you position:Home > new york stock exchange > new york stock exchange

Unlocking the World of Trading Stocks in the US

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you intrigued by the idea of trading stocks in the US but unsure where to start? Look no further! This comprehensive guide will provide you with the essential knowledge and tips to navigate the exciting world of stock trading in the United States.

Understanding the Basics of Stock Trading

Before diving into the specifics of trading stocks in the US, it's crucial to understand the basics. Stock trading involves buying and selling shares of publicly-traded companies. These shares represent ownership in the company and can be bought and sold on stock exchanges.

Key Stock Exchanges in the US

The United States has several major stock exchanges where trading takes place. The most prominent ones include:

- New York Stock Exchange (NYSE): Established in 1792, the NYSE is the oldest and largest stock exchange in the world. It's home to many of the world's largest and most well-known companies.

- NASDAQ Stock Market: NASDAQ is the second-largest stock exchange in the US and is known for its technology and growth companies.

- Chicago Stock Exchange (CHX): The CHX is a smaller exchange but offers a wide range of trading options, including equities, options, and futures.

Choosing a Broker

To trade stocks in the US, you'll need to open an account with a brokerage firm. A broker acts as an intermediary between you and the stock exchange, facilitating the buying and selling of stocks. When choosing a broker, consider factors such as fees, customer service, and available trading platforms.

Top Brokers for Trading Stocks in the US

Several brokers stand out in the US market, offering a range of services and tools to help you trade effectively:

- Fidelity: Fidelity is known for its extensive research tools, user-friendly platform, and competitive fees.

- Charles Schwab: Schwab offers a wide range of investment options, including stocks, bonds, and mutual funds, along with a strong mobile app.

- E*TRADE: E*TRADE is a popular choice for active traders, offering advanced trading tools and a variety of research resources.

Strategies for Trading Stocks

There are various strategies you can use when trading stocks in the US. Here are a few popular ones:

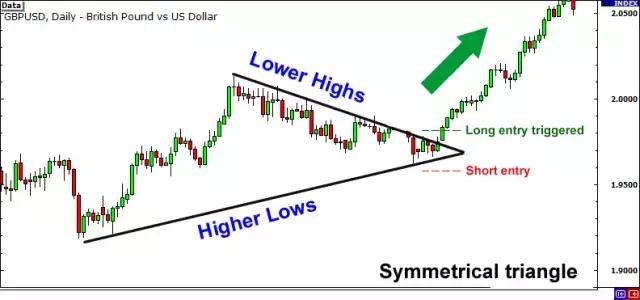

- Day Trading: This involves buying and selling stocks within the same trading day. It requires quick decision-making and a thorough understanding of market trends.

- Swing Trading: Swing traders hold positions for a few days to a few weeks, aiming to capture short-term price movements.

- Position Trading: Position traders hold positions for longer periods, often months or even years, and focus on long-term market trends.

Risk Management

One of the most important aspects of trading stocks is managing risk. Here are some key risk management strategies:

- Diversify Your Portfolio: Diversifying your investments can help reduce risk by spreading your investments across different sectors and asset classes.

- Use Stop-Loss Orders: A stop-loss order is an instruction to sell a stock if it reaches a certain price, helping to limit potential losses.

- Stay Informed: Keeping up with market news and trends can help you make informed decisions and avoid unnecessary risks.

Case Study: Successful Stock Trading

Let's take a look at a real-life example of successful stock trading. John, a beginner trader, decided to invest in a technology company he believed in. After conducting thorough research and analyzing market trends, he bought shares at

Conclusion

Trading stocks in the US can be a rewarding endeavor, but it requires knowledge, discipline, and a willingness to learn. By understanding the basics, choosing the right broker, and implementing effective strategies, you can increase your chances of success in the stock market. Remember to stay informed, manage your risk, and never invest more than you can afford to lose.

so cool! ()

last:US Stock Holiday Today: What You Need to Know

next:nothing

like

- US Stock Holiday Today: What You Need to Know

- In-Depth Analysis of HP Stock: A Comprehensive Look at HP's Market Performan

- Top Stocks of the US Market: Unveiling the Best Investments"

- US Oil Companies on the Stock Market: A Comprehensive Analysis

- Best Aggressive US Stocks to Buy: Your Guide to High-Potential Investments

- Us Steel Stock Prediction: A Comprehensive Analysis

- Latest US Stock Market News: July 31, 2025 - Major Developments and Analysis

- US Silica Stock Price Target: What Investors Need to Know

- Santander US Stock Price: Current Trends and Analysis

- Recent FDA Approval: A Game-Changer for Small Cap US Stocks

- Unlocking the Secrets of US Stock Index Returns

- Title: Mmen Stock Price US: Trends, Analysis, and Future Projections

hot stocks

HSBC US Stock Trading Fees: What You Need to K

HSBC US Stock Trading Fees: What You Need to K- HSBC US Stock Trading Fees: What You Need to K"

- Top Momentum Stocks in the US Market August 20"

- Unlocking Opportunities with US Small Value St"

- Shionogi Stock US: A Comprehensive Analysis of"

- Unlocking the Potential of Barclays Bank US St"

- American Stock Traders Outside the US: Opportu"

- Does MGM Macau Affect MGM Stocks in US?"

- Unlock the Power of Free US Stock Data: Your U"

recommend

Unlocking the World of Trading Stocks in the U

Unlocking the World of Trading Stocks in the U

Title: Mmen Stock Price US: Trends, Analysis,

News on US Steel Stock: The Latest Updates and

Sanofi Stock Price US: The Latest Trends and A

http stocks.us.reuters.com stocks fulldescript

Hydrogen Power Stocks: The Future of Energy in

US Large Cap Momentum Stocks: October 2025 Tec

Difference Between Us Stock Exchanges: A Compr

Expensive Stock in US: What You Need to Know

"Market-Weighted US Stock Indexes: A

Understanding the US Dollar's Influence o

tags

-

AllegedNon-USOpenHolidaysDelekSmallPurchaseBYDEarthClosedGoldEssentialCanTomorrowLNGChineseComprehensUnderstaGrowingRareFuturesAprilHolSchwabManyJonesDefinitiofromIndianMFCDaysTotalFoodSixth-GenerBogleheFallCitizensNintendoDidListTimings100verutodshareamerican10miniliveShausaTarCleanasdaqequityratioTraPriLucrRegSmarspreadHoldingToOptCom2022UnveilinaverageUndertodayFuCorreTradETPharmacequantitativeGaFuturSustainaAvGuidWhisBroadcFindLloanEarningcolacoca us stocks silver etf games us stock

like

- Top Pot Stocks in the US: Unveiling the Hottes"

- Buy Stocks: A Guide to Investing in the US Sto"

- Best US Stock Index Funds: Your Ultimate Guide"

- Enbridge Stock: A Comprehensive Guide to Inves"

- US Large Cap Growth Stocks: Your Guide to Inve"

- "US Delisting Chinese Stocks: What Yo"

- Condome Stocks in the US: A Lucrative Investme"

- InMed US Stock: A Comprehensive Guide to Inves"

- Dividend Paying US Stocks for 2016: Top Picks "

- "Fintech US Stock: A Thriving Market "