.S. government stocks, it's crucial to adopt a well-rounded investment strategy. Here are a few key points to consider:

- Diversification: Diversifying your investment portfolio can help mitigate risks associated with market volatility.

- Risk Assessment: Evaluate your risk tolerance and invest accordingly. U.S. government securities are considered low-risk, but it's essential to understand your investment goals and time horizon.

- Market Analysis: Stay informed about economic and political events that may impact U.S. government stock prices.

Conclusion

Understanding the stock statistics on the U.S. government is crucial for investors looking to add stability and reliability to their portfolios. By analyzing market trends, considering interest rate impacts, and adopting a well-rounded investment strategy, investors can make informed decisions and achieve their financial goals.

so cool! ()

last:Nasdaq Calendar: Your Ultimate Guide to Upcoming Market Events

next:nothing

like

- Nasdaq Calendar: Your Ultimate Guide to Upcoming Market Events

- Unlocking the Potential of Sing.pk: A Comprehensive Analysis of Its Stock Perform

- Navigating the China-US Trade War: Impact on Stock Market Dynamics

- Total US Stock: The Ultimate Guide to Investing in the American Market

- US PS5 Stock: The Ultimate Guide to Finding Availability and Deals

- Rare Earth Stock in US: The Future of Advanced Technology

- Differences in US Stock Markets: A Comprehensive Guide

- How's the Dow Jones Doing? A Comprehensive Look at the Market Index

- Good Time to Buy US Stocks: Why Now is the Perfect Moment for Investors"

- Best Marijuana Stocks to Buy in the US: A Comprehensive Guide

- Maximizing ROI: A Deep Dive into CNN Data Markets

- Lightspeed POS US Stock Symbol: Unveiling the Key to Investment Success

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Stock Statistics on the U.S. Government: Insig

Stock Statistics on the U.S. Government: Insig

Closing Time: Understanding the US Stock Marke

Stocks Open Lower on Trump Concerns Ahead of U

Discover the Best US Stock Clothing: Your Ulti

Cheap End Mills US Stock: Your Ultimate Guide

Best Marijuana Stocks to Buy in the US: A Comp

How 9/11 Affected the U.S. Stock Market: A Dec

Good Time to Buy US Stocks: Why Now is the Per

Medtronic US Stocks: A Comprehensive Guide to

How Many Companies Are in the US Stock Market?

"Unveiling the US Senators' Stoc

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Best Stocks to Invest in the US Now: Top Picks"

- Computershare Stock Transfer Form US: A Compre"

- Understanding HSBC US Stock Dividend Tax Impli"

- Us China Trade War Stocks to Buy: 6 Must-Have "

- Must Invest Stocks in US: Top 5 Reasons to Div"

- Bitcoin ETFs: A Game-Changer for the US Stock "

- How Can I Invest in US Stocks?"

- Today's Stock Market News: Key Developmen"

- http stocks.us.reuters.com stocks fulldescript"

- Should I Buy US Stocks Now?"