you position:Home > stock coverage > stock coverage

Should I Buy US Stocks Now?

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you contemplating investing in US stocks but unsure about the right time? The stock market can be unpredictable, but there are several factors to consider before making your decision. In this article, we will explore the current market trends, potential risks, and opportunities to help you determine if now is the right time to buy US stocks.

Understanding the Current Market Trends

The stock market is influenced by various factors, including economic indicators, geopolitical events, and corporate earnings. As of early 2023, the US stock market has experienced a rollercoaster ride, with several ups and downs. However, several key trends have emerged:

- Economic Growth: The US economy has shown signs of recovery, with low unemployment rates and a strong GDP growth rate. This has led to increased investor confidence in the stock market.

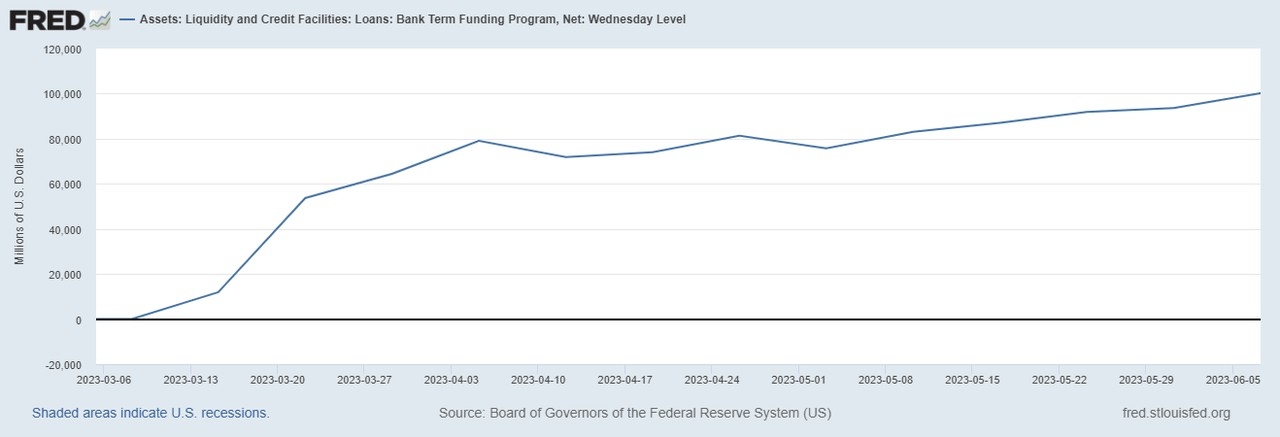

- Inflation: Inflation has been a concern for investors, but the Federal Reserve has been implementing measures to control it. This has helped stabilize the stock market.

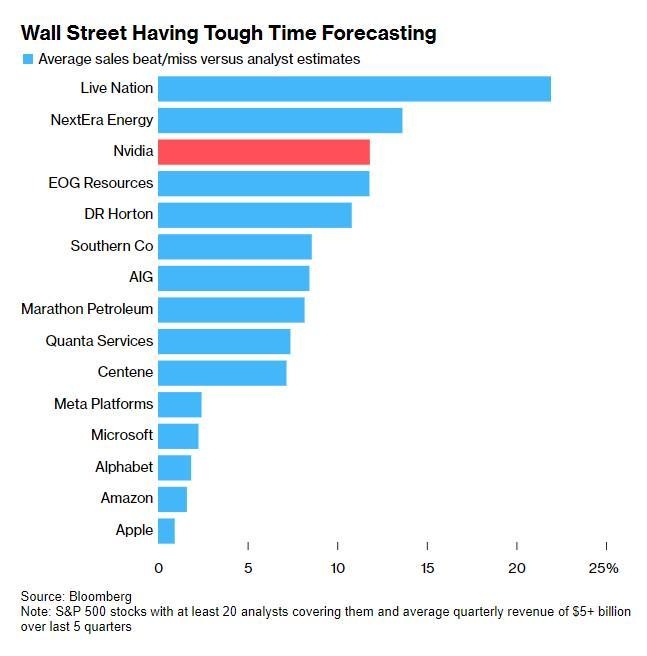

- Tech Stocks: The technology sector has been a significant driver of the US stock market, with companies like Apple, Microsoft, and Amazon leading the charge.

Potential Risks to Consider

While there are opportunities in the US stock market, it's crucial to be aware of the potential risks:

- Economic Downturn: A global economic downturn could negatively impact the US stock market.

- Geopolitical Events: Tensions between major economies, such as the US and China, could lead to market volatility.

- Corporate Earnings: A decline in corporate earnings could result in a drop in stock prices.

Opportunities in the US Stock Market

Despite the risks, there are several opportunities in the US stock market:

- Dividend Stocks: Dividend-paying stocks can provide a steady income stream and protect your investment during market downturns.

- Growth Stocks: Growth stocks offer the potential for significant capital gains but come with higher risk.

- Sector Rotation: Investing in sectors that are expected to outperform the market can lead to substantial returns.

Case Study: Apple Inc.

Apple Inc. is a prime example of a successful investment in the US stock market. Since its initial public offering in 1980, Apple has grown to become the world's most valuable company. By investing in Apple's stock, investors have enjoyed significant returns over the years.

Factors to Consider Before Investing

Before deciding to buy US stocks, consider the following factors:

- Risk Tolerance: Assess your risk tolerance to determine the type of stocks that align with your investment goals.

- Investment Strategy: Develop a clear investment strategy that includes diversification and regular monitoring.

- Financial Goals: Align your investment decisions with your long-term financial goals.

In conclusion, the decision to buy US stocks now depends on various factors, including market trends, potential risks, and your investment goals. By understanding these factors and conducting thorough research, you can make an informed decision. Remember, investing in the stock market requires patience, discipline, and a long-term perspective.

so cool! ()

last:Jan 17 US Stock Market: Key Highlights and Insights

next:nothing

like

- Jan 17 US Stock Market: Key Highlights and Insights

- Recommended Us Stocks: Top Picks for Investors in 2023

- FDA Approval: A Game-Changer for US Stocks

- Unveiling the Powerhouse: US Financial Sector Stocks

- US Election 2020: How It Impacted the Stock Market"

- List of US Tech Stocks: Top Investments for 2023

- Unlocking the Power of US Net Capital Stock: A Comprehensive Guide"

- T-Mobile US Inc Stock Price: A Comprehensive Analysis

- Unlocking Wealth: Top US Large Company Stocks Fund Investments"

- Is the US Stock Market in a Bubble?

- March 2020 IPOs: A Deep Dive into the US Stock Market's Dynamism

- Title: Top US Stocks to Invest in 2018: Your Guide to Success

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- ATVI US Stock: A Comprehensive Guide to Unders"

- "http stocks.us.reuters.com stocks fu"

- "Impact of Covid-19 on the US Stock M"

recommend

Should I Buy US Stocks Now?

Should I Buy US Stocks Now?

Best Performing Large Cap US Stocks Past Week:

T-Mobile US Inc Stock Price: A Comprehensive A

Best US Stock Real-Time Data Subscription: Unl

Best US Stocks for RRSP: Top Investments to Bo

How to Buy US Steel Stock: A Comprehensive Gui

Jan 17 US Stock Market: Key Highlights and Ins

Unlocking High Yield Monthly Dividend Stocks i

Unlocking Opportunities in Health Care Stocks:

Holidays of the US Stock Market: Understanding

Reddit US Stock Picks in Late 2019: A Look Bac

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks games silver etf us stock

like

- Moving Averages Analysis: Predicting US Stock "

- Expected Rate of Return in the US Stock Market"

- Computershare Stock Transfer Form US: A Compre"

- Ianthus Stock Price: A Comprehensive Analysis"

- Stocks for US Corporations: A Comprehensive Gu"

- US Bump Stock Ban: Understanding the Impact an"

- "Unveiling the Ratio of US to Interna"

- Uber Stock: A Smart Investment for U.S. Invest"

- March 2020 IPOs: A Deep Dive into the US Stock"

- How 9/11 Affected the U.S. Stock Market: A Dec"