you position:Home > new york stock exchange > new york stock exchange

Title: US Automaker Traded on Stock Exchange: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the dynamic world of finance, the stock exchange serves as a platform where investors can buy and sell shares of various companies, including automakers. This article delves into the intricacies of US automakers traded on the stock exchange, providing valuable insights into the market dynamics, investment opportunities, and the factors that influence stock prices.

Understanding the Stock Market

The stock market is a marketplace where buyers and sellers trade shares of publicly-traded companies. These companies issue shares to the public, allowing investors to own a portion of the company. When a US automaker decides to go public, it offers shares to the public through an Initial Public Offering (IPO). This process allows the company to raise capital and expand its operations.

Notable US Automakers Traded on the Stock Exchange

Several US automakers have made a significant impact on the stock market. Here are some of the most prominent ones:

- Ford Motor Company: One of the oldest and most recognizable automakers in the world, Ford has been traded on the stock exchange since 1956. The company offers a diverse range of vehicles, including cars, trucks, and SUVs.

- General Motors Company: GM is another American icon with a rich history in the automotive industry. It has been traded on the stock exchange since 1916 and is known for its wide range of vehicles, including Chevrolet, Buick, GMC, and Cadillac.

- Tesla, Inc.: As an emerging player in the electric vehicle (EV) market, Tesla has captured the attention of investors worldwide. The company has seen a remarkable rise in its stock price over the years, thanks to its innovative products and ambitious goals.

Investment Opportunities

Investing in US automakers offers various opportunities for investors. Here are some factors to consider when evaluating these investment options:

- Market Trends: Keep an eye on the global automotive market, including trends such as electric vehicles, autonomous driving, and advancements in technology.

- Financial Performance: Analyze the company's financial statements, including revenue, profit margins, and debt levels.

- Management Team: A strong and experienced management team can significantly impact a company's performance and stock price.

- Industry Competitors: Monitor the actions of competitors and their impact on the market share of the companies you are considering for investment.

Factors Influencing Stock Prices

Several factors can influence the stock prices of US automakers:

- Economic Conditions: Economic downturns can negatively impact the automotive industry, leading to lower sales and lower stock prices.

- Regulatory Changes: New regulations related to emissions, safety, and technology can impact the profitability and market share of automakers.

- Consumer Sentiment: Consumer confidence and purchasing power can influence the demand for vehicles, affecting stock prices.

- Global Events: Events such as trade wars, political instability, and natural disasters can impact the automotive industry and stock prices.

Case Studies

To illustrate the impact of various factors on stock prices, let's consider a few case studies:

- Ford Motor Company: In 2008, the global financial crisis had a significant impact on Ford's stock price. However, the company's ability to weather the storm and implement cost-cutting measures helped it recover and even experience growth in subsequent years.

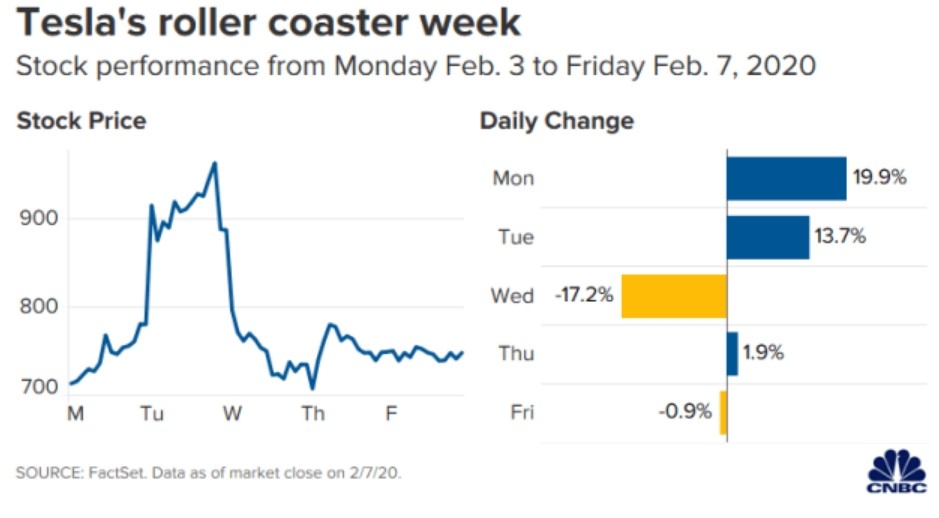

- Tesla, Inc.: Tesla's stock price has been highly volatile, with significant spikes and dips. The company's success in delivering its products and expanding its market share has often driven its stock price upward.

In conclusion, investing in US automakers traded on the stock exchange can be a lucrative opportunity for investors. By understanding the market dynamics, analyzing financial performance, and staying informed about relevant factors, investors can make informed decisions about their investments.

so cool! ()

last:Unlocking the World of Trading Stocks in the US

next:nothing

like

- Unlocking the World of Trading Stocks in the US

- US Stock Holiday Today: What You Need to Know

- In-Depth Analysis of HP Stock: A Comprehensive Look at HP's Market Performan

- Top Stocks of the US Market: Unveiling the Best Investments"

- US Oil Companies on the Stock Market: A Comprehensive Analysis

- Best Aggressive US Stocks to Buy: Your Guide to High-Potential Investments

- Us Steel Stock Prediction: A Comprehensive Analysis

- Latest US Stock Market News: July 31, 2025 - Major Developments and Analysis

- US Silica Stock Price Target: What Investors Need to Know

- Santander US Stock Price: Current Trends and Analysis

- Recent FDA Approval: A Game-Changer for Small Cap US Stocks

- Unlocking the Secrets of US Stock Index Returns

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Does MGM Macau Affect MGM Stocks in US?"

- Unlock the Power of Free US Stock Data: Your U"

recommend

Title: US Automaker Traded on Stock Exchange:

Title: US Automaker Traded on Stock Exchange:

How Will Democratic Win Affect Us Stocks?

Top ETFs to Invest in U.S. Stocks: Your Ultima

"1995-2000: The OTC Stock Bubble in t

American Stock Traders Outside the US: Opportu

"US Delisting Chinese Stocks: What Yo

Maximize Your Investment Potential with Etoro

Maximizing Returns: A Deep Dive into US Oil an

"How Many Israeli Companies Are in th

"Stock Exchange US Holidays: Understa

Best US Stock Index Funds: Your Ultimate Guide

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Hatchimals Toys R Us in Stock: The Ultimate Gu"

- LTCG on US Stocks in India: A Comprehensive Gu"

- "Market-Weighted US Stock Indexes: A "

- Best ETFs for Non-US Stocks: Your Guide to Glo"

- "Best Shares to Buy in the US Stock M"

- Best US Penny Stocks to Watch in 2024: Top Pic"

- The End is Nigh for Us Stocks? A Deep Dive int"

- Current Market Conditions: US Stocks in Octobe"

- Unlocking the Potential of Run.O: A Deep Dive "

- Trade US Stocks from UK: Your Ultimate Guide t"