you position:Home > new york stock exchange > new york stock exchange

LTCG on US Stocks in India: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Investing in US stocks from India has become increasingly popular among investors looking to diversify their portfolios. One such investment strategy that has gained traction is the Long-Term Capital Gains (LTGC) approach. This article delves into the concept of LTGC and its implications for investors in India looking to invest in US stocks.

Understanding LTGC

Long-Term Capital Gains refer to profits earned from the sale of an asset that has been held for more than a year. In the United States, LTGC are taxed at a lower rate compared to Short-Term Capital Gains (STCG), which are profits from assets held for less than a year. This tax advantage makes LTGC an attractive strategy for long-term investors.

Tax Implications in India

For Indian investors, understanding the tax implications is crucial. While the LTGC from US stocks is taxed in the US, it may also be subject to tax in India under the provisions of the Double Taxation Avoidance Agreement (DTAA) between India and the United States. It is essential to consult with a tax professional to ensure compliance with both Indian and US tax laws.

Investment Opportunities in US Stocks

The US stock market offers a wide range of investment opportunities across various sectors and industries. From tech giants like Apple and Google to energy companies like ExxonMobil, there are numerous options for Indian investors to consider. Here are some key factors to consider when investing in US stocks:

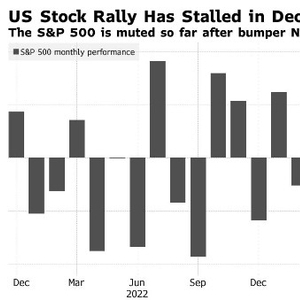

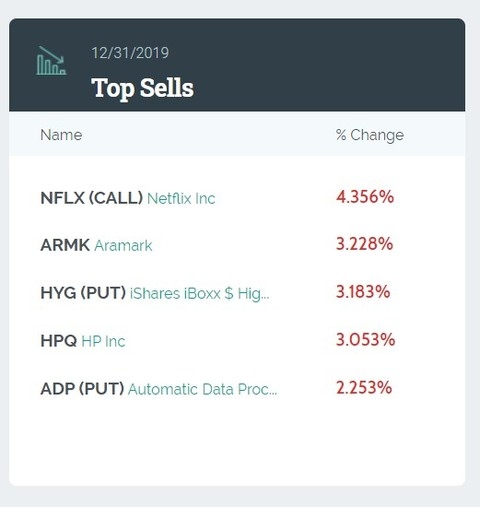

Market Performance: The US stock market has historically offered higher returns compared to other markets. However, it is essential to conduct thorough research and analyze the performance of individual stocks before making investment decisions.

Diversification: Investing in a diverse portfolio of US stocks can help mitigate risks associated with market volatility. This approach allows investors to benefit from the growth potential of different sectors and industries.

Dividends: Many US stocks offer attractive dividend yields, providing investors with a regular income stream. This can be particularly beneficial for investors seeking steady returns.

Case Studies

Let's take a look at two case studies to illustrate the LTGC approach in action:

Apple Inc.: An Indian investor purchased 100 shares of Apple Inc. at

150 per share in 2018. After holding the shares for five years, the investor sold them at 200 per share. The total capital gain from this transaction is $10,000, which is classified as LTGC in the US. In India, this gain may be taxed at a lower rate under the DTAA.Microsoft Corporation: Another Indian investor bought 200 shares of Microsoft Corporation at

100 per share in 2019. After holding the shares for three years, the investor sold them at 150 per share. The total capital gain from this transaction is $20,000, which is classified as STCG in the US. In India, this gain may be taxed at a higher rate compared to LTGC.

Conclusion

Investing in US stocks through the LTGC approach can be a lucrative strategy for Indian investors. However, it is crucial to understand the tax implications and conduct thorough research before making investment decisions. By diversifying their portfolios and staying informed about market trends, investors can maximize their returns while minimizing risks.

so cool! ()

last:Maximize Returns: The Ultimate Guide to US Shell Stock Investing"

next:nothing

like

- Maximize Returns: The Ultimate Guide to US Shell Stock Investing"

- Active Small Cap US Stock Fund: A Strategic Investment Opportunity

- Time to Sell Us Stocks: Strategies for Maximizing Returns

- US Hospital Stocks: A Comprehensive Guide to Investing in the Healthcare Sector

- US Stock Calendar 2019: A Comprehensive Guide to Market Events

- Top ESG Stocks to Watch in the US Market in 2025"

- Top 10 US Blue Chip Stocks at 52-Week Low: Opportunities for Investors

- How to Sell Canadian Stocks in the US: A Comprehensive Guide

- Top 10 US Stocks to Watch Today: Investment Insights for Active Traders

- Recent Breakout Stocks: US Momentum That's Not to Be Missed

- Top 5 US Stocks to Buy in 2023: A Strategic Investment Guide

- Understanding the US Bancorp 1.1% Preferred Stock Series A: A Comprehensive Guide

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- Does MGM Macau Affect MGM Stocks in US?"

- Unlock the Power of Free US Stock Data: Your U"

- "Can US Residents Open a Stock Accoun"

recommend

LTCG on US Stocks in India: A Comprehensive Gu

LTCG on US Stocks in India: A Comprehensive Gu

Unlocking the Potential of Puge.pk: A Deep Div

US Large Cap Growth Stocks: Your Guide to Inve

Best Mutual Funds for US Stocks: Top Picks for

Can Not Find Us Stock Ticker for True Leaf Med

Buying US Stocks in Australia: Understanding t

Best US Stock Index Funds: Your Ultimate Guide

Understanding U.S. Stock Market Holidays: What

Stocks That Benefit from a Weak US Dollar: A S

InMed US Stock: A Comprehensive Guide to Inves

Best Performing US Stocks: Momentum Analysis f

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Buy Stocks: A Guide to Investing in the US Sto"

- Unlocking the Potential of Marijuana Stocks in"

- Stock Up for US Holidays: A Comprehensive Guid"

- Unlocking the Potential of the US Small Stock "

- Greenbrier Companies: A Leading Force in US Ra"

- Understanding the US Markets Stocks: Key Insig"

- Prefilled Xmas Stockings US: The Ultimate Holi"

- BP Stock Price in US Dollar: A Comprehensive A"

- Understanding Taxes on Stocks in the US: A Com"

- Is It a Good Time to Buy US Stocks? A Comprehe"