you position:Home > stock coverage > stock coverage

Top 500 Companies in the US Stock Daily Volume: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, understanding the daily trading volume of the top 500 companies is crucial for investors and analysts alike. This article delves into the significance of daily trading volume, the top companies driving this trend, and the implications for market dynamics.

The Importance of Daily Trading Volume

Daily trading volume provides a snapshot of investor interest in a particular stock or company. It reflects the number of shares bought and sold within a day, offering valuable insights into market sentiment and liquidity. A high trading volume usually indicates strong investor interest and liquidity, which can lead to significant price movements.

Top Companies by Daily Trading Volume

The top 500 companies in the US stock market by daily trading volume are a mix of household names and emerging players. Let's take a closer look at some of the key players:

Apple Inc. (AAPL): As the world's largest company by market capitalization, Apple Inc. commands a significant portion of the daily trading volume. Its diverse product portfolio, including smartphones, computers, and wearables, continues to attract investors worldwide.

Microsoft Corporation (MSFT): Microsoft, known for its Windows operating system, Office productivity suite, and cloud computing services, also ranks high in the daily trading volume. The company's strong financial performance and innovative approach to technology have made it a favorite among investors.

Amazon.com, Inc. (AMZN): As one of the largest e-commerce platforms, Amazon.com dominates the retail industry and commands a significant trading volume. Its expansion into cloud computing with Amazon Web Services (AWS) has further bolstered its market position.

Google's Parent Company Alphabet Inc. (GOOGL): Alphabet, the parent company of Google, is a major force in the tech industry. Its search engine, advertising services, and other tech products contribute to a substantial daily trading volume.

Facebook's Parent Company Meta Platforms, Inc. (META): Meta Platforms, the parent company of Facebook, Instagram, and WhatsApp, is another tech giant with a significant presence in the stock market. Its diverse portfolio of social media and messaging platforms drives a high trading volume.

Implications for Market Dynamics

The daily trading volume of the top 500 companies has several implications for market dynamics:

Market Sentiment: A high trading volume often indicates strong market sentiment, which can lead to significant price movements. Conversely, a low trading volume may suggest uncertainty or lack of interest in the market.

Liquidity: Companies with high daily trading volume tend to have higher liquidity, making it easier for investors to buy and sell shares without significantly impacting the stock price.

Innovation and Growth: Companies with a high trading volume are often innovative and growing rapidly. This can attract investors looking for long-term growth opportunities.

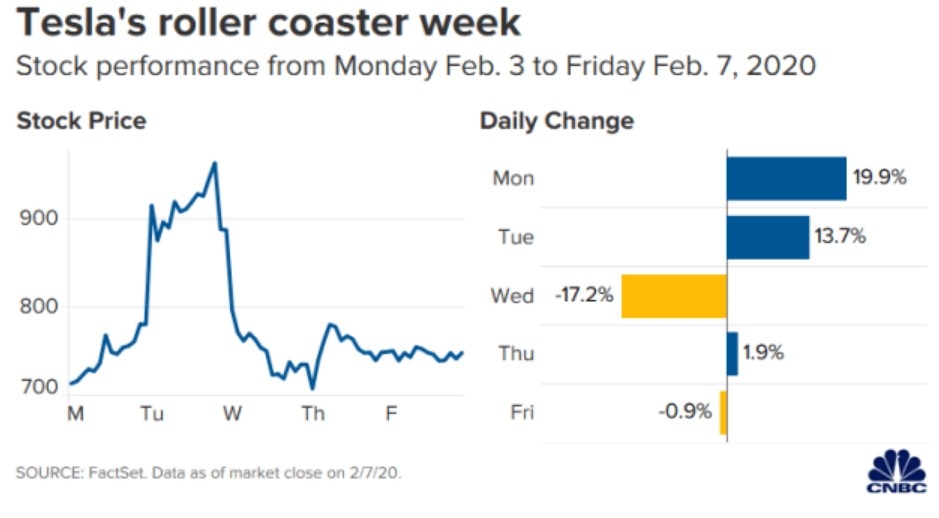

Case Study: Tesla, Inc. (TSLA)

Tesla, Inc., the electric vehicle manufacturer, is a prime example of a company with a high daily trading volume. Its revolutionary approach to the automotive industry, coupled with strong financial performance and innovative technology, has made it a favorite among investors. Tesla's trading volume often reflects the market's excitement and anticipation for its future growth.

In conclusion, the daily trading volume of the top 500 companies in the US stock market is a crucial indicator of market dynamics and investor sentiment. By analyzing these volumes, investors and analysts can gain valuable insights into market trends and potential opportunities.

so cool! ()

like

- Dow Futures Stock Price: Understanding Market Trends and Investment Opportunities

- Contrarian Long Small Cap Stocks US: Navigating the Hidden Gems

- Standard Deviation of US Stock Market: Understanding Volatility and Investment Im

- Did the Stock Market Close Up or Down Today? A Detailed Look

- Google Share Price vs Yahoo: A Comprehensive Analysis"

- Biggest US Cannabis Stock: What You Need to Know

- Paper Trade US Stocks: A Risk-Free Investment Strategy

- Stock Statistics on the U.S. Government: Insights and Analysis

- Nasdaq Calendar: Your Ultimate Guide to Upcoming Market Events

- Unlocking the Potential of Sing.pk: A Comprehensive Analysis of Its Stock Perform

- Navigating the China-US Trade War: Impact on Stock Market Dynamics

- Total US Stock: The Ultimate Guide to Investing in the American Market

hot stocks

IEA Global EV Outlook 2021: US Electric Vehicl

IEA Global EV Outlook 2021: US Electric Vehicl- IEA Global EV Outlook 2021: US Electric Vehicl"

- Best Performing US Stock Market Sectors in 202"

- Best Stocks to Invest in the US Now: Top Picks"

- Magnificent 7 US Stocks 2023 Performance: Top "

- Undervalued US Growth Stocks: Unlocking Hidden"

- Title: In-Depth Analysis of PNRA.O: A Comprehe"

- S&P 500 Inclusion Today: What You Need"

- Exploring the Era of 1950-60 US Rolling Stock:"

recommend

Top 500 Companies in the US Stock Daily Volume

Top 500 Companies in the US Stock Daily Volume

US Stock Index Futures: A Comprehensive Guide

Japan and US Stock Market: A Comparative Analy

US Steel Stock Premarket: A Deep Dive

"Unveiling the Ratio of US to Interna

"Maximizing Returns with US-Based Sto

Best Performing Large Cap US Stocks Past Week:

Sona Nanotech Stock: A Promising Investment in

Spy Us Stock Price: How to Monitor and Analyze

Optimizing US Building Stock: Strategies for E

US Express Stock: NYSE's Rising Star

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Holidays of the US Stock Market: Understanding"

- Costco Stock Checker US: Your Ultimate Guide t"

- Percent of US Market Value in Small Cap Stocks"

- Computershare Stock Transfer Form US: A Compre"

- T-Mobile US Inc Stock Price: A Comprehensive A"

- Upcoming Stock Splits: What Investors Need to "

- Magnificent 7 US Stocks 2023 Performance: Top "

- Piperdoll US Stock: A Comprehensive Guide to I"

- "Decade of Growth: A Comprehensive An"

- How Many Companies Are in the US Stock Market?"